Fed cattle prices struggling as summer sets in.

July 9, 2015

Going into June, some key similarities existed (note the past tense) with last year’s market. Most notably, this year’s fed market had been surprisingly steady, coupled with strong basis through much of the spring. Therefore, last month’s column addressed the likeness between 2014 and 2015:

“While the market has behaved similarly to 2014 during the past several months, this is probably where the parallel ends. Looking ahead to summer, it’s unlikely 2015 will repeat 2014’s incredible run. So, the market now begins in earnest to transition to summer with somewhat tempered expectations. The primary question around the trend of weekly negotiations in the months to come will be just how deep the expected seasonal downturn might be.”

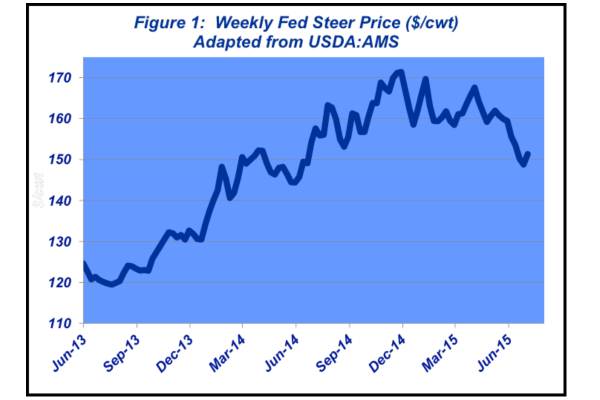

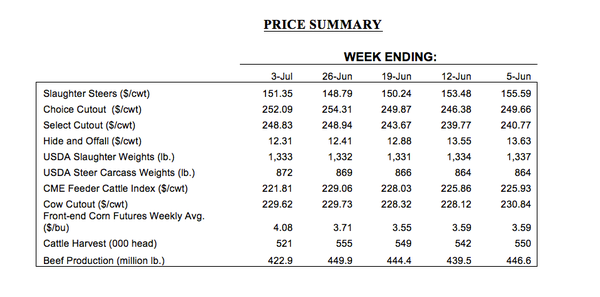

Indeed, any hope for a repeat performance was put to rest early in June. Fed cattle trade finished May at $159-$160. Then June arrived; the first week of trade gave up nearly $4 per cwt. The following week it was another $2, $3 after that and $1.50 at the end of the month (Figure 1).

As such, by the end of June, fed steer and heifer trade had retreated all the way back to $149. Contrast that with last year’s market when fed trade tacked on nearly $10 during the month of June. So, despite the first week of July providing some upside, the market is still sharply lower versus just a month ago and trending in a more expectant seasonal pattern than what occurred in 2014.

Accordingly, fed market basis has also weakened. As explained last month, basis has been historically strong during the past several years. And basis averaged just over $7 in May – consistent with the longer-run basis trend of late.

However, the June contract went off the board with a weekly average around $150.50 against the $149 cash market noted above. The shift to negative basis during June marks a sharp reversal in trend, considering it was positive by nearly $7 at the end of May. And compared with last year’s action, when basis only backed up about only $4 in June, it also represents a significant turn in leverage.

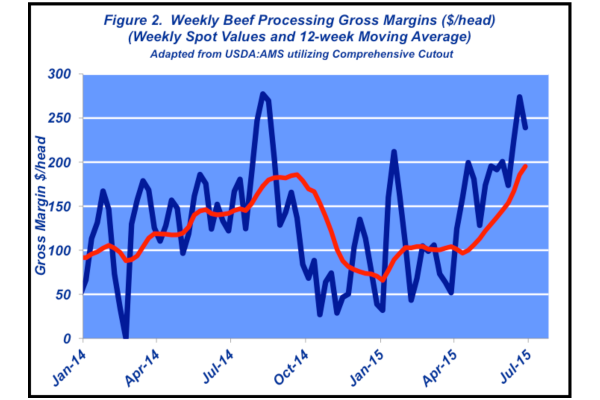

Therein enters the biggest transition of the past several months. Leverage has turned in favor of the packer, allowing their respective margins to improve dramatically during that time frame. The packer has worked hard this spring to manage slaughter and consequent wholesale prices. Those efforts have paid off. It’s allowed for relatively steady, predictable cutout values: the Choice cutout has averaged $251.90 per cwt through the first half of 2015; the final week of the June saw the cutout close at $252.09 per cwt.

But more importantly, seasonally bigger supply has softened the spring fed market – especially in recent weeks. That reality, coupled with solid cutout values, has enabled beef processors to mark some profitability during the past 12 weeks or so. Since the middle of April, gross margins have averaged $190-$200 per head (Figure 2). That’s well ahead of where the packer was operating through the first quarter of 2014.

