Industry At A Glance: How fed market volatility has changed

Market volatility is something that all cattle feeders accept. How has it changed?

May 14, 2015

Last week’s Industry At A Glance highlighted the shift in basis patterns during the past several years in the fed cattle market. As review, the current basis trend has been moving in an upward channel (albeit that trend has moderated some in recent months). Meanwhile, basis swings from high to low have also amplified during the same time frame. The shifting basis represents somewhat of a new, and very important, challenge for both beef processors and feedyard managers.

To better understand the importance of this dynamic, it’s helpful to have some additional context, most notably, a review of overall market volatility. That’s because the inherent question that arises when discussing shifting basis patterns surrounds the broader influence of market volatility.

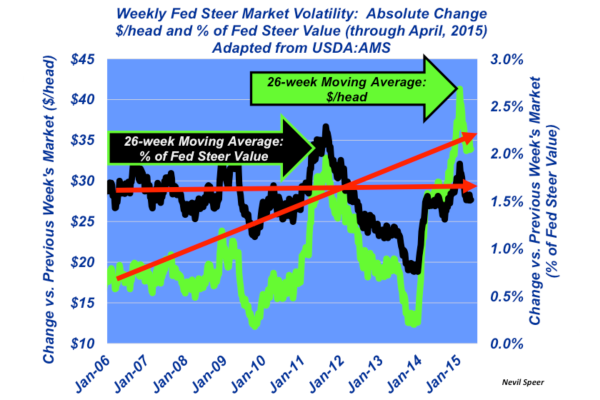

This week’s illustration highlights fed market volatility. The fed market’s change versus the prior week is expressed from two perspectives: dollar value and percentage of total value. In both instances, weekly volatility is represented in absolute value terms. In other words, the only thing that matters is relative change – not the direction of the change.

Not surprisingly, from a dollar value perspective, the weekly change trend has increased over time. The 26-week moving average has jumped from about $17 per head to $35 per head. That’s roughly equivalent to doubling the average weekly move—going from an expectation of one week’s market being $1.25 to $1.50 per cwt different compared with the previous week, to an average weekly change of $2.50 to $3.00 per cwt.

Considering that factor alone, it would seem that volatility has become an important concern. However, when representing the weekly change relative to total steer value, a different picture arises. So while higher prices have brought about bigger shifts from week to week, relative volatility has remained constant. The average weekly shift peaked around 2%, and bottomed out at 1%. And from a longer-term perspective, the long-run expectation remains right in the middle, or 1.5% of the previous week’s market.

Market volatility possesses some other important considerations – especially when it comes to the issue of captive supply (another topic for another week). Nevertheless, what’s your perspective of overall market volatility in recent years? Does any of this week’s explanation around market volatility yield a different consideration for last week’s discussion around basis? Do you expect that market volatility might ramp up in the future with a shifting supply picture? Leave your thoughts in the comments section below.

You might also like:

Breed-back on first-calf heifers starts with nutrition

How to treat leg fractures in young calves

Picture perfect summer grazing scenes from readers

Enjoy a laugh on us with Rubes cow cartoons

80+ photos of our favorite calves & cowboys

60 stunning photos that showcase ranch work ethics

How one farm made room on the ranch for nine sons

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)