Production Sector Environment Continues To Shift

The latest USDA data indicates the commercial sector is treading very carefully regarding plans for expansion.

October 31, 2012

A great TV or book series always strings you along. Their strategy is to keep you captivated by providing just enough clues along the way to hold your interest, but never enough to ensure confidence about the final outcome. The result is you end up hooked until the very end.

So it goes with this year’s cattle-on-feed reports. Important signals about the business have percolated during the past 6-12 months, but they’ve come intermittently, along with other noise and subplots in the beef complex. Last month’s report, though, provided some pertinent indicators around the collective decision-making throughout the supply chain.

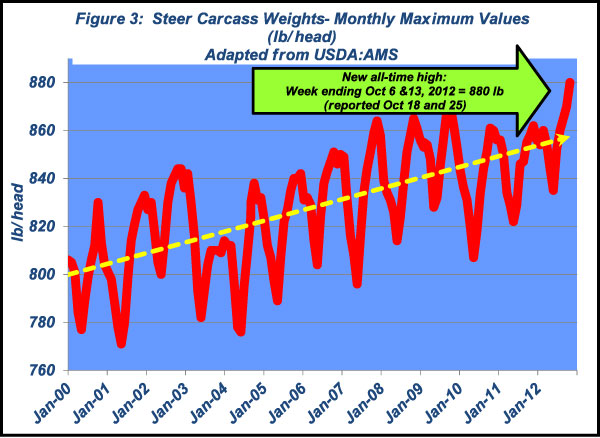

The first aspect revolves around the cow-calf sector. October’s report also includes a quarterly assessment of the inventory’s composition. Figure 1 reflects the relative proportion of heifers on feed over time. The data reflect feedlot heifer numbers drifting lower and, subsequently, the intention to rebuild the cowherd. However, that interpretation needs some broader context.

Sure, there’s a better appetite to keep back some females, but the change is very incremental, which leaves the overall trend relatively flat. In other words, the commercial sector is treading very carefully with any plans for expansion. This reluctance exists for many reasons, including volatile feed prices, surging land values, weather challenges, demographics, and a general anxiety about duration risk associated with heifer investment.

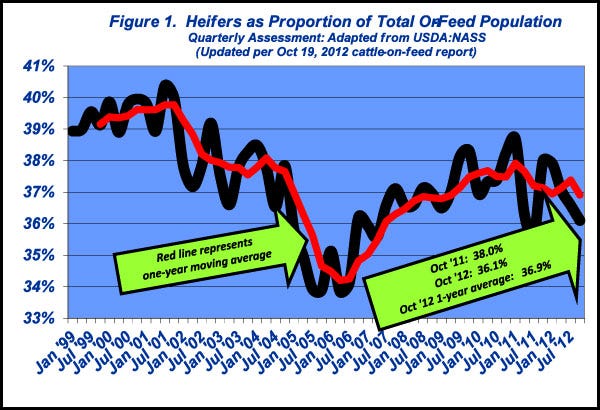

The second story surrounds feedyard trading strategies. September placements were down sharply and established a new low in the series for the month. That comes on the heels of last month’s sluggish pace (second-slowest August on record). None of that’s really surprising, given costly replacements, burdensome feed prices and heightened risk within the current operating environment. Overall, placements are 6% behind last year’s pace through September.

That brings us around to the other side of the balance sheet – marketings. September’s shipments were disappointing (though somewhat muted by 2012 having two fewer marketing days in September vs. 2011). Nonetheless, the discussion returns us to May’s column detailing the work ahead between April and September. Most notably, weekly shipments needed to average about 465,000 head to remain current. But that didn’t happen, as the pace was closer to about 444,000 head.

Joint consideration of placements and marketings reflect an overall theme of lagging throughput (Figure 2). This year’s collective pace is second only to 2009 (then driven by the financial crisis and a struggling market). Feedyard managers are carefully managing the swap and are much more reserved about inventory turnover.