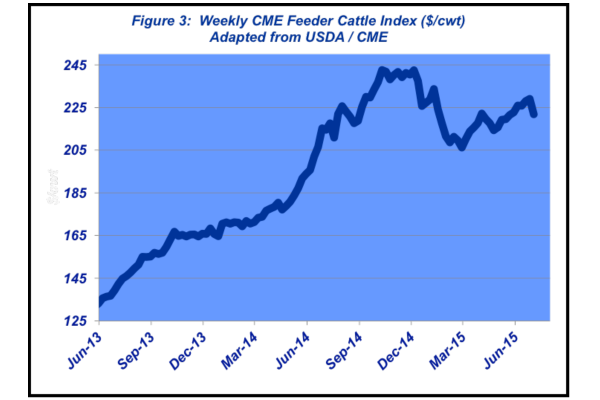

Turning our attention to the feeder cattle market, recall the CME Feeder Cattle Index traded mostly $240-242 through October and November last year. December, though, was another story as the feeder market witnessed the start of a sharp correction – most dramatic amidst a sell off that occurred when the feeder cattle futures market ran out of buyers and closed limit down for five consecutive days in December. The downturn continued through January and February with the CME Index bottoming out at $206 at the end of February; a retreat of $36 per cwt in just three months – or the equivalent of about $275 per head.

Meanwhile, those selling feeder cattle have enjoyed a solid recovery during the second quarter of 2015. The market gained back more than half those losses with the Index closing at $228 at the end of June – about $15 per cwt of that coming in May and June alone (Figure 3).

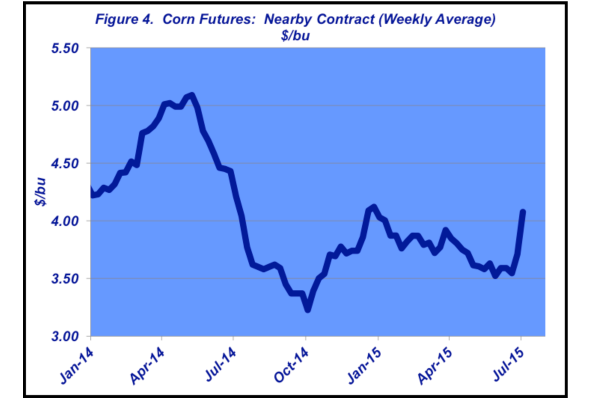

That said, the feeder market retreated sharply going into July. That’s because the biggest surprise of June came on the final day of the month on the corn front. USDA’s quarterly Grain Stocks report indicated approximately 4.45 billion bushels in storage – that was about 100 to 110 million bushels less than analysts expected.

Simultaneously, the June Acreage report also fueled the market as USDA pegged 2015 corn plantings at 88.9 million acres – down nearly 1.7 million acres versus 2014. All the while, this year’s crop is suffering from too much rain and flooding in key states including Indiana, Illinois and Ohio.

The market responded accordingly. Corn futures jumped 30 cents on the news (Figure 4). The data will subsequently be fed into the July 10 WASDE report where there’ll be some markdown of carryover coupled with markup in expected farm price average for the current crop year.

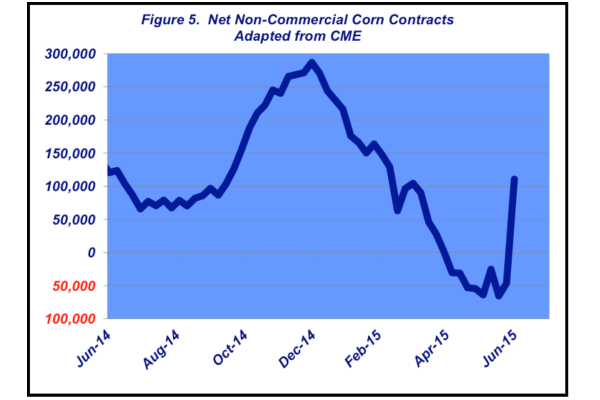

So now comes the hard part – volatility. The market will be increasingly responsive, especially considering the underlying investment shift that occurred with the recent market news (Figure 5). That’ll set the market to be especially reactive to any additional weather challenges as we move through pollination.

The shifts in all key markets—fed cattle, feeder cattle and corn—during the past month or so underscore the never-ending challenges within the current operating environment. That’s compounded by consideration of new levels of capital required to maintain business operations.

So, every month in closing, it’s important to include some reminder of the importance of risk management – both around price and margin. The requirements of successful decision-making are two-fold: first, ensuring access to accurate, data-driven, objective information; and, second, allowing sufficient time to adequately digest that information. Both components are essential to being successful over the long run.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

How to prevent & treat pinkeye in cattle

Feedyard losses: How bad is it?

What's the best time to castrate calves? Vets agree the earlier the better

About the Author(s)

You May Also Like