What's the cattle market's 5-year outlook?

With an expected downward trend in beef cow numbers over the next five years, what does that mean for feeder cattle prices?

August 20, 2020

My study herd rancher and I have spent a lot of hours discussing the cattle cycle and its resulting beef price cycle. Since 2020 is the first year of the next cattle cycle as well as its resulting beef price cycle, he asked me to focus this month’s discussion on the next five years.

He said his herd’s economic performance for the last couple of years has not been totally satisfactory, and he wants to see if we can increase the annual net income. He wants to know the projected economic environment for the first five years of the next cattle cycle.

It turns out that the Food and Policy Research Institute (FAPRI) at the University of Missouri just released its 2020 spring projections, so I suggested that we spend this month’s meeting reviewing FAPRI’s projections. These are the best long-run projections that I am aware of. We can use these projections to review the economic setting that my study herd manager will have to operate in over the next five years.

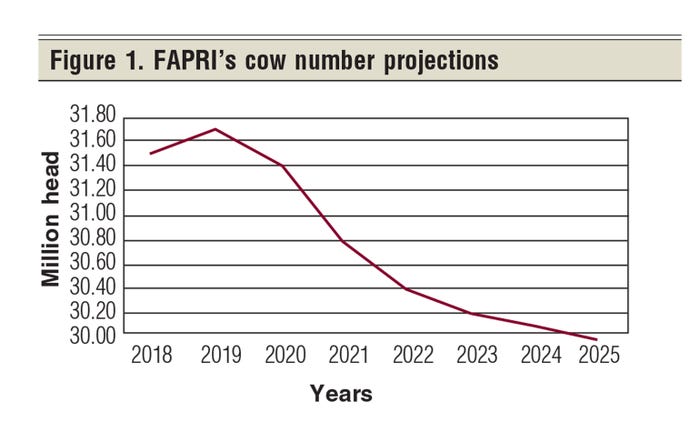

Projected national beef cow numbers. Jan. 1 beef cow numbers tend to change from year to year in a delayed response to cattle prices. This cycle of beef cow numbers tends to repeat approximately every 10 years.

Since beef cow numbers cannot change overnight, there is a lag in response to calf prices. Beef cow numbers have been increasing since the 2014 price high of the last cycle and appear to have peaked in 2019.

We are now entering the downward phase of the cow number cycle. As shown in Figure 1, FAPRI projects beef cow numbers to decrease from 31.7 million head in 2019 down to 30 million head in 2025.

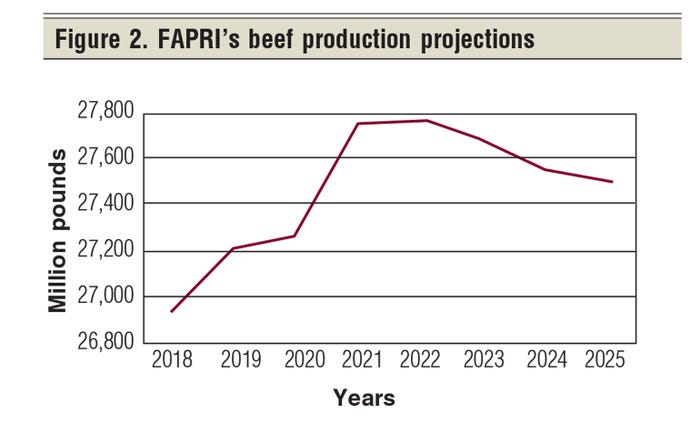

Projected U.S. beef production. Decreasing beef cow numbers over the next five years imply that beef production is also projected to decrease over the first half of the next cattle cycle. Figure 2 presents FAPRI’s beef production projections through 2025.

Beef production is projected to slightly increase in 2020, with approximately a 700-million-pound increase in 2021. The largest projected increase in the next five years is projected for 2021.

After 2021, beef production is projected to slowly trend downward (Figure 2). Note that even in 2025, beef production is projected above years 2018 to 2020.

