Run, baby, run: Fed market looks to run higher, but supply worries continue

The October and early November fed cattle market shows signs of life. But keep an eye on supply before breaking out the party hats.

November 14, 2018

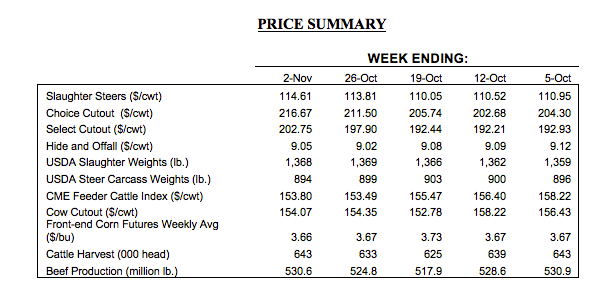

Something finally happened in October. Starting in mid-September, the fed cattle market strung together six consecutive weeks of trade at $110-$111 per cwt. That flat-line streak is unprecedented as I look through the historic data. But in mid-October there came a break in the stalemate.

Cattle feeders managed to tack on another $3 in the final week of October, ratcheting the market back up to $114. And then subsequently added another dollar to open November at mostly $114-$115.

More importantly, that’s the best price level received by feedyards since early June. As noted last month, now the market will begin to look toward better prices ahead of the holiday season.

So now the work ahead revolves around how far the market might be able to run. Unfortunately, the answer is a little muddy.

Fed trade has been under the same broader story for most of 2018: big demand and big supply. The market’s ability to run further is a function of how that tug-of-war plays out.

Demand developments

Let’s take the demand side first. Strong beef demand, both domestically and internationally, has helped solidify prices all year. And it was better Choice wholesale values that helped pull the market higher in recent weeks.

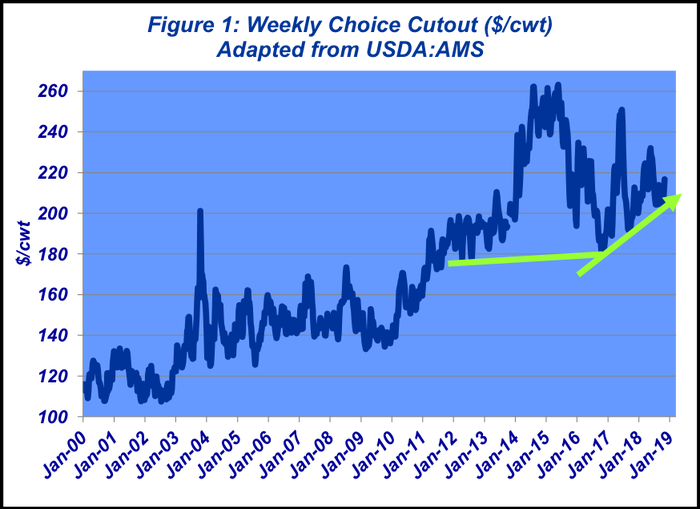

But what’s really important is the long-run view. To that end, the Choice cutout has forged a substantial and favorable support trend in recent years. During the past three years, the established lows have been $180, $191 and $203 in 2016, 2017 and 2018, respectively, all of those coming in September or October (Figure 1).

Best of all, that’s happened against bigger year-over-year kills. In other words, stronger demand has underpinned pricing power within the wholesale market.

Meanwhile, this column has noted month after month that domestic demand has been bolstered by better beef quality coupled with a strengthening economy; consumers generally feel good about, and seem committed to, spending money on beef.

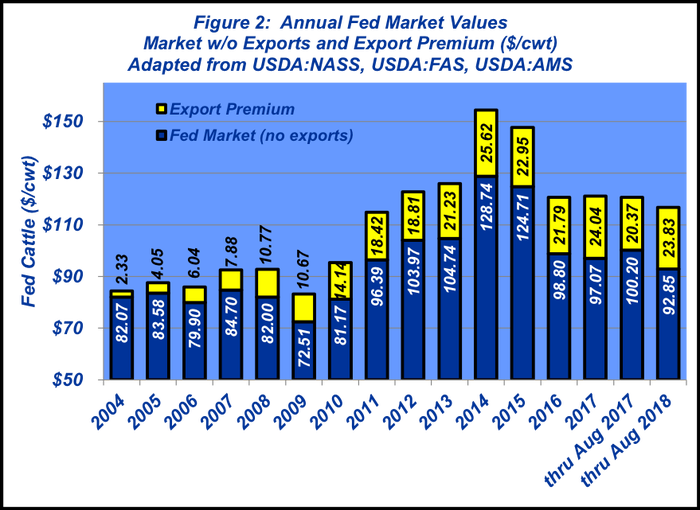

Within that discussion, international demand has also played an important role in supporting the fed market. That’s equivalent to nearly $325 per head – or about $24 per cwt.

What’s more, international sales to date have added an additional $3.50 per cwt to the fed market on a year-over-year basis (Figure 2). That translates to an extra $47 per head for every steer and heifer marketed thus far in 2018 versus 2017.

Supply worries

But then there’s the supply side of the price equation to consider. To be sure, there’s no shortage of supply. USDA’s Cattle on Feed report pegged October feedyard inventories at 11.4 million. That Oct. 1 mark is the biggest in the series history, 5% bigger than last year’s number and 11% ahead of the 5-year average. Feedyards will be looking to free up some pen space.

And that needs to happen. From a near-term market perspective, what really matters is the composition of those pens in terms of market readiness.

Average placement weights in 2018 haven’t materially differed from previous years. Therefore, cattle arriving around 750 pounds will be on feed 150 to 170 days. With that in mind, the 120-day count becomes important because it indicates the magnitude of the wave that needs to be marketed over the next 30-60 days.

As of Oct. 1, feedyards were holding nearly 3.975 million head that had been on feed at least 120 days. Like total inventory, that’s the biggest count for October in the series history – beating out 2015’s previous record by over 100,000 head and over 400,000 head bigger versus 2017.

That means there’s marketing work ahead. Carcass weights will be important to monitor during the next several months as an indicator of whether cattle feeders are getting backed up.

To that end, last week’s Industry At A Glance highlights some of the recent trends around feeder cattle futures. They’ve worked higher in recent months – largely pulled ahead by strength of deferred feeder cattle futures.

As such, current values are on the upper side of lifetime contract highs. Given some of the supply concerns mentioned above, the market is seemingly providing some viable pricing opportunities for producers planning to sell feeders this coming spring.

Meanwhile, this week’s Industry At A Glance features recent grading trends. Most notably, in the middle of October, USDA’s Steer/Heifer Estimated Grading report revealed new record percentages for cattle achieving Prime – nearing 9% of the total weekly kill.

That’s a feat once thought impossible and it’s highly significant. As noted above, the trend of better beef quality has been fundamental to bolstering beef demand over the long run.

To close, Morgan Housel published some important commentary back in June: The Psychology of Money. Housel’s focus is on finance – and behavior. He notes that, “No amount of intelligence is stronger than poor behavior.”

That comment underscores the importance of understanding risk tolerance. It’s different for every operation. And within that, producers are encouraged to be attentive to all factors – especially negative influences on the market and their business.

Understanding those effects, in context of one’s risk profile, can ensure that poor behavior (i.e. impulsive decisions) doesn’t occur and shift the balance toward successful decision-making along the way.

Nevil Speer serves as an industry consultant and is based in Bowling Green, KY. Contact him at [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)