Is supply or demand driving the fed cattle market?

Price spreads for high-quality beef have seen a strong uptick.

June 30, 2016

The primary focus in recent weeks has been the Choice -Select spread and the ensuing inferences for the beef industry. That began with highlighting the surge of rib/loin values versus end-meat prices. It appears that consumers are voting with their dollars: they want high-end, high-quality beef.

The inherent pushback with that observation, though, invokes questions around supply. Accordingly, last week’s graph featured the beef industry’s annual production of Prime and Choice product. Last year, the beef industry produced record tonnage of Prime and Choice beef. That occurred despite the beef industry producing only 23.8 billion pounds in 2015, including production from non-fed cows and bulls – the lowest total since 1993. As such, supply shortfalls are not driving the market.

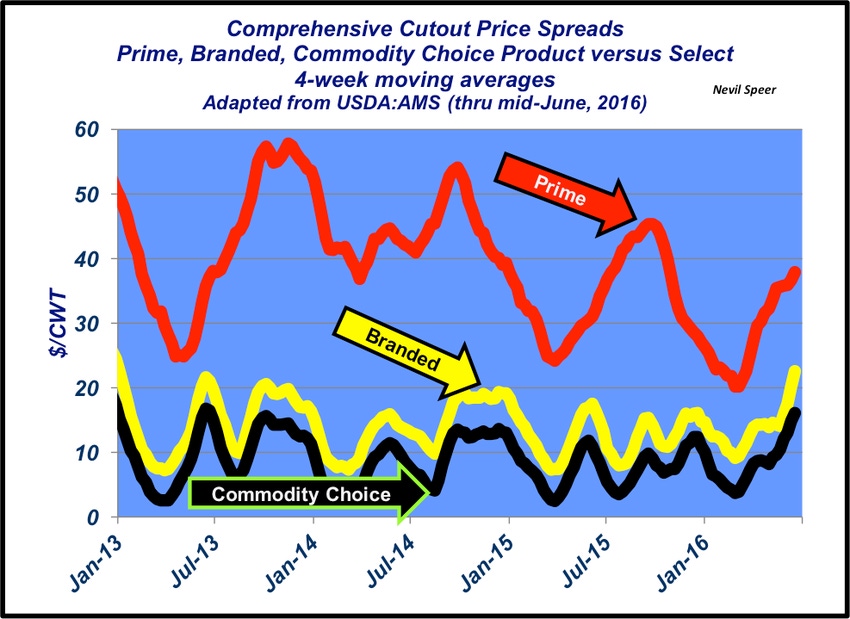

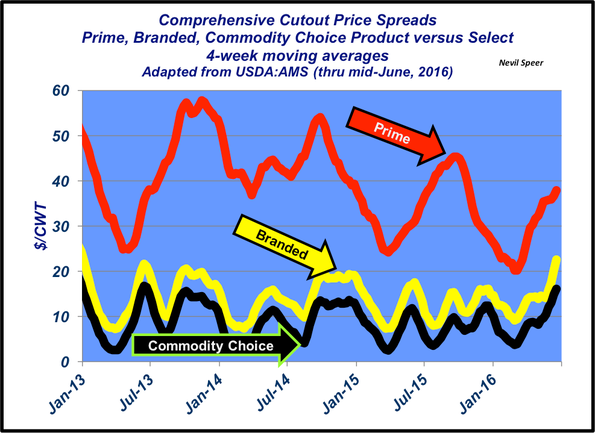

This week’s illustration emphasizes wholesale beef price trends from a somewhat different perspective. The graph features the wholesale value differences (four-week moving averages) between Prime, Branded and commodity Choice versus Select. Not surprisingly, the price spreads of late have seen an upward trend in all three categories: e.g. the Prime premium is nearly $40 per cwt while the Branded premium averaging $25 per cwt. All the while, that’s occurring amidst bigger volume and a much more tenuous market environment for beef - both domestically and internationally – versus 2013 and 2014.

Finally, Industry At A Glance highlighted earlier in the year some recent struggles on the ground beef side and what that means for the beef industry going forward. Most notably, “…[the beef industry] may begin to witness greater pricing diversion across the beef categories going forward in 2016.”

It appears that consumers are increasingly opting in at the top end of the beef market. How do you read this trend occurring within the beef complex? Will the demand at the higher end of the market have staying power? If so, what are the long run implications? How might this change the industry going forward? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

Photo Tour: World's largest vertically integrated cattle operation

When is the best time to wean? It might be younger than you think

You won't believe this is the least expensive way to breed cows

Picture perfect summer grazing scenes from readers

Can ranching be sustainable without profits? Burke Teichert says no

Price implications of the next cattle cycle

80+ photos of our favorite calves & cowboys

9 things to consider before culling a cow

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)