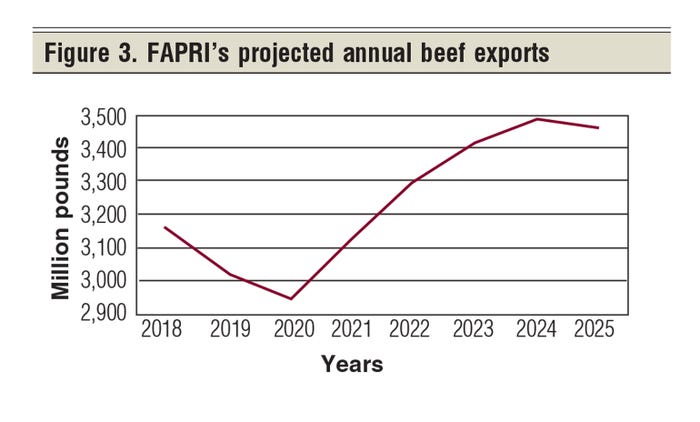

Projected beef exports. While beef exports have been decreasing from 2018 through 2020, FAPRI projects beef exports to start increasing in 2021 and peak in 2024, with a small drop in 2025 (Figure 3). This should help some with the projected increased production shown in Figure 2.

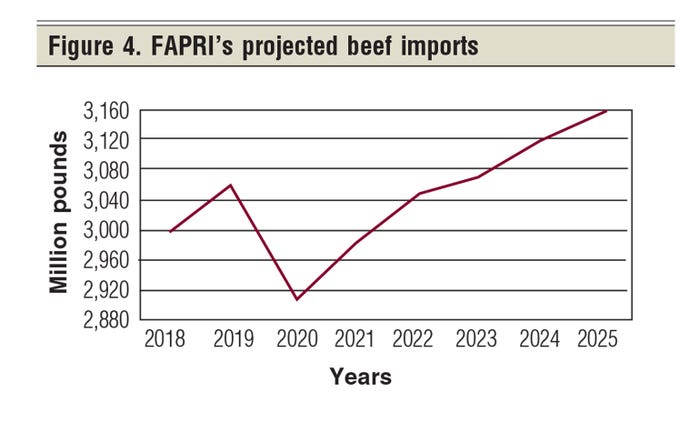

Projected beef imports. This year’s COVID-19 experience is projected by FAPRI to decrease 2020’s beef imports. In turn, imports are then projected to increase for 2021 through 2025.

It is important that my readers recognize that we import lower-quality beef generally for grinding, and that we export high-quality beef. The economic value of imports is much less than the economic value of exports. Hamburger consumption accounts for a very significant portion of domestic beef consumption — beef imports keep us from grinding high-quality beef for hamburger.

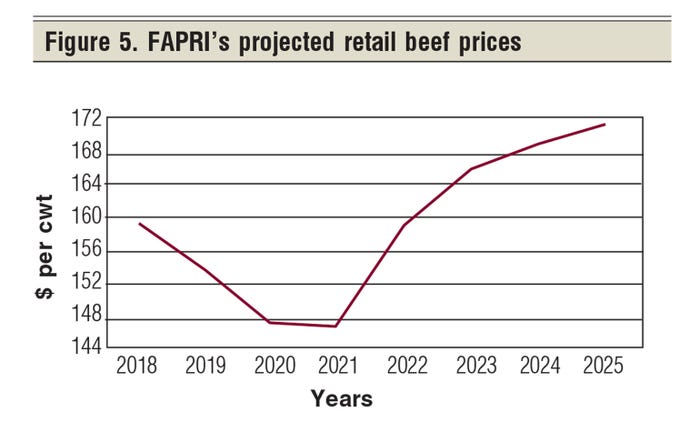

Projected beef retail prices. Retail beef prices are a function of domestic beef production, beef exports, beef imports and the national economy’s performance. All of this is heavily impacted by COVID-19 and its eventual control.

Figure 5 presents FAPRI’s projected retail beef prices through 2025. High beef production in 2018 and 2019, which increased poundage due to COVID-19, leading to heavy cattle in 2020 and 2021, is projected to lower retail beef prices in 2020 and 2021.

But after that, lower beef production is projected by FAPRI to generate increasing retail beef prices from 2020 through 2025.

