Whereto now, oh fickle cattle market?

Cattle feeders are fighting to get some equity back and buffer risk by become more reluctant purchasers of feeder cattle.

May 5, 2016

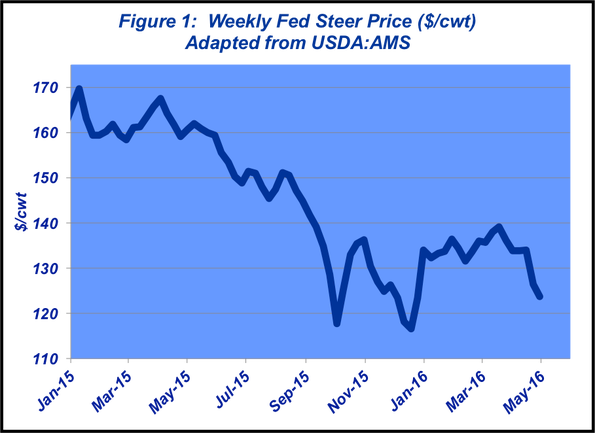

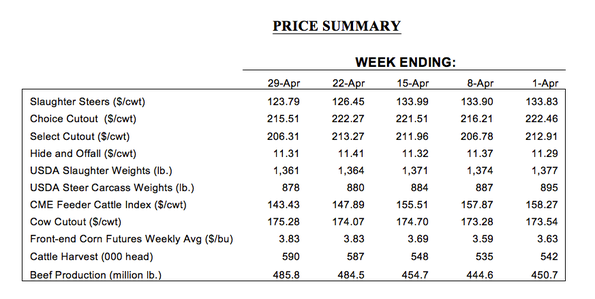

April was just downright ugly for the market. The market had enjoyed a surprisingly consistent run thus far in 2016, but that all came to an end in the second half of the month. Following 16 straight weeks of fairly narrow trading ($133-139), the fed cattle market plunged $8 per cwt to $126-127 during the third week of April, marking the market’s biggest one-week decline since last October when the market experienced three straight weeks of moves of $100 per head or more. The month closed out by giving up another $3, leaving fed trade at $123-124 per cwt (Figure 1).

While the cash market was fairly quiet through March, the futures market churned in the background. First, late-February, early-March Live Cattle futures experienced a failed rally. That stab saw the market run almost to $140 and then just as quickly fade. Then a second rally ensued several weeks later, helping to support cash trade back to $139. But once again, buying interest at the CME was insufficient to fuel any kind of lasting pursuit to the upside.

The failed rallies spelled trouble ahead. Sooner or later, there was likely going to be a break to the downside, especially in the face of bigger supplies and choppy at best boxed beef values. So now, fed trade goes into May in the mid-$120s – that’s equivalent to nearly $450 per head less than last year at this time when the market was trading at $160 per cwt.

The bulls have been fighting selling pressure through much of the spring – and they finally gave in, taking the fed cattle cash market with them.

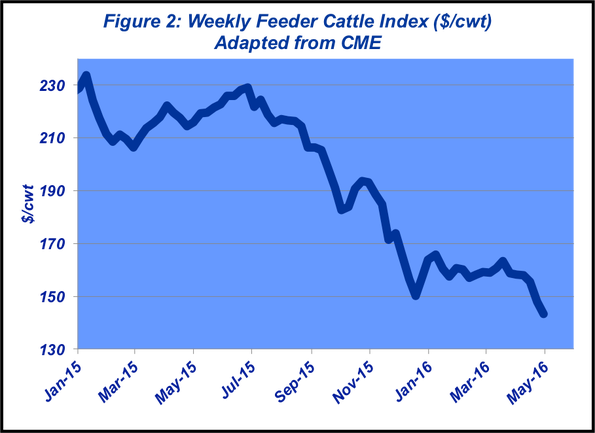

Meanwhile, feeder cattle have been pummeled along the way. Cattle feeders are fighting to get some equity back and buffer risk by becoming more reluctant purchasers of feeder cattle, not to mention that in many cases, liquidity is also a challenge. CME’s Feeder Cattle Index finished the month below $145 per cwt (Figure 2) - off nearly $550 per head on a year-over-year comparison.

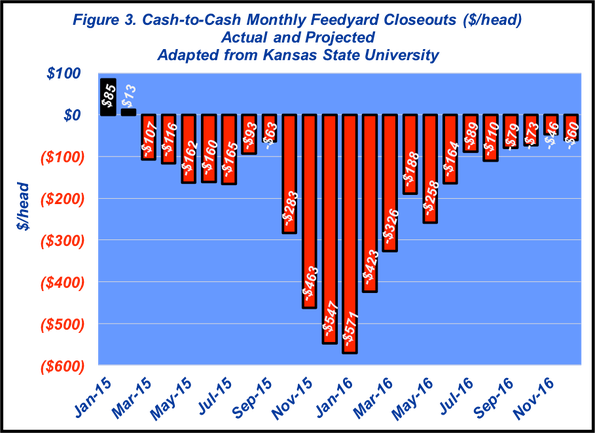

Perhaps most important, the recent break has eroded prospects for better closeouts; the trend is going the wrong way. Figure 3 depicts Kansas State University’s monthly cash-to-cash feedyard returns (actual and projected). Actual closeouts vary greatly across the industry, but what’s important is the overall trend. At this point in the game, following last fall’s debacle, there was some hope to at least reverse the negative momentum. But the illustration highlights the persistent challenge ahead given the current state of the market.

The good news is that cattle feeders have been aggressive sellers. USDA’s April Cattle on Feed report indicated a drop in the 120-day plus inventory. Meanwhile, weights have also reversed the contra-seasonal trend and now following the expected seasonal trend. As such, it appears that some of the concerns around currentness have been abated for the time being.

From a broader perspective, some parallels to this year’s stock market can’t be ignored. I recently had opportunity to catch some discussion on Bloomberg’s daily show, Surveillance, with hosts Tom Keene and Michael McKee. Their guest was noted quantitative market analyst, Emanuel Derman from Columbia University. The important dialogue goes as follows:

Host Tom Keene asks Derman: “What is the biggest mistake market participants make, the applied people, when they try to take your theoretical world and apply it to the real world?”

Derman: “They think if you’ve written down an equation that describes the market, the market is going to behave that way forever…And I think that’s the biggest mistake they make.”

Tom Keene: “To take it away from quant then, Sir John Templeton made very clear that any trend that is successful, people learn from it and the trend becomes less valuable – the model becomes less valuable over time.”

To that end, some review of the January column seems fitting:

Where all does all that leave us for 2016? That’s the most difficult question to answer. Let’s hope we’ve weathered the worst of the storm. But suffice it to say, gains likely won’t come easily – and sure not like they did in 2014. There’ll be a several key factors that need to be monitored carefully heading into 2016 – including fundamentals discussed above coupled with FOMC monetary policy and strength of the world’s economy during the coming year. As such, lots of unknowns remain heading into 2016, thus volatility will likely remain with us for the foreseeable future.

Decision making in markets like these is extremely challenging. The market will likely continue to bounce around as traders find their way. Producers need to be well positioned from a risk management perspective that includes consideration around all facets of the business. And as such, producers are encouraged to relentlessly review priorities within their operations while also investing time and effort in keeping up with both the market and the business environment in general.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

How to control sucking & biting lice on cattle

When is the best time to wean? It might be younger than you think

Late-gestation trace mineral supplementation shows promise

7 tips for limiting the spread of invasive species in your pastures

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)