Do trends in the cattle crush foretell the future for feeder cattle prices?

A large cattle crush is good news. What does the trend line foretell?

December 3, 2015

The market…it’s been the enduring story around the beef industry during the past several months. Rightfully so as the equity loss is unprecedented for cattle feeders and the implications will be enduring for the business at all levels.

And it’s left many asking questions about how the market ended up in the position – especially on the heels of 2014. Accordingly, much of the focus in recent weeks with Industry At A Glance has been around the market, the drivers and the implications of 2015’s slide since April.

As noted several weeks ago, feedyard returns were mostly positive during 2014. During that time, feeder cattle prices also turned sharply higher. Feedyard managers rotated favorable closeouts back into buying replacements, betting on the come of the market. And for the most part, that strategy had proven to be a good bet during the previous several turns of cattle.

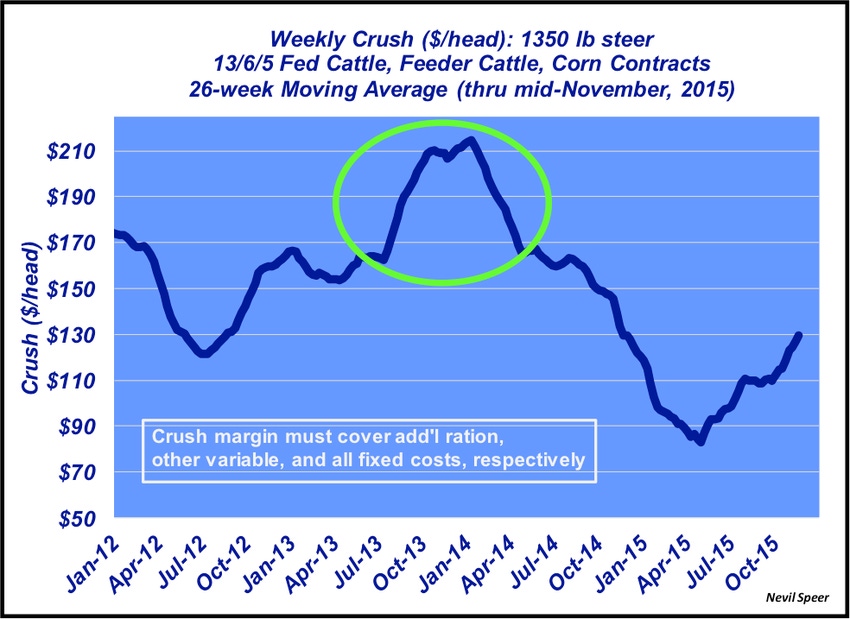

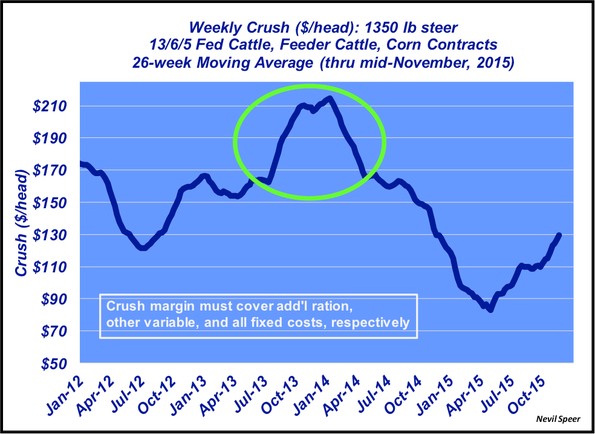

That said, this week’s graph highlights the timing of market conditions and helps illustrate why this market reversal has been especially painful. The graph depicts the 26-week cattle crush moving average. Crush represents the margin difference between revenue based on deferred fed cattle futures less costs associated with purchasing feeder cattle and corn. It does not account for other variable, ration, or fixed costs but the larger the crush, the better the opportunity for profitability.

Crush margins peaked in late 2013 and early 2014; those margins ultimately explained profitable closeouts in much of 2014. However, as noted above, those profits were plowed back into the purchase of feeders and the crush margin subsequently moved lower through early 2015. And because crush is a leading indicator, it’s clear that closeouts will remain challenging for some time to come – at least until they get back in line with more historical norms.

That likely means the spread between fed and feeder cattle must widen to allow feedyards some renewed opportunity at profitability. With that in mind, where do you see the feeder cattle market headed? How hard will the feeder cattle market break in order to allow cattle feeders new hope for positive closeouts?

Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

13 new utility tractors for the ranch in 2015

Crunch the numbers before you buy those heifers

5 tips for managing feed intake in calves

What's the secret of a profitable cow? Burke Teichert shares

About the Author(s)

You May Also Like