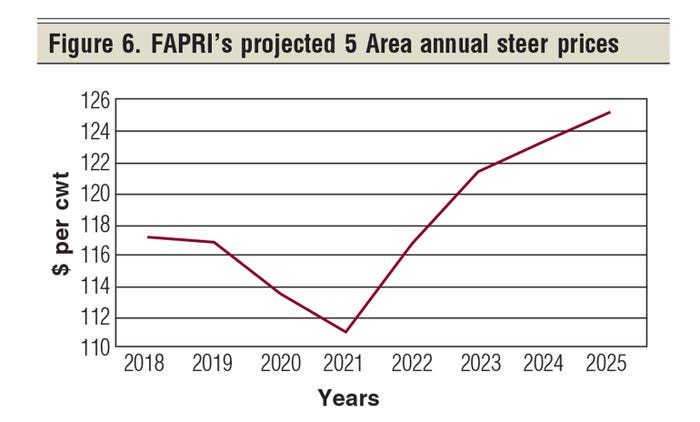

Projected slaughter cattle prices. Let’s return this discussion to cattle feeders and ranchers. Figure 6 presents FAPRI’s direct slaughter steer annual price projections.

COVID-19 increased the backlog of heavy slaughter cattle. Coupled with the market interruption from COVID-19, it’s projected to lower the 2020 annual average slaughter steer price, and to again lower the 2021 annual slaughter steer price. Then, decreasing beef production is projected to increase slaughter steer prices from 2022 through 2025 (Figure 6).

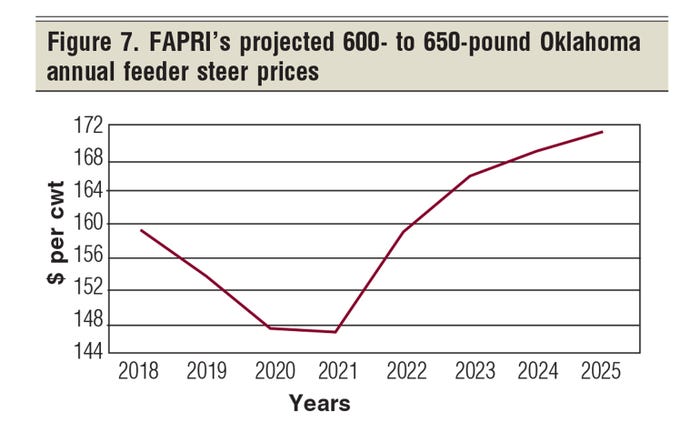

Projected 600- to 650-pound Oklahoma feeder steer prices. Finally, let’s start bringing this discussion back to the ranching community. FAPRI projects that Oklahoma 600- to 650-pound feeder steers will continue the downward trend established in 2018 and 2019, and with COVID-19 into 2020 and only slightly into 2021.

From 2022 through 2025, prices are projected to trend upward —again as beef cow numbers are projected to trend downward at least through 2025.

This all suggests to me that the next beef price cycle could peak in the 2025-26 time period. An earlier FAPRI projection suggested the peak could be as late as 2028. At this time, I would not yet rule that later date out.

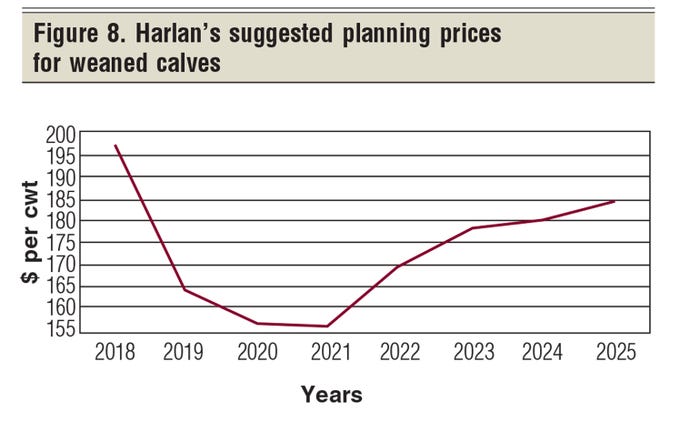

My projected planning prices presented to my study rancher. Over many, many years, I have tracked eastern Wyoming-western Nebraska sale barn prices compared to FAPRI’s historical U.S. prices. I use this historical price relationship to generate my set of planning prices for eastern Wyoming-western Nebraska ranchers.

Figure 8 presents this month’s suggested long-run planning prices for my study herd manager for his weaned steer calves over the next five years. Stay tuned.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)