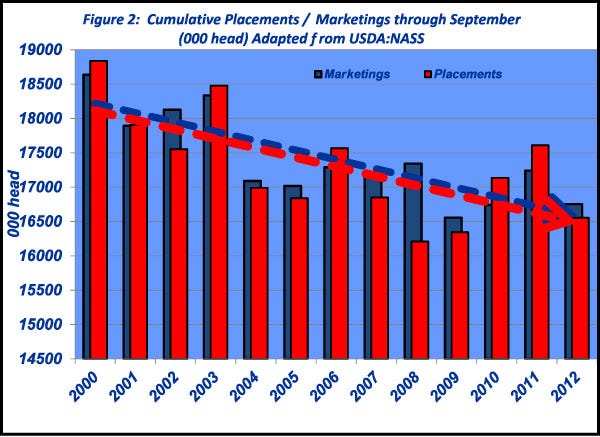

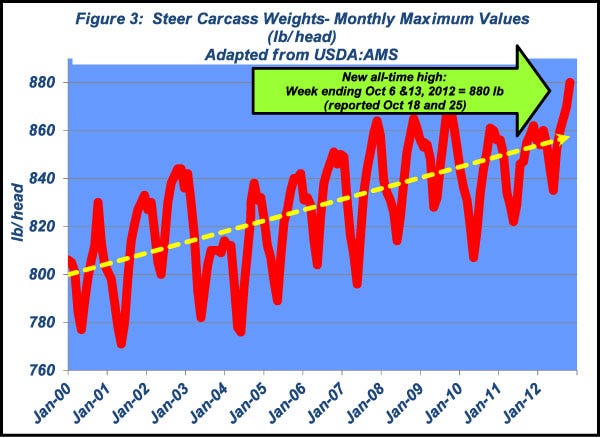

Carcass weights continue to get bigger

When the impending rotation is unfavorable (especially considering the capital at risk) and closeout cash flow turns negative, the rational strategy for feedlot managers is to defer the swap as long as possible. Thus, cattle stay on feed longer, generate more weight and create additional revenue, while avoiding management headaches and the risk associated with new arrivals.

That strategy is evidenced by the recent surge in carcass weights (Figure 3). Despite higher ration costs, steer carcass weights peaked in excess of 880 lbs. in mid October. Bigger weights may still be in store given that seasonal weight sometimes peaks in November. Moreover, the 120-day, on-feed inventory is record large for October (3.6 million head vs. 3.0 million head in 2011) and now accounts for one-third of the total cattle on feed. That influence is two-fold:

One, it’ll take time to work through that population, meaning bigger cattle and more weight;

Two, leverage will be hard to maintain on the selling side for the next several months, though that should transition quickly as we move into spring.

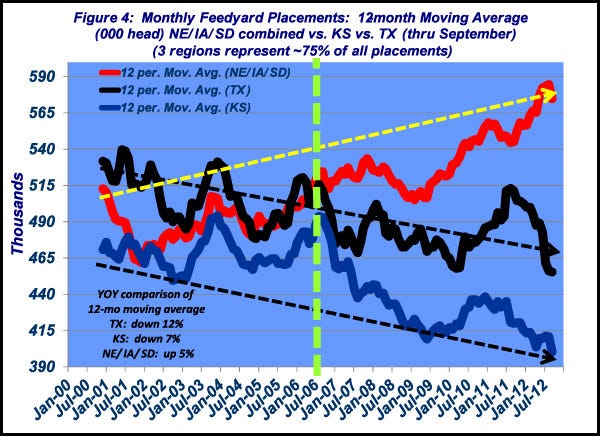

Finally, the packer merits some discussion here. Therein enters consideration of regional differences. In aggregate, through September, only two months have witnessed placements exceeding year-ago levels (February and May). But there’s an exception to be considered. Placements in the three-state region of Nebraska, Iowa and South Dakota have lagged 2011 only two months (April and September) out of nine. Moreover, total placements in the region are 5% ahead of 2011, while placements in Kansas and Texas are both running 8% behind last year’s delivery rate.

That’s not a new trend (Figure 4) and underscores the evolving nature of the feeding industry. As mentioned in June: “…cattle feeders in the Nebraska/Iowa/South Dakota region operate under different business dynamics vs. larger operations in the High Plains. Many are diversified businesses allowing for greater marketing flexibility from week-to-week.” But what’s most important, especially in light of excess packing capacity, is the influence on the fed market and likelihood of impending rationalization. Clearly, beef processors are playing catch-up in the southern region, while supply is much more comfortable in the north.

There’s never space enough to do it all justice. The discussion above revolves around the production sector but overlooks adjustments also occurring among food-service vendors, restaurateurs and food retailers. This month’s discussion also ignores the weekly and monthly market developments.

The priority, though, is to illustrate the shifting environment within the production sector around those markets. And seemingly, the pace of change is accelerating and mandating ever-faster response from all players in the value chain. With that in mind, as always, it’s critical to remain objective and stay informed.

Nevil Speer is a Western Kentucky University professor of animal science. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)