Nothing about the U.S. cattle market should surprise us any more

Feedyards currently possess good leverage as packers chase cattle; the front-end supply will need to be monitored carefully going into 2015.

December 4, 2014

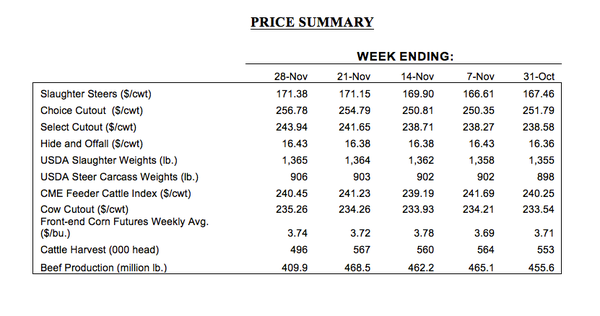

Another month, another set of new highs. November witnessed even more cattle prices for the record book in back-to-back weeks. First, fed cattle trade averaged nearly $170 (~$2,300/head) in the middle of the month – bettering the previous record by $1/cwt. established just three weeks earlier. Then, follow-through the following week tacked on another $1.25 making it the first time average fed trade has crossed the $170/cwt. threshold. Thanksgiving’s trade was steady to finish out the month. That action puts the fed cattle trade four-week moving average hovering right around $170.

Perhaps more importantly (at least from the cattle feeder’s perspective), the futures market has also joined in the bullish action. The February and April contracts have surged nearly $20 since mid-August. That cushion has enabled some opportunity in recent weeks for improved risk management strategies on feeders purchased earlier in the fall (more on that below).

Meanwhile, gains on beef’s wholesale side continue to lag behind those on the live side. Packers have struggled to force the cutout to higher levels to keep up with their respective procurement costs. From a cost perspective, the fed market has tacked on $10/cwt. or $130/head since the first part of September. The Choice cutout, though, has only improved about $7/cwt. – or $60/head.

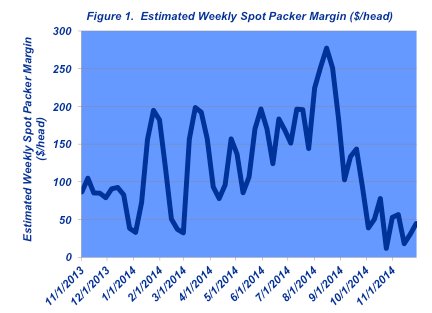

As such, packer margins have gotten increasingly tough through the fall and running sub-$100/head since the middle of September (Figure 1). As noted last month, packers will undoubtedly work to claw back some margin in the coming weeks/months. However, that’s an uphill battle in the midst of historically tight supply of cattle on one side, and customers on the other side that are reluctant to pass on the higher prices to consumers.

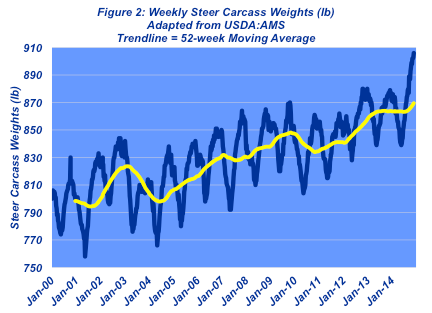

Per the supply issue, November’s Cattle on Feed report came in pretty much as expected. Total inventory equals 10.63 million head, just about even with last year’s mark. That said, cattle weights have spiked and are running well ahead of last year (Figure 2). Additionally, there are more cattle to come in the spring months; the 120+day feedyard inventory equals 3.28 million head. That’s the second-largest level in the series history (behind 2012’s 3.41 million head). And proportionally speaking, the 120+day inventory represents the highest level on record (nearly 31%). So while feedyards currently possess good leverage as packers chase cattle, the front-end supply will need to be monitored carefully going into 2015.

All that aside, the fed cattle market has been nothing short of incredible this year. But that doesn’t mean feedyard margin concerns have been alleviated. That’s because the feeder cattle market has been even more impressive. Cattle feeders have competed hard to procure replacements throughout the year – all to the benefit of sellers.

Consider that feeder cattle were trading at $170/cwt. at the first of the year; they’re now trading at most $240/cwt – that represents an increased value exceeding $500/head (~40%). Simultaneously, fed cattle prices have improved only $420/head (or ~25%). Some of that difference has been compensated for by cheaper feed prices. But it doesn’t solve the problem regarding profit challenges amidst the latest round of replacements.

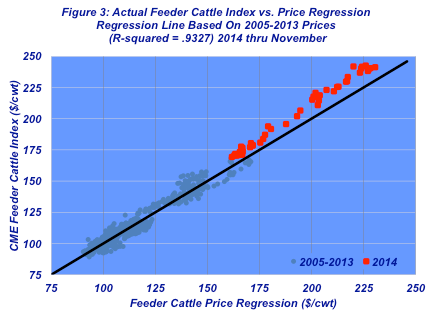

The relative strength of 2014’s feeder cattle market is best represented by Figure 3. It depicts the relationship between predicted (based on statistical regression) and actual price; the regression is comprised of nine years’ worth of data (2005 through 2013). Subsequently, 2014’s predictions vs. actual prices are also represented in the graph. Data points above the line represent prices higher than expected. Most importantly, every week in 2014 the CME Feeder Cattle Index has finished above the predicted value.

In other words, as alluded to above, cattle feeders have aggressively chased cattle. That’s occurred for several reasons: 1.) to ensure operating at increased capacity levels, and 2.) to procure placements as means to bet on a surging fed cattle market. As long as the fed market continues to reward that behavior, risk appetite is likely to remain elevated (keeping prices above the regression line). That’s a good strategy when prices are improving, but could/will prove problematic if/when the fed cattle market goes through a corrective phase.

Despite new records, look for some continued chop through the holidays. Looking out further, the market faces some uncertainty. The key will be which side gets the upper hand in terms of bargaining leverage. The winner will largely dictate direction for the next phase of the market in the spring.

Clearly, lower fuel prices favor increased shopping and propensity to spend, thereby underpinning beef demand. That keeps packers coming back for cattle to meet customer demands. Alternatively, any hiccup against the backdrop of larger front-end supply and tight packer margins, as discussed above, could force some setback for the market. And of course, there’s always weather to consider this time of year.

Subscribe now to Cow-Calf Weekly to get the latest industry research and information in your inbox every Friday!

In closing, as noted in previous months: “Trying to outguess or outsmart this market is about like trying to outrun a speeding train. It’s nearly impossible to do and the consequences can be devastating.” This market has been very challenging to predict and will likely be so going forward. Nothing should surprise us anymore.

From a business perspective, higher markets mean ever-higher levels of capital requirements and point toward the need for careful risk management. So, as always, it’s important to have objective information and disciplined review; both are essential to helping ensure successful decision-making going forward.

Nevil Speer serves as a private industry consultant. He is based in Bowling Green, KY, and can be reached at [email protected].

You might also like:

Get Your Cattle Feeding Program Geared Up For A Bad Winter

What's The Best Breeding Weight For Beef Heifers?

5 Steps To Winterize The Ranch

Billionaire Aims To Make Florida The U.S. Grass-Fed Beef Capital

Burke Teichert: Beef Cow Reproduction; What, How, Why

8 Apps For Ranchers Recommended By Ranchers

What Do The Results Of The 2014 BEEF Efficiency & Profitability Contest Teach Us?

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)