For the workaholic, June’s cattle market was ready-made

If you like busy, then June was the month for you. On the other hand, if you prefer calm and clarity, last month’s cattle market proved unsettling.

July 7, 2016

If you like busy, then June was the month for you. On the other hand, if you prefer calm and clarity, last month’s cattle market proved unsettling.

June’s action contained catalysts for additional economic uncertainty (more on that later) plus a tug-of-war between the bulls and the bears around the market. Now the market enters the dog days of summer in somewhat of a wait-and-see mode – hence, the likelihood of some more choppy days or weeks ahead.

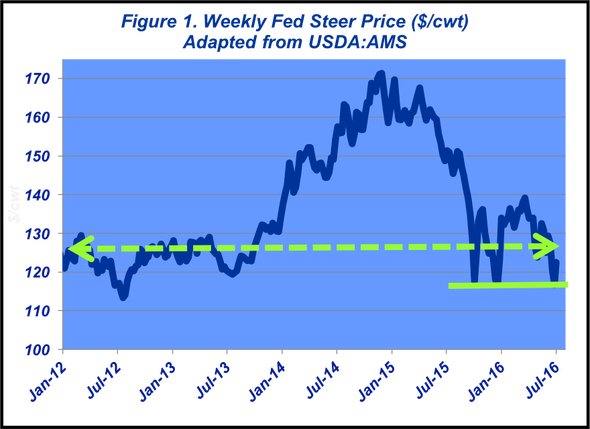

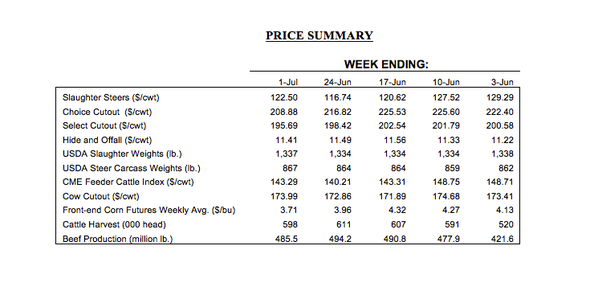

Fed cattle trade ended the month sharply lower compared with the end of May. The market finished June at $122 per cwt, down $7-8 versus the established market around Memorial Day. However, $120 plus trade is a victory - up $5-6 from the previous week when cattle were priced at $116-117.

That mid-teen price point has seemingly become an important support level. Cash trade has now tested that threshold three times in the past eight months – October, December, and June. In the meantime, fed trade seems to be iterating to a longer-run trading range of $120-130, with some bouncing around to find their way into those values. As such, summer trade will be very important in dictating the market’s general trend and ensuring that trading range remains intact (Figure 1).

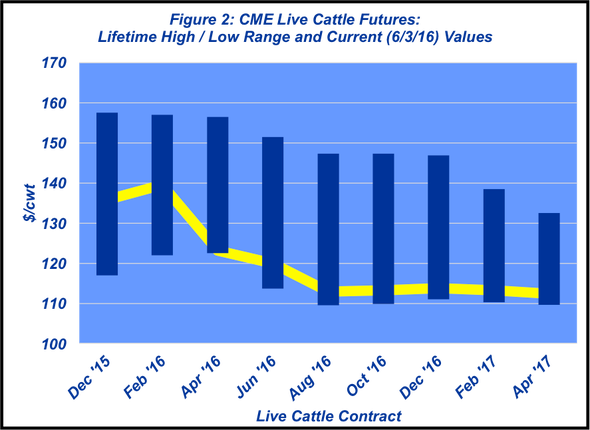

However, weight on the market comes from the futures side. CME contracts are currently priced below that range. The August live cattle contract closed sub-$113 heading into the 4th of July weekend – only $3 above the contract’s lifetime low. Meanwhile, the deferred contracts (October, December, February and April) are also all trading at $112-114 (Figure 2).

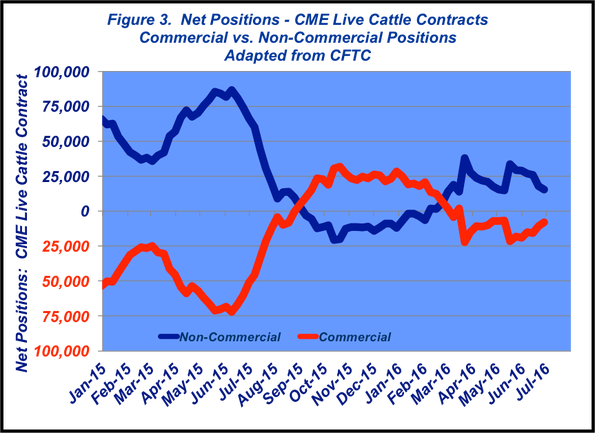

Therefore, there’s some tug-of-war occurring and leaves uncertainty on the table for the foreseeable future. Will the futures market drag down cash trade, ultimately forcing fed prices to violate the $116-117 support? Or is the bottom in and the CME will rally on signs of consistent beef demand and throughput? The latter may be challenging given that non-commercials have been slowly unwinding their net long position (Figure 3).

