U.S. beef cow herd faces several challenges as it rebuilds from drought

Rabo AgriFinance report outlines difficulties the U.S. beef sector might face in the first quarter.

Lance Zimmerman, senior beef analyst for Rabo AgriFinance, reminds cattle producers that even after the rains return and the drought eases up in cattle country, rebuilding beef cow herd numbers isn’t going to happen overnight.

U.S. cattle producers have seen this cycle before — in 2014 to 2016, following the droughts of 2012 — but this time is different, he says.

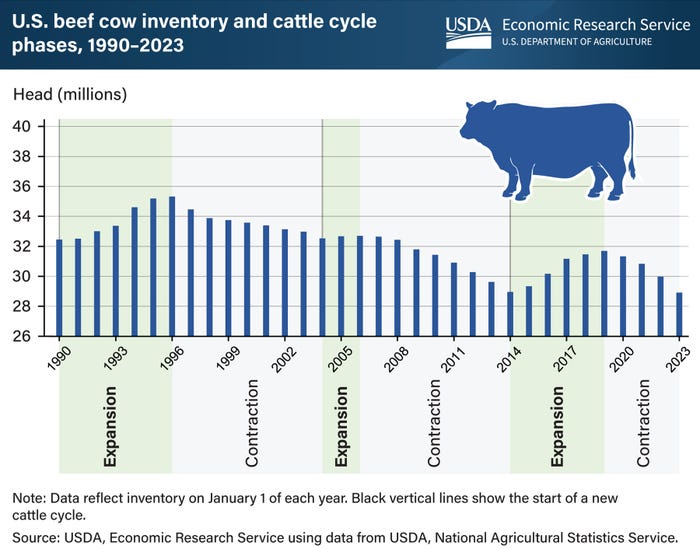

“First, we culled 13.5% of the beef cow herd, and the prior record was 12.5%,” Zimmerman says. The USDA’s cattle inventory report Jan. 1 reflected a four-year decline in numbers, landing at 28.9 million head. That’s the smallest beef cow herd since 1962, according to Rabo AgriFinance’s first-quarter Global Beef Quarterly Report released in February.

Heifer placements in feedyards were record-high on Jan. 1, and heifer calf sales were some of the strongest seen, he says. That means there are limited numbers of young heifers on ranches now that can be put into production to quickly rebuild the herd.

“We need moisture,” Zimmerman says. Even with weather patterns expected to swing back to El Niño, 2023 is still likely to be dry, and that affects feedstocks.

Feedstocks down

The drought has hay stocks sitting at the tightest levels seen since the 1970s, Zimmerman says. The feeding segment is struggling with $6 corn on the futures basis, he adds, with some southwest Kansas feedyards facing a local cash market at $1.50 to $2 over the futures price.

“We went through this in the early 2000s, with the Renewable Fuel Standard propping up the corn market with ethanol demand,” Zimmerman says. “That’s great for our grain farmers — nothing against them in that — but we’re repeating that again with the renewable diesel. And when you have $15 soybeans you have to keep prices for corn high because there’s only so many acres to go around.”

Retail decreasing

Consider, too, that consumers are tightening their purse strings with concerns about the economy.

“We saw record-high beef prices post pandemic, in about October 2021,” Zimmerman says. “We’ve pulled back about 40 cents per pound since then. But, if we’re talking about needing to get calf prices to, let’s say, $3 a pound, we probably need to get beef prices to $8 to $9 per pound on the retail side.”

However, there’s ample protein supplies from the poultry and pork sectors competing for those consumer dollars. Rabo’s first quarter report predicts first-quarter U.S. retail beef prices to be 1% to 2% softer than the prior year.

Cash-conscious consumers are still reaching for ground beef, Zimmerman says. And that is a trend that’s interesting to see.

“Ground beef is pretty hard to beat, and really, the price data would back it up,” he says. “You can take the ground beef price paid at retail against the chicken breast or against the pork chop, bacon, roasts, steaks, and there’s really only two items that ground beef hasn’t continued to gain a premium over — that’s bacon and steaks. Otherwise, it continues to grow in a premium price advantage to all the other protein categories, and that’s pretty fascinating.”

Older ranchers

Lastly, Zimmerman says, there’s even the question if ranchers are at a point in their careers where they want to rebuild herds at all. The last U.S. Census of Agriculture in 2017 reported the average age of beef cow producers was 57. “They were a full five to 10 years older than any other producing segment within the livestock space,” he says.

So, who’s managing these ranches? What does the generational transfer look like? Will ranches stay in the same family?

“How do we make sure that we keep those ranches, farms, operable, even if ownership changes?” Zimmerman asks. The cow-calf segment is 90% owned and operated by producers with 200 head or less, he says. With aging operators and increasing pressure to implement and record sustainability measures, management must adjust in the future, and cattle producers need to have an idea of what that change might look like for them.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)