How much money do packers really make?

May 27, 2015

Previously in this column, we looked at the trend of declining cash sales and increased captive supply in the weekly fed cattle market. As noted in that discussion, the subject is, “…an enduring, often contentious, issue for the beef industry.” For our discussions, I define captive supply as transactions that include formula-based sales, packer-owned, forward-contracted and/or grid-marketing transactions.

The primary concern around increased levels of captive supply is it potentially allows packer to assimilate supply needs independent of cash negotiation, and that excessive levels of captive supply cattle in any given week gives packers undue leverage in the marketplace and disproportionate profitability as a result.

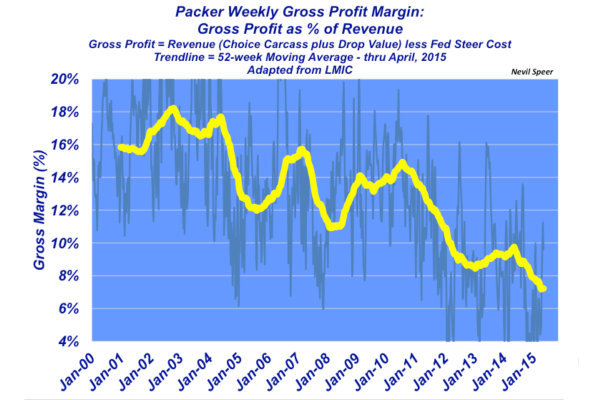

This week’s illustration features packer gross margin trends over time, gross margin (or gross profit) being defined as revenue less cost of goods sold. In the case of the packer, revenue results from the combination of carcass sales and drop values. And in this instance, the cost of goods sold is simply the cost of a fed steer. It should be noted that gross margin does not take into account operating costs (wages, utilities, etc…).

When analyzing gross margin, the most important aspect is the trend. Clearly, the packer remains under pressure with respect to profitability. The 52-week trend line is currently around 7% (and averaged only 7.9% in 2014)—that’s roughly half the gross margin packers were generating just five years ago. Lower gross margins lead to long-term profitability concerns – there’s only so much a company can cut in terms of operating costs to compensate for that type of margin compression.

Tight supply is clearly creating that compression for packers (the same challenge also being faced by cattle feeders). before mpensate for that type of margin compression. How do you perceive these margin trends? Beside larger inventories, what steps might packers (and feeders) take to help with margin compression? What might the packer gross margin trend look like a year from now?

Leave your thoughts in the comments section below.

You might also like:

60+ stunning photos that showcase ranch work ethics

Q&A: Nutrition author says dietary recommendations are shockingly unscientific

Don't bid away future profits by overpaying for cows

Pricklypear control helps replenish pastures

6 steps to low-input cow herd feeding

10 negative reviews of the Food Babe worth reading & sharing

About the Author(s)

You May Also Like