Where’s the corn market headed?

As long as there’s tension in the corn market, there’ll also be some limit to how much feeder cattle prices can recover.

July 17, 2019

An interesting phenomenon occurred last week following USDA’s release of the July WASDE report. First, as expected, USDA raised the acreage estimate from 89.8 million acres (June estimate) to 91.7 million acres, based on estimates from the Acreage report released on June 28. As a side note, the agency’s June 28 acreage report caught the market off-sides – the nearly 92-million acres was unexpected and served to drive the market lower in the short term.

However, the July WASDE report resulted in ending stocks being revised upwards from 1.675 billion bushels to 2.010 billion bushels. Accordingly, USDA revised the average farm price down from $3.80 per bushel to $3.70 per bushel.

The corn-ending stocks also caught the market off-sides. That’s because the average trade estimate (depending on your source) was roughly right in line with the June WASDE number. And even the highest trade estimates didn’t have carryover exceeding 2 billion bushels.

While the market may have been caught off-sides, it played on through and completely disregarded the new information. That is, although USDA provided a bigger ending stocks number, the market found strength to the upside.

In fact, in the two days that followed, both the September and the December contract added 19 cents on sizeable volume. Some of that strength may be directly attributed to concerns about tropical storm Barry and its potential impact on the crop in the southern U.S.

Nevertheless, the market saw a bigger number and yet traded higher. USDA noted that, “In July, USDA’s National Agricultural Statistics Service (NASS) will collect updated information on 2019 acres planted, and if the newly collected data justify any changes, NASS will publish updated acreage estimates in the August Crop Production report.”

That statement underscores the broader uncertainty surrounding this year’s crop – it’s all subject to change. Markets hate uncertainty and often work off the adage of “buy the rumor, sell the fact.” In other words, as long as there’s uncertainty, the market will likely remain volatile and continue to push higher.

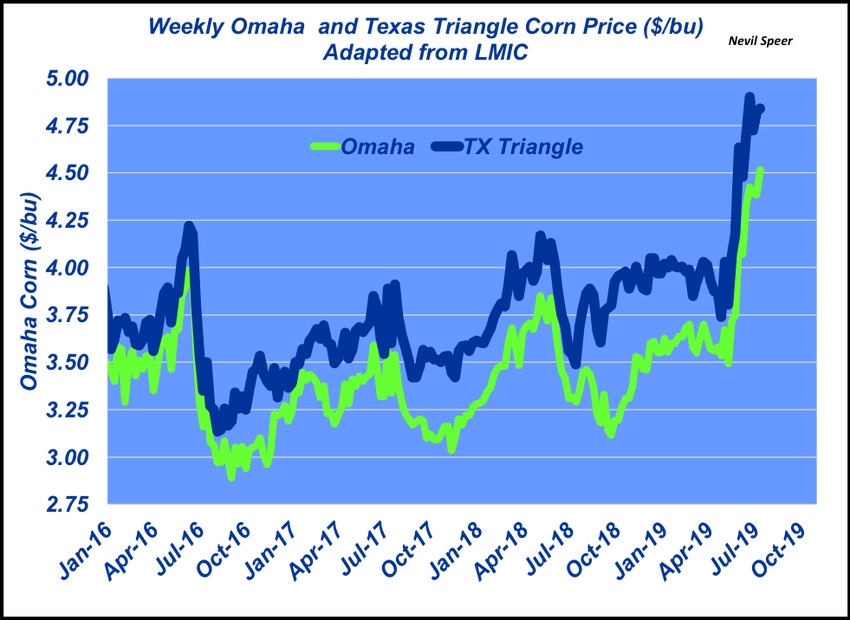

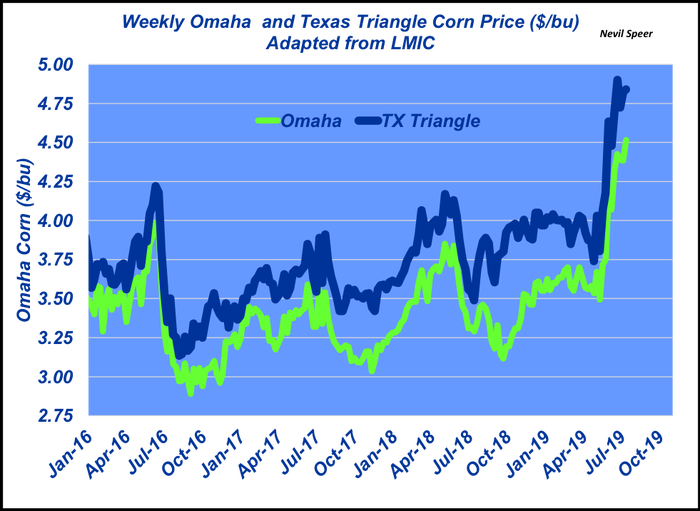

This week’s illustration highlights the influence this is having on key cash markets. The average Omaha price is now above $4.50, and the Texas Triangle is encroaching on $5.00 – levels not seen since 2014. And as long as there’s this tension in the corn market, there’ll also be some limit to how much feeder cattle prices can recover. There’s a lot that can happen yet before 2019’s corn crop is a sure thing. Stay posted!

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)