Industry At A Glance: How shifting dynamics affect the spot vs. comprehensive market for Choice boxed beef

Shifting dynamics in the wholesale market translate to changing prices in the live cattle market.

June 15, 2015

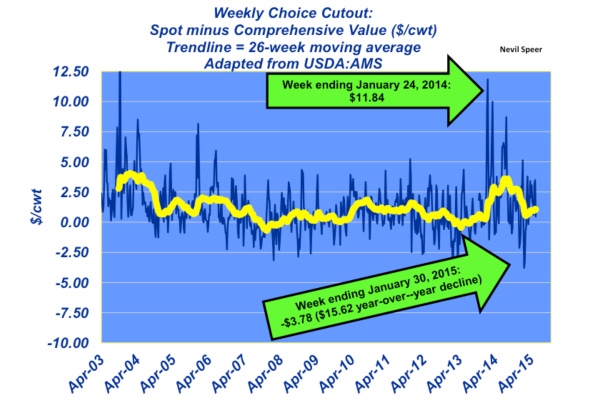

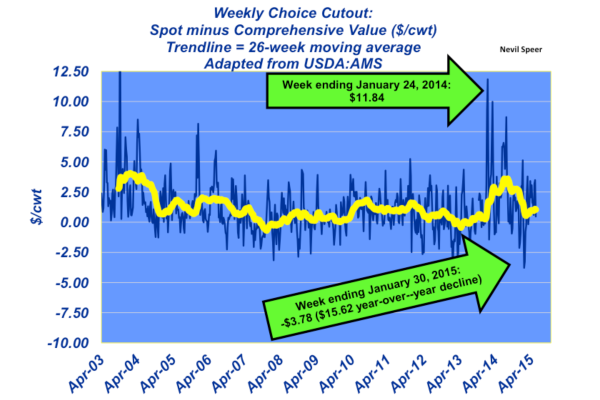

The theme this spring for Industry At A Glance has been a focus on some of the shifting dynamics within the market. Specifically, we’ve focused on items such as price volatility, shifting basis, captive supply, packer margins and the increasing portion of non-negotiated boxed beef sales. With the wholesale market in mind, this week’s column highlights weekly differences between the spot versus the comprehensive price for the Choice cutout as quoted by USDA.

The trendline in the graph represents a 26-week moving average going back to 2003. That trendline began to change in 2014 when beef demand remained extremely strong through the summer, creating pull for the product. While spot prices continued to surge through the summer, the comprehensive cutout was dragged down by prior commitments at lower prices. As such, the spot price outpaced the comprehensive quote through the summer and the running average peaked in August.

That average has since declined and now is in line with longer-run expectations. Of special interest is the change in price difference between January 2014 and January 2015. The Choice cutout spot price exceeded the comprehensive price by nearly $12 in 2014 – that relationship inverted to negative $4 in 2015. The turnaround is striking given that beef demand remains strong in 2015. Clearly, price differences have since normalized with fewer weekly spikes during the past several months.

Nevertheless, it’s clear that market participants are trying to adjust to shifting dynamics within the beef complex – hence, this week’s feature and the price difference outlined in the graph. It points to broader implications of sharp and unprecedented shifts that can occur within the beef complex. Seemingly, the industry continues to be in uncharted territory that began in earnest in 2010.

Within that broader discussion, how do you perceive what’s occurring within the beef industry from a broader perspective? Where do you see the business headed in the years to come in terms of volatility and uncertainty? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

60 stunning photos that showcase ranch work ethics

7 tools to win the war against cattle flies

Is agriculture the bad boy in the nation's water use?

Proper timing & products needed for deworming pasture cattle

21 ATV UTV and side-by-side units for 2015

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)