Here’s how much beef imports contribute to total beef supply

Beef imports to the U.S. have long been accused of disrupting the domestic cattle market. Is that accusation accurate?

July 9, 2018

Of all the topics I’ve covered over the years, international trade is seemingly the one from which I’ve received the most feedback from readers. And the enduring question that seems to always emerge revolves around the collective impact of imports. That is, many readers appreciate the importance of exports, but are often concerned about what imports might be doing to the market.

Because of the heightened activity around international trade, this column has recently emphasized the topic as it relates to the beef industry. Thus far, that’s primarily included four separate discussions to provide readers some context around imports and exports. Those prior columns have highlighted these key points:

Exports serve as a critically important source of revenue for U.S. beef producers. To that end, last year’s export value totaled $7.12 billion – a new record surpassing the previous record of $6.98 billion established in 2014. Japan, South Korea, Mexico, Hong Kong and Canada represent the five largest customers, respectively, - collectively accounting for about 80% of all international trade.

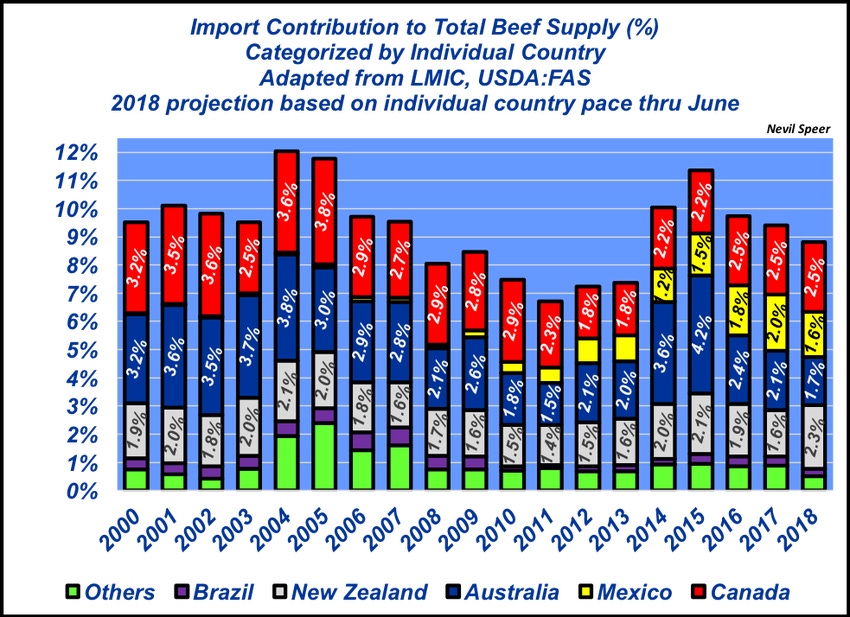

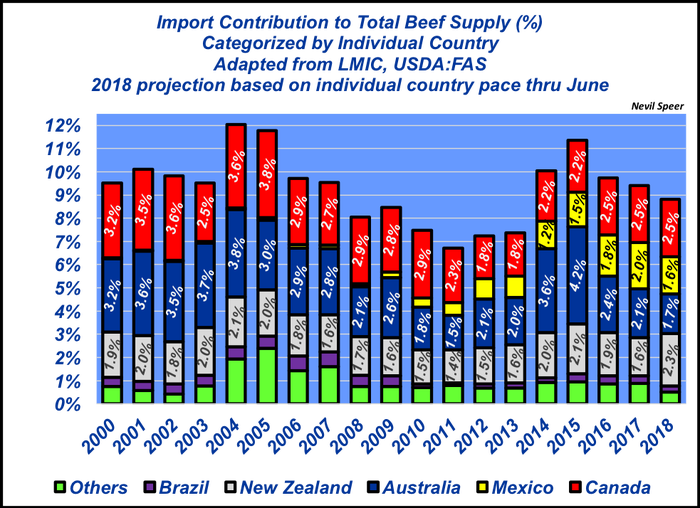

As noted above, the overwhelming majority of imports to the U.S. are comprised of lean trimmings. Nevertheless, there still remains concern about the overall impact of imports on the market. To that end, this week’s graph provides some long-term context around imports – expressed as a contributor to overall supply. Total beef supply defined as previous year holdings in cold storage, domestic production and imports.

This year’s import contribution is projected to fall below 9% - just slightly under the overall average of 9.3% dating back to 2000. Canada is perhaps where the most angst lies, largely because of their ability to feed cattle and produce high-quality beef. Canadian imports through June are up year-over-year, but as total contribution still only comprise 2.5% of the beef supply and remain lower compared to levels prior to 2010. Meanwhile, imports from Mexico and Australia are down year to date.

Based on this data, what’s your perspective about the historical run of imports to the U.S.? Leave your thoughts in the comments section below.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like