Negotiated cash trade trends -- Is the cash market for fed cattle sufficient?

In contrast to conventional wisdom, the overall price change for fed cattle from week to week (price volatility) has faded during the past several years despite working with only about 25% cash trade.

January 16, 2019

The Organization for Competitive Markets previously filed a petition for review of USDA’s order to withdraw implementation of the GIPSA Farmer Fair Practices Rules, otherwise referred to as the GIPSA rule. That petition was recently denied in Federal Court. The background to the GIPSA rule has a lengthy history.

Price discovery is an issue that is always sure to spark controversy in the beef industry. Moreover, focus on the issue always seems to amplify when cattle prices are under pressure. Nevertheless, recent developments around the GIPSA rule provide a good opportunity to review pricing trends within the beef industry – especially as we start the new year.

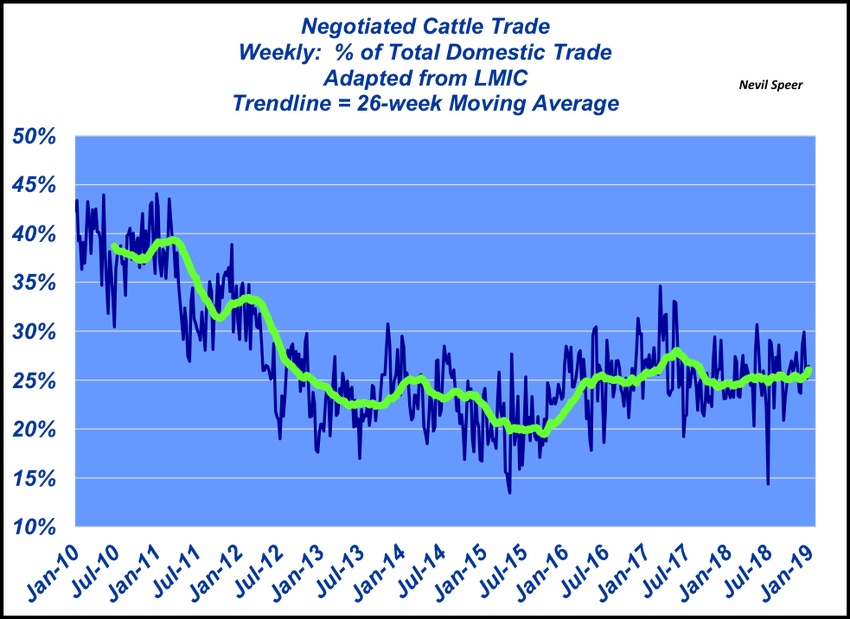

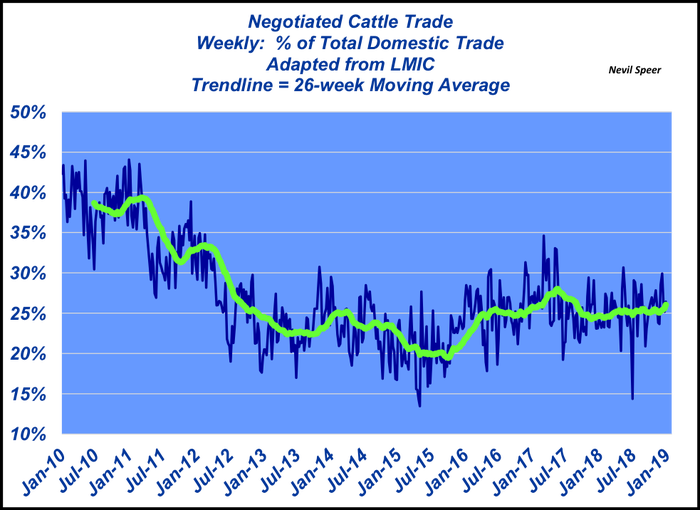

This week’s graph highlights weekly negotiated cattle as a percent of total domestic trade – i.e. cash trade. It represents the percentage of cattle traded on a weekly basis that are subject to actual packer-feeder negotiation. The remainder of the cattle not sold on a cash-trade basis would be sold on some sort of grid, formula or forward pricing arrangement. Seemingly, during the past three years, the industry has found somewhat of an equilibrium where cash trade represents roughly one-fourth of all cattle traded on a weekly basis.

Therein enters the concerns for some – they’d argue that 25% is insufficient when it comes to facilitating true price discovery. Those concerns are two-fold: First, there’s a perception that thin cash trade inevitably causes softer prices, thereby benefitting the packer; second, insufficient cash negotiation inherently leads to amplified volatility.

Interestingly enough, though, cash trade percentage was falling while the market was working to new highs in 2013, 2014 and the first half of 2015. Meanwhile, when it comes to volatility, 2018 saw an average change of about $25 per head (up or down) on a weekly basis; that’s about half of the weekly change average in early 2016, when it hit $47 per head.

Stated another way, in contrast to conventional wisdom, the overall price change for fed cattle from week to week (price volatility) has faded during the past several years despite working with only about 25% cash trade.

With that in mind, what’s your assessment of negotiated trade in the fed cattle market? What level would you consider to be sufficient for a fully functional market? Where do you see all this headed in the coming years? Leave your thoughts in the comments section below.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)