Industry At A Glance: Factors Driving The Lean Trimmings Market

External forces are a significant factor in market movements for lean trimmings and ground beef.

September 4, 2014

Ground beef and trimmings comprise about 20% of the cutout value on any given week. Despite its minority position within the broader beef market and derivation of total wholesale value, this category is likely the most complex. That’s because there are any number of variables that drive the value of ground beef and/or trimmings at any given time – and many of them derive from external sources.

As such, the pricing, and subsequent use, of those trimmings is contingent upon those variables on a weekly basis. The outcome being the decision to produce more or less ground beef depending upon sales opportunities, value along with availability of fat, lean trimmings and 50/50 trim. Moreover, there’s any number of ways to derive ground beef, which includes using both domestic and imported beef sources. For more insight into the influence of imported beef on the domestic market, see last week’s chart on boneless beef imports.

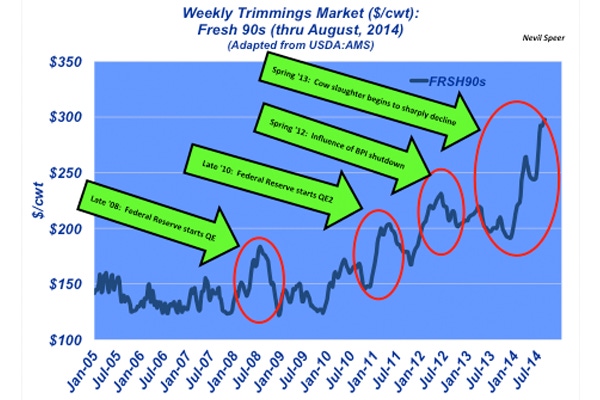

The complexity within the trimmings and ground beef market, coupled with the influence of lean trimmings and international markets, has received a large amount of media attention during the past several years. To that point, the accompanying graphic reflects the weekly market of 90% lean trim. Several key factors are important when understanding the market from an extended perspective.

During the past five or six years, there have been some distinct events propelling the market to new highs. All of these factors are primarily driven by external factors and not directly associated with consumer behavior and/or pull-through from the marketplace.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

The first two spikes occurred primarily because of quantitative easing (QE), which inherently results in devaluation of the U.S. dollar, which makes import costs relatively more expensive. The third leg up occurred when BPI shut down operations at several plants producing lean finely textured beef (LFTB) in 2012, severely curtailing the availability of this product. The final surge is ongoing and is directly associated with plunging cow slaughter, which was discussed in this column in mid-August.

While nearly 80% of the beef market is driven by whole-muscle cuts, the ground beef sector remains important, too. What do you perceive as some additional drivers adding to the weekly noise within that particular market? Do you foresee LFTB coming back in full force? Will eventual QE unwinding by the Federal Reserve make imported beef more competitive and influence this market going forward? Leave your thoughts in the comments section below.

Other trending headlines you may enjoy:

Enjoy This --> Picture Perfect Summer Grazing Scenes From Readers

Grass-Fed Vs Grain-Fed Ground Beef | Are There Any Difference In Healthfulness?

How To Prevent & Treat Pinkeye In Cattle

100+ Photos Of Our Favorite Ranch Dogs

How Drones May Change Food Production From Pasture To Plate

Why Is Death Loss Increasing In Heavier Beef Cattle?

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)