Income over feed cost update

Will consolidation in the dairy industry bring more slaughter cows to market?

February 16, 2018

There has been lots of chatter in recent months about profitability in the dairy industry. Many operations are struggling with cash flow issues as milk prices remain challenging – especially compared to the strong prices that occurred in 2014. Anecdotally, many are predicting more consolidation in the coming year.

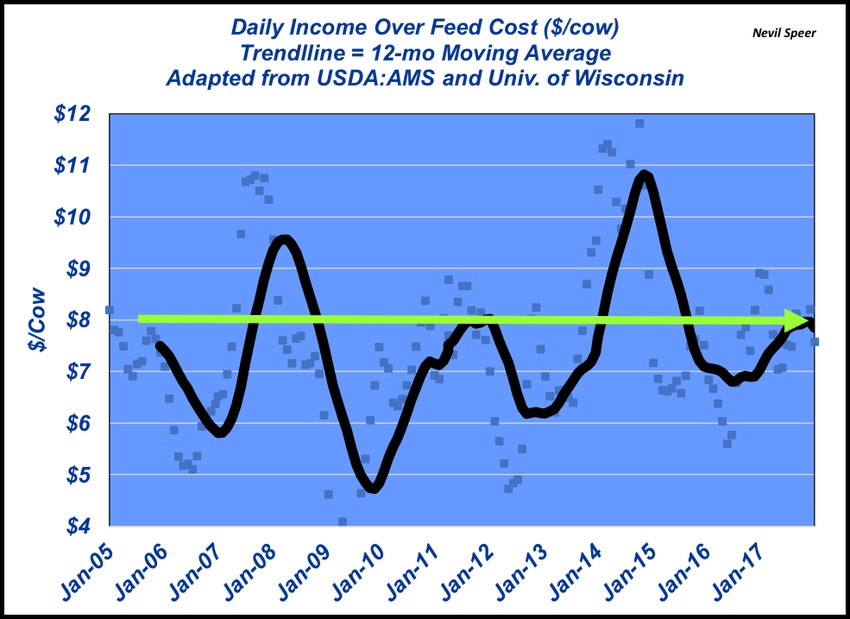

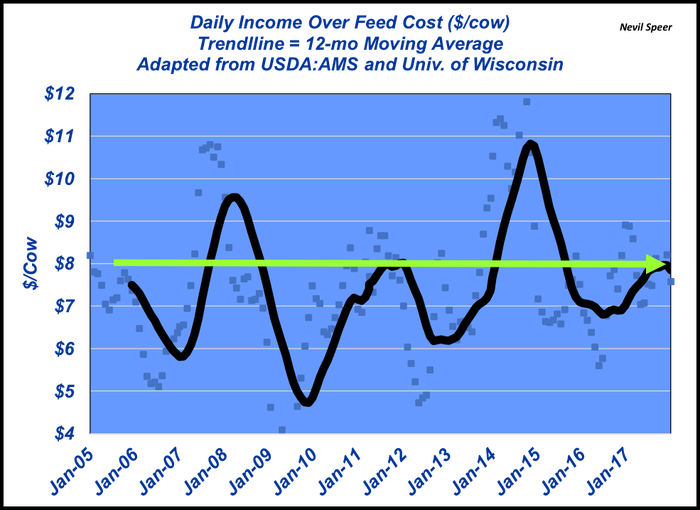

This week’s graph highlights how little has changed in terms of gross profit over the years. The illustration highlights daily income over feed costs available to the dairy producer, based on 65 pounds of milk per cow per day – roughly equivalent to a 20,000-pound rolling herd average. Despite ups and downs, the data reveal that gross profit seemingly keeps regressing back to an $8 mean.

Accordingly, how does a dairy operator improve overall profitability in light of that trend? The only way to squeeze out bigger margins amidst never-changing milk margin is to get bigger. Consolidation has occurred because of the consistent income-over-feed-cost trend. Typically, expanding the operation enables an operator to take advantage of economies of scale.

Simultaneously, that consolidation generally enables producers to obtain better cows while also implementing better knowledge management (e.g. ready access to consultants, etc.…) That has meant improved productivity over the years. The trend of more milk with stable cow numbers is an enduring one. Total production in 2017 marked a new record at 216 billion pounds. All that occurring with about 9.35 million cows. In fact, you have to go back 20 years to find an inventory of 9.5 million cows.

However, as Michael Hammer (Fast Company, 2002) points out, “Increasing productivity does enable a company [or an industry] to lower its costs while increasing its output and that ought to be good for any business. But what is good for any business, it turns out, isn't good for every business.” With all that in mind, how do you foresee the dairy industry transforming in 2018? Will consolidation continue? What impact might that have on the beef industry? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)