Does the changing feeder cattle basis trend during the second half of 2014 signal what’s ahead in 2015?

December 23, 2014

For cattle market participants, the most important event in recent weeks occurred around the feeder cattle market when futures went limit down for five days in a row. That wasn’t an isolated action; it represented the follow-through of earlier downward pressure. The January contract closed at nearly $236 on Dec. 4, but the limit-down action didn’t start until Dec. 11. That’s when the market became stuck at $228.60 (down $3 from the previous day’s $231.60 close). The contract finally attained some liquidity on Dec. 18, at $217.

There are likely a number of explanations for the sharp downturn. The market, though, has been on a sustained upward trend; sooner or later, it was bound to run out of buyers. Apparently, the industry has found that level (at least for now). And once the markets get to run – one way or the other – the direction can prove to be self-perpetuating.

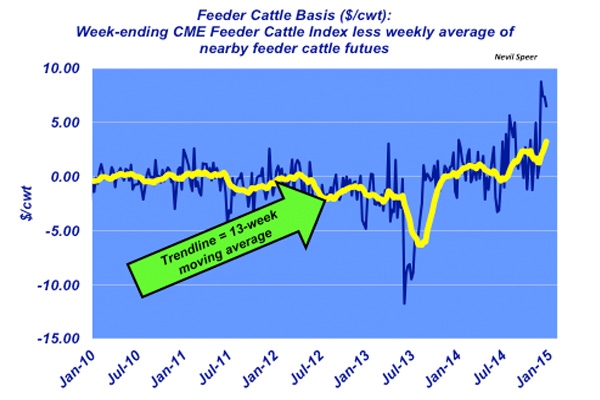

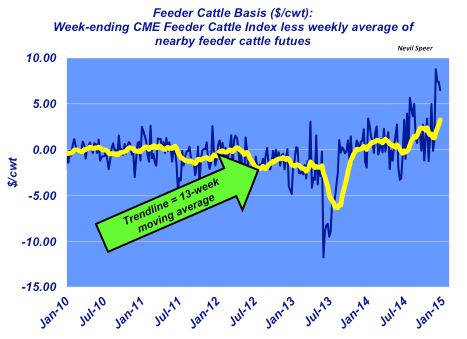

Nevertheless, the cash market ultimately brings futures markets back around. The accompanying illustration highlights the weekly basis along with the 13-week moving average.

Negative basis occurred in early-summer 2013 when feed supplies (corn) were tight. Moreover, negative closeouts were getting priced into the market. Those two factors put the feeder cattle market into retreat mode.

Since that time, though, the trend has been in the other direction with buyers hunting feeder cattle. That forced the market to operate in a positive-basis mode during the past several months – an unusual pattern compared to previous years. So, despite the negative action at the CME, it appears that the cash market has upheld the concept of tight supplies (at least for now).

How do you perceive the changing basis trend during the second half of 2014? Does that signal present clues about what might occur in 2015? Despite the recent setback in feeder prices, do you remain bullish on the market or do you perceive the market is setting up for a consolidation phase?

Leave your thoughts in the comments section below.

Nevil Speer serves as a private industry consultant. He is based in Bowling Green, KY, and can be reached at [email protected].

You might also like:

Prevention and treatment of cow prolapse

Gallery: Ranching is a family affair; meet the generations on the ranch

What's the best breeding weight for beef heifers?

Grass-fed vs grain-fed ground beef | Research shows no difference in healthfulness

Is this the year to over-winter cull cows?

Bale grazing lets cows feed themselves

About the Author(s)

You May Also Like