Has the beef market’s winning streak come to an end?

The primary questions about the cattle market going forward will surround bargaining position and leverage.

March 4, 2015

The cattle market seemed almost unbeatable in 2014. Heading into 2014, fed trade was mostly $130-$132 per cwt; mid-January had the market $10 higher and, by the end of February, cattle values had breached $150. Given the streak of new record-highs, the market almost seemed unstoppable.

Given the action of the past 90 days, it’s clear this year is shaping up very differently. The long-running winning streak has seemingly come to an end. Fed prices began to retreat in December as trade slipped $13 back to $158/cwt from the record-high established in November. Since that time, steer and heifer prices have made a run to the upside, even managing $169 in early-January. But that rally was short-lived.

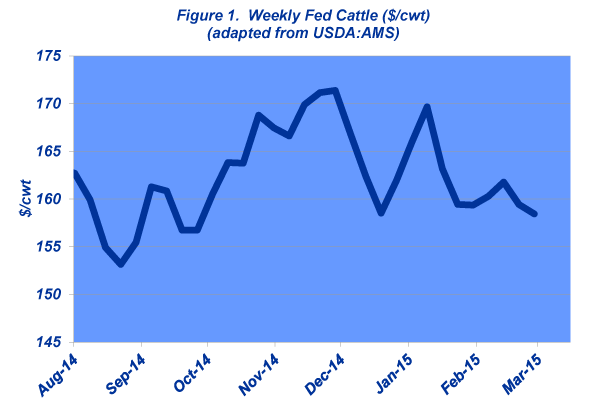

Following January’s run to $169, the market subsequently snapped lower. Over the course of the past six weeks, the market has chopped between $159 and $161 (Figure 1). The absence of traction for the fed steer and heifer trade indicates the market is setting up for a period of consolidation – at least for the foreseeable future.

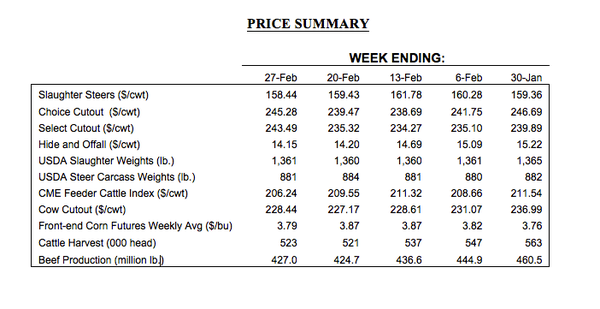

Meanwhile, futures trading at the CME has witnessed some even bigger swings. The February live cattle contract reverted all the way back and eventually closed below $150 amid a huge sell-off in January (much of which is simply follow-through of a longer-running trend). The selloff set up several weeks in which fed trade basis was near $7 per cwt during the last half of January and the first half of February. Meanwhile, the February contract recovered some ground from there and closed for business at $158 following a sharp rally in the closing days.

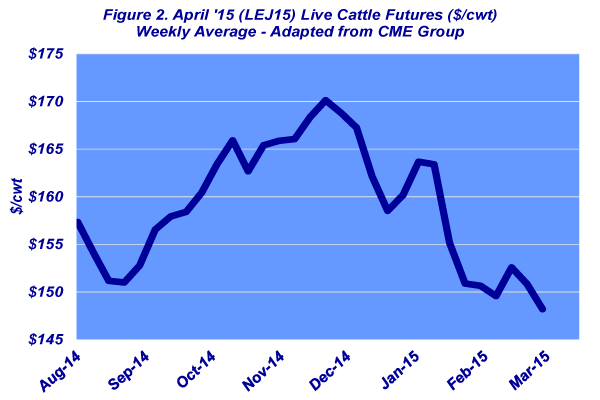

Trade will now fully turn its attention to the April contract and the outlook for spring prices. April has been subject to the same pressures as the rest of the complex. The weekly average peaked back in November along with the cash market at $170. And, similarly, the April contract then slipped back to $160 to finish out the year; it’s since traded around $150 for much of the past six weeks (the weekly average closing out February at $148 – Figure 2). That said, depending on basis, the cash market is likely poised for further downside risk in the weeks to come.

Therein represents the real challenge for cattle feeders heading into the next several months. Consider that yearling purchases in October and November were priced at the peak and against the April contract at the time. As such, yearlings coming out of the feedyard in the next several months were laid in around $235-240. And even against a $165-170 live cattle board, those breakevens were tenuous.

However, the fed market has now backed up another $20 – or the equivalent of about $260 per head. And, as noted in January, “The slide possesses some especially important implications. Primarily, cattle feeders that haven’t hedged fall-run purchases, on hopes of a spring rally, now have a deeper hole to dig out of.”

As alluded to earlier, the market hasn’t experienced these tough dynamics for some time. The primary question going forward will surround bargaining position and leverage. Cattle feeders will fight the market and become reluctant sellers. Collectively, though, that can become a downward spiral in which front-end supply becomes burdensome and hampers prices even more. Accordingly, basis will be a significant signal regarding the packer demand for cattle balanced against the relative size of show lists on a weekly basis.

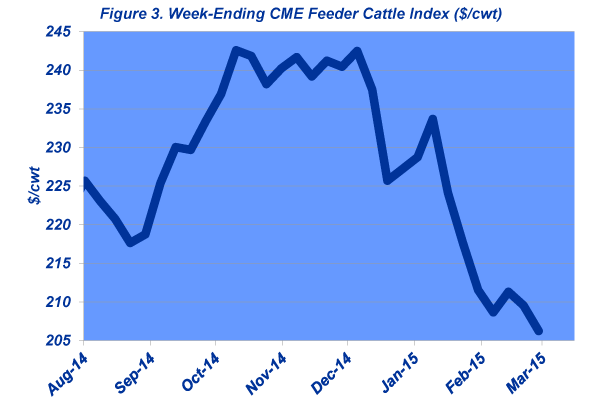

The market’s broader ramifications have and will continue to pressure the feeder cattle market. The CME Feeder Cattle Index has retreated $30+/cwt over the course of four months following the October high (Figure 3). Negative closeouts will make for careful buyers going forward.

All of this discussion can seem somewhat gloomy, especially on the heels of 2014. With that said, two things are important to point out:

• Commodity markets are inherently challenging. Corrections are inevitable and many seasoned industry veterans will likely tell you they’re not surprised; they’ve weathered some big swings in the market (albeit, never at these levels of capital at risk).

• It doesn’t mean 2014 was a fluke. There were key reasons for 2014’s success – the surge was partially supply-driven, but was fundamentally underpinned by solid beef demand, both domestically and internationally.

Nevertheless, the market’s obstacles in recent months are unsettling. Moreover, it’s also a firm reminder how demanding this business can be. The industry experienced an incredible 2014; the coming year will be far more challenging.

At these new heights of required capital, the need for strategic risk management has never been more important. Successful decision-making is challenging! To that end, investing resources and time to obtain trusted, objective information and perform disciplined review are essential!

You might also like:

Bale grazing lets cows feed themselves

It's possible to pasture cattle without using fences

70 photos honor the hardworking cowboys on the ranch

7 U.S. cattle operations honored for stewardship efforts

How Schiefelbein Farms made room on the ranch for nine sons

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)