Monthly Outlook: August's Biggest Market News Was Zilmax™

The beef industry has always managed to be amazingly resilient, and this time will prove no different.

September 5, 2013

Constructive and confirming: those descriptors are far more favorable compared to last month’s column describing the market as mostly flat, fuzzy and frustrating. Indeed, August has proven to be a relatively solid month for the markets. Knock on wood, because it’s been a long time coming – it’s the first month this year where market action played out about as expected.

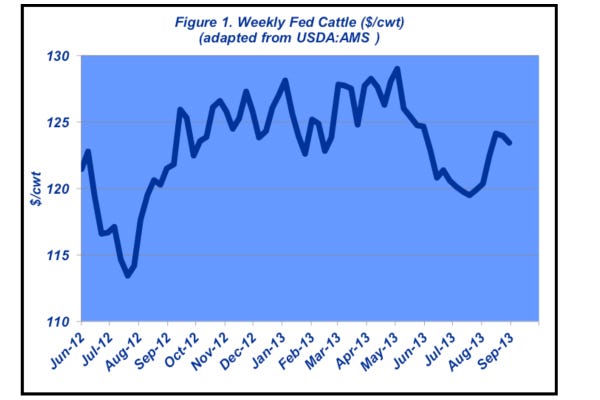

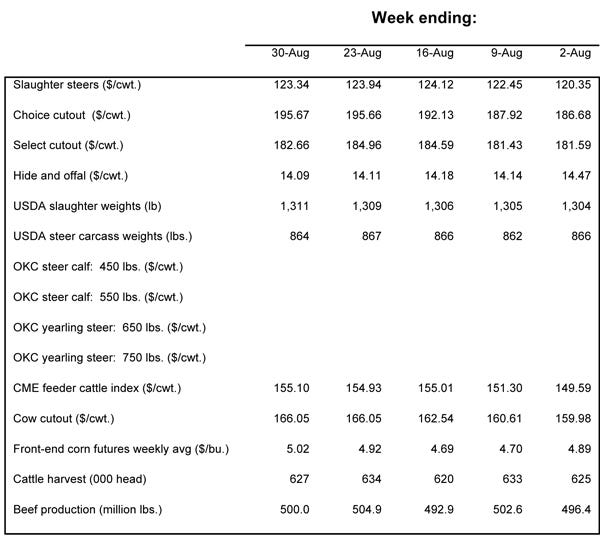

The fed market, after bottoming during the latter half of July (around $120), began to catch some wind as August opened for business. Fed steer and heifer trade subsequently moved into $123-$124 range as business embarked on the Labor Day weekend (Figure 1). Perhaps even more important than the recent gains is that cattle feeders held off any slippage below the $120 threshold.

Cattle feeders' tenacity has been an enduring theme throughout the summer. Such success is especially important for cattle feeders given the broader tone around the business. As mentioned last month was the fact that, “Beef processors [were] clearly hoping for a rebound in cutout values in the run-up to Labor Day and will also work hard to keep fed cattle prices in check.”

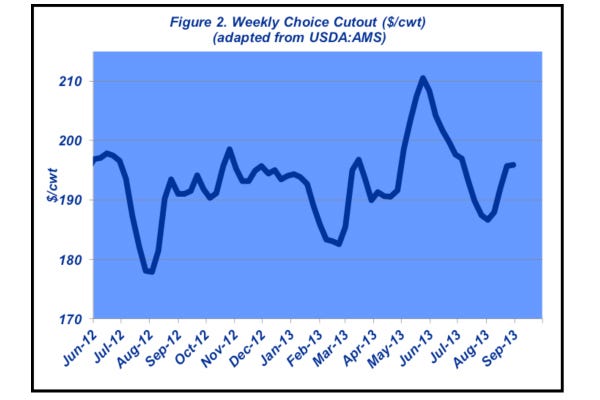

On that note, it’s important to review beef trade during the past 4-5 weeks. The Choice cutout bottomed in late-August at $187. The summer doldrums were on. And not surprisingly, the Choice-Select spread simultaneously narrowed to $5.

No sooner than the lows were established, the wholesale market began to perk up. The Choice cutout surged back to $195 (Figure 2), and also pulled the spread back above $10. In both cases, the move was a promising indicator of beef movement, or at least the anticipation thereof by restaurants and retailers, heading into Labor Day.

Whatever the reason, though, cattle feeders garnered most of that boxed-beef bounty in the month of August. The packer yielded his margin potential and extended his losses that began in late-July. And so, coming back to the start, what could have been a tough, back-and-forth, sloppy month was actually constructive for the market. More significant, it provides a good base to jump from into the final four months of the year.

All that aside, clearly the biggest news of the month are developments around zilpaterol (Zilmax™). The market is still trying to figure out the ultimate long-run effect of the beta-agonist being pulled off the U.S. and Canada market by its manufacturer Merck Animal Health. That question will only be appropriately answered over time. Nonetheless, there’s probably some fairly straightforward reckoning that can address the uncertainty – or at least provide some framework to work from.

