While the upside in the cattle market is always welcome, any sharp move in either direction just adds complexity to risk management and cattle marketing decisions.

October 2, 2014