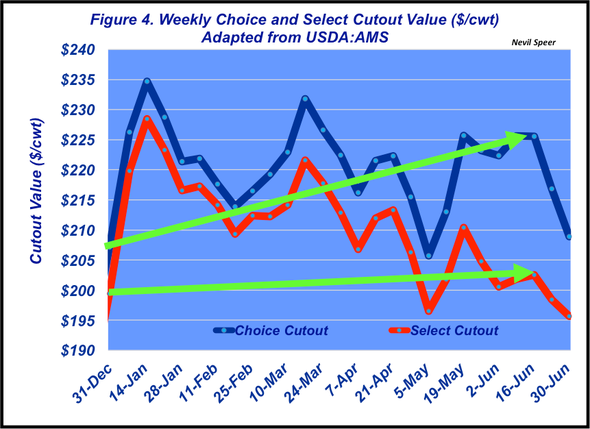

A further test for the market comes on the demand side. Choice product has been a positive force in terms of wholesale movement and thus supportive for the fed market. The widening spread thus far in 2016 has resulted from better sales of Choice beef products, while Select products have remained relatively flat (Figure 4).

Simultaneously, rib and loin values have also been surprisingly strong and supportive of throughput. As noted in last week’s Industry At A Glance, “It appears that consumers are increasingly opting in at the top end of the beef market.” The tussle around 2016 summer lows will be largely dictated what that looks like in the coming weeks and how much staying power the consumer has going forward.

On to the supply side, the Cattle on Feed report came in largely as expected. Nevertheless, one important trend among placements continues: bigger cattle. Feedyards continue to place a bigger mix of cattle on the heavy end. Total placements in May equaled 1.884 million head – up 10% versus 2015. However, 850,000 head weighed over 800 pounds – record large for May – and represents over 45% of the total placement mix. That represents a new placement mix record – eclipsing last month’s 43% mark.

As noted earlier, June was busy. Clearly, Brexit—Britain’s exit from the European Union—was the major news that influenced financial markets – at least initially. Also noted previously, consumer activity will be key to some major tests upcoming for the market. While those aren’t inherently related, they possess some connectivity. Moreover, they matter more because of the general backdrop of economic uncertainty, both in the U.S. and across the globe. Fixing economic uncertainty has been a long haul.

To that end, some excellent analysis on why the markets reacted so sharply following the Brexit vote comes via Jeffrey Rosenberg, Blackrock chief investment strategist for fixed income. Rosenberg provided the following insights in the June 24 Bloomberg Surveillance:

Why is this bad? Why are financial markets having this reaction? ...Why is this vote out of Europe so important? It's so important because economic growth is fragile. And a shock to economic growth is what this is all about.

Why is it a shock? Because it's a confidence shock. And the implications for us - the U.S. markets. Clearly, the implications are in Europe - clearly, the biggest financial movements are in Europe. But why do you see the flight to quality? Why do see the impact in U.S. stock markets? It's because the threat these external shocks have had - we've seen them over the course of the seven or eight years since the global financial crisis and they've had negative repercussions to confidence.

And that matters when you're not growing very much because a small change can be a big turning point for the outlook - not just for the UK or for Europe, but for the global economy…The key question here is how much does this political uncertainty translate into policy uncertainty, trade uncertainty and how much does that affect the real economy? Because in the real economy, if you're a business person thinking about investments, whether they're domestic or international, or making new hires - uncertainty is bad. If you're a consumer thinking about making a major purchase, you see this uncertainty.

How do most American consumers see the implications of the U.K. vote? They're going to see it in the domestic stock market. So that's where the longer-run implications are.

What does the uncertainty do to growth? That becomes a self-fulfilling idea: because if we're worried about the growth, then those worries weigh on stock markets. And the weighing on stock markets weighs on confidence. And you can get yourself back into an environment where it can be a negative feedback loop.

With that in mind, as noted last month, producers need to be well positioned from a risk management perspective around all facets of the business. Markets don’t like uncertainty – and that will likely ramp up even further as we get closer to the election.

Therefore, there exists any number of external factors that influence the market in the coming months. As always, producers are encouraged to determinedly review priorities within their operations while also investing time and effort in keeping up with both the market and the business environment in general.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

9 new pickups for the ranch in 2016

Use cow-pie-ology to monitor your herds nutritional status

70 photos of hardworking beef producers

5 must-do steps for fly control on cattle

Here's when you should castrate beef valves

Photo Tour: World's largest vertically integrated cattle operation

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)