First, documented research indicates the Zilmax boost is equivalent to approximately 30 lbs./head of carcass weight. Second (and much harder to ascertain) comes consideration of Zilmax’s market share. Let’s roughly assume that beta-agonist use represents approximately 70% of the fed cattle population, and Zilmax owns roughly half of the market. Thus, Zilmax generously covers about 35% of the fed cattle population. In combination, the absence of Zilmax from the production system represents an overall decline to the U.S. beef industry of about 10 lbs./animal of carcass weight from the fed steer/heifer population (30 lbs. multiplied by 35%).

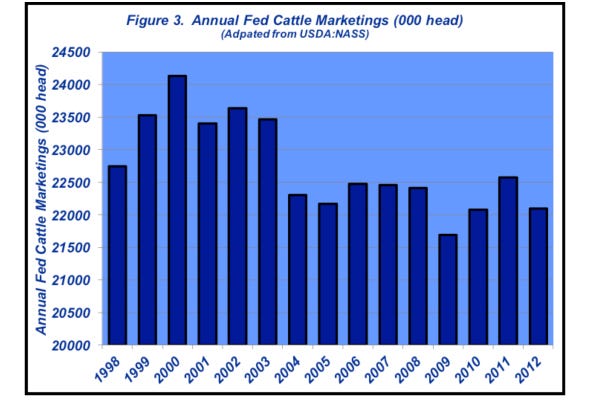

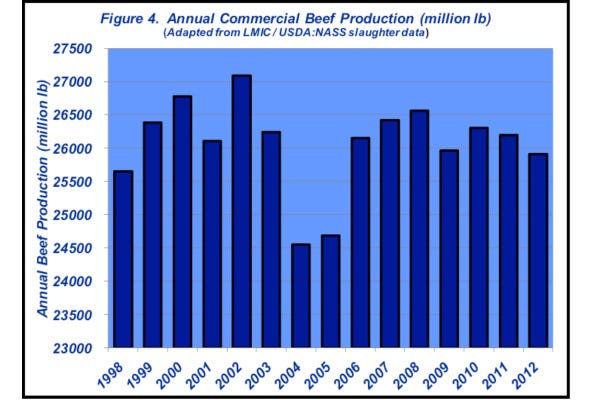

Now let’s put that in perspective. Utilizing annual fed cattle marketings of about 22 million head (Figure 3), the net loss equals 220 million lbs. of beef. That represents less than a 1% of the nation’s total commercial beef production on an annual basis (Figure 4).

Meanwhile, one also needs to consider that a competing beta-agonist, Optaflexx™ from Elanco, will gather up some of Zilmax’s lost market share over time, thereby compensating for some of that lost weight. Simultaneously, cattle feeders are on the cusp of a very different ration cost structure vs. previous years; lower feed costs, coupled with steady-to-higher fed prices, means the marginal cost of gain mounts more slowly. That allows for additional time on feed and will help offset some of the loss. Lastly, USDA's recent Cattle on Feed report indicates that both calves and yearlings appear to be staying out on grass longer; that ultimately means bigger placement weights: heavier in means heavier out.

The best analytical parallel for all of this discussion is probably invoked with the dairy industry’s ability to adapt and adjust once the large retailers (e.g., Kroger and Walmart) and others opted to forego purchase of milk from cows treated with bST. The industry managed to overcome that challenge without much disruption to supply.

Similarly, the beef industry has always managed to be amazingly resilient, and this time will prove no different. Somehow, some way, much of this will likely end up being perceived as a non-event from a production standpoint over the long run.

The bigger issue that needs to be grappled with comes from the broader perspective when discussing the beef industry and its inner workings. I recently noted in some commentary for Feedstuffs that, "…the manner in which this played out wipes out any preconceived notion any of us might have when speaking collectively about the 'industry.' Ironically (or maybe not), Tyson’s initial pronouncement occurred during the same time NCBA was hosting a special beta-agonist meeting at its Summer Conference. Therefore, let’s never assume any broad allegiance to 'industry.' These companies operate based on the best interests of their customers and shareholders. With that in mind, the decision represents an appropriate response to concerns; Tyson is attempting to protect its brand equity."

August Price Summary

But no matter the motive, it all points to a new dynamic occurring within agriculture and the food business.

With that observation, this column closes every month with some discussion around the need to remain fully informed and maintain objectivity around all aspects of the business. The recent developments serve as a stark reminder of how rapidly business can change. It also calls to mind a meaningful summary about the mandate for versatility when there’s sudden and unforeseen transition within the business environment: “Successful business is essentially the pragmatic art of survival. It's about challenge and competition, prospering in the face of ever-changing obstacles and threats. (C. Kerry Nemovicher, Letters To the Editors, The Atlantic Monthly, October 2006)

You might also like:

How To Receive The Most Money For Your Calves

80+ Photos Of American Cowboys & Cattlemen

Capping An Eventful Nine Days Merck Halts Zilmax Sales

About the Author(s)

You May Also Like