Gotta love April’s market gymnastics

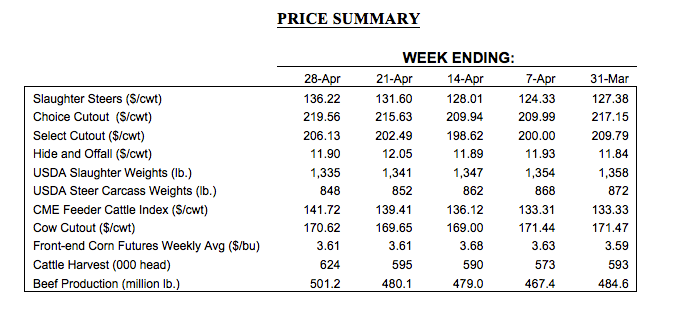

The market pause at the beginning of April was just a head fake; the fed cattle market ended the month on a $9 uptick.

May 4, 2017

Well that was a good surprise! April’s sharp move to the upside caught everyone (if they’re honest) off guard about where the fed cattle market was headed. The especially strong market action was unexpected. That’s evidenced by the huge jump late in the month; markets in equilibrium don’t make such drastic jumps.

So, just as the market seemed poised to trade steady at best to softer, packers scurried hard to secure supply, driving prices to new spring highs. And to be certain, no one on the selling side is complaining, except for wishing they had more cattle to sell into the rally.

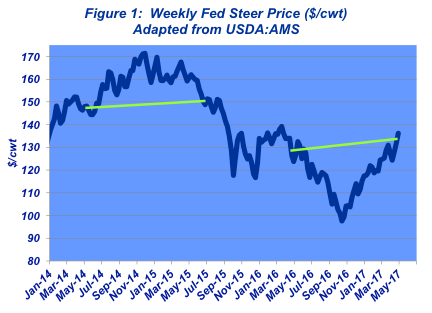

As review, the latter half of March saw fed trade climb to $131—and to what seemed, at that point, would likely be 2017’s spring high. That’s because the week that followed, ending March business, settled on a softer note back to $127-128. April subsequently opened with further bearish sentiment: fed trade retreated back to $124.

But all that was a head fake. The next few weeks each saw gains of $3-4 per cwt, enabling steer/heifer prices to sneak past the previous March high. The market now had confirmation of the previous high—and seemed poised to work lower from there. However, the fed cattle market has found renewed strength all spring – there was yet more gas in the tank. April closed by tacking on another $5-6 to settle at $136-137.

That’s been the norm for market behavior during the past three months. Similar to April, both February and March saw fed trade starting the month off in steady or softer fashion and then surging at month’s end. February, March and April have gained $5, $6, and $9, respectively, as the month progressed.

Most important, the market has now added nearly $40 per cwt since the mid-October low. And for the first time in 22 months, the market is trading at better levels on a year-over-year basis, the last time being mid-June 2015 (Figure 1).

So what happened in April that drove the market to new unexpected highs? The answer comes in two parts. First, cattle feeders have been disciplined and determined marketers. They’ve managed to keep the front end current; that’s provided solid bargaining leverage from week to week.

Second, and more important, that can only occur in a favorable environment; feedyards were selling into stronger cash prices because of solid beef demand. It’s demand that drives the first factor. In other words, without stronger demand, packers aren’t hunting and pricing cattle to encourage feedyards to pull supply ahead.

It’s clear that beef demand has been surprisingly strong as we’ve moved through the spring. And as eluded to above, that miscalculation explains the huge jump as April closed for business. Packers needed to procure supply in preparation for Memorial Day.

That said, as noted the previous two months, better cattle prices would (or could) come if wholesale demand remained solid.

The real driver, though, for the fed market in coming months resides on the beef side…better prices of late are a positive signal with respect to beef demand. And in light of solid consumer sentiment about the economy, there’s general hope that could be sustained through the spring.

To that end, why has beef demand been so enduring this spring?

Some of last month’s coverage is pertinent in answering that question. The discussion below revolves around the industry’s recent landmark in which Prime and Choice aggregated to surpass 80% of the slaughter mix. That occurrence is part of a longer-term trend that’s central to what’s occurred this spring and what we witnessed in April’s market action:

Better carcasses mean better eating experiences and better sales. That’s the result of a long-run commitment to quality by the beef industry. And as noted in the column, “… that is beginning to pay real dividends for the industry. Undoubtedly, this has played an important role with respect to beef demand in recent years.”

Better beef quality and consistency are underpinning demand creation and pricing power that’s not been experienced previously For more on this, see this week’s Industry At A Glance.

Price moves to the upside are always welcome by sellers. But April’s sharp move underscores another important take-away: no one seems to complain about market volatility when it’s working in a positive manner. However, big price swings—regardless of the direction—make decision-making more difficult. The weekly showlist becomes more consequential amidst a rapidly moving market—and in an upmarket may mean foregoing some of next week’s gains. Hence, back to the wish of having more cattle to sell.

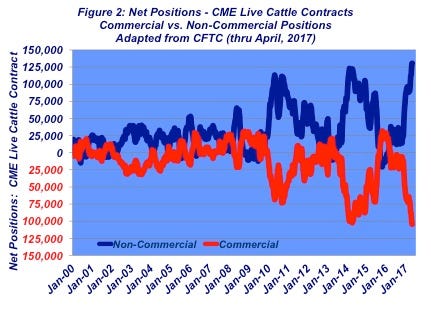

Heightened volatility is not a new phenomenon. It’s an enduring theme in recent years. Moreover, the market is now working within an environment of record large open interest at the CME and record-large non-commercial long positions (Figure 2). At some point, that’s bound to reverse direction; when that occurs, the fall-out could be sharp and fast.

So, April could be summarized by better-than-expected beef demand and large price swings: the first a positive tail wind, the second an important business consideration for all producers. With both in mind, as noted every month, producers must remain keenly focused on all factors which potentially influence their business. That consideration mandates access to objective information and dedication of time to analyze and absorb that information. Investment in such helps ensure the likelihood of making good business decisions going forward.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like