While feeder cattle prices are off their historical highs, the relative strength of the feeder cattle market remains intact. Will that continue as 2016 works toward the fall run?

June 8, 2016

Over the past several years, this column has consistently monitored the direction of the feeder market. Last year around this time, one such discussion noted that, “While feeder cattle prices are off their highs from 2014, the relative strength of the feeder cattle continues to march on.”

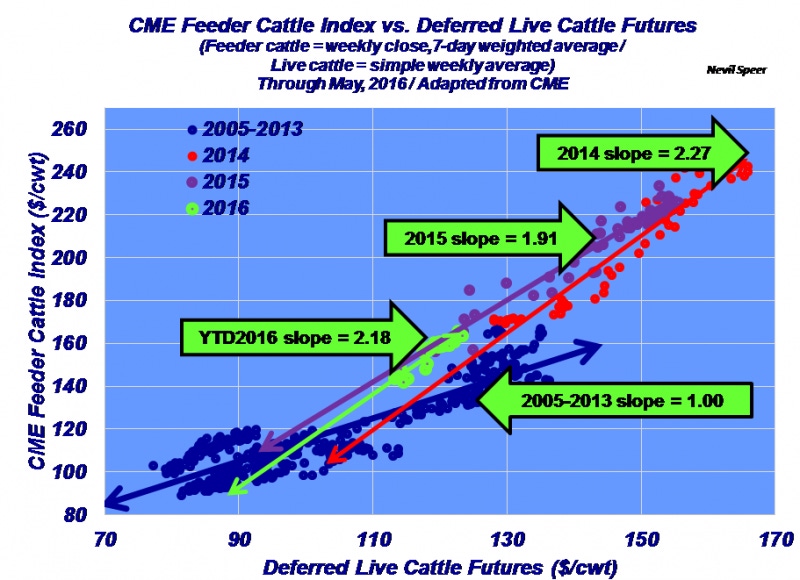

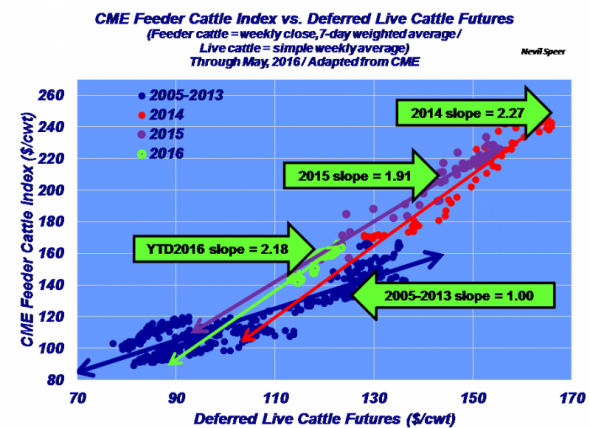

This week’s illustration depicts a similar conclusion. Two major components define the feeder cattle market on any given week: the corn market and the deferred fed cattle contract against which the feeder cattle are being purchased. Of the two, the latter is the overwhelming determinant.

The graph above depicts the weekly CME Feeder Cattle Index against the deferred Live Cattle futures contract. The data are outlined for 2005-2013, 2014, 2015 and year-to-date 2016 (through May). The long-run (2005-2013) historical pattern established a mostly one-to-one relationship. In other words, if the back end of the fed cattle market was up $1per cwt (or about $12.50/head), feeder cattle would rise approximately $1 per cwt (or approximately $7.50/head) – and vice-versa. That relationship jumped to 2.10:1 in 2014. In other words, if the deferred fed cattle contract rose $1 per cwt ($13/head), feeder cattle prices jumped $2.10 per cwt ($15/head).

Stated another way, the risk appetite for feeder cattle was historically strong in 2014 – cattle feeders bet on the come through the entire year. That works well if fed prices ultimately outpace the deferred fed cattle contract at the time of purchase. However, that begins to be problematic if the fed market proves to disappoint – the risk strategy cuts the wrong way.

70 photos show ranchers hard at work on the farm

Readers have submitted photos of hard-working ranchers caring for their livestock and being stewards of the land. See reader favorite photos here.

Despite the sharp correction in 2015, the feeder market remained on a very similar course to 2014. Looking at 2016, the expectation would a somewhat different relationship. That is, the feeder market would begin to soften with respect to the deferred fed market and rotate to a relationship that looks more like 2005-2013. But that hasn’t happened thus far in 2016. In fact, the pattern is remarkably similar to 2014 and 2015.

How do you perceive the feeder market thus far in 2016? Do you foresee major changes coming during the second half of the year? Will cattle feeders become more careful about pricing replacements – or will they continue with a similar pattern? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

When is the best time to wean? It might be younger than you think

Late-gestation trace mineral supplementation shows promise

7 tips for limiting the spread of invasive species in your pastures

55 photos celebrating spring on the ranch

About the Author(s)

You May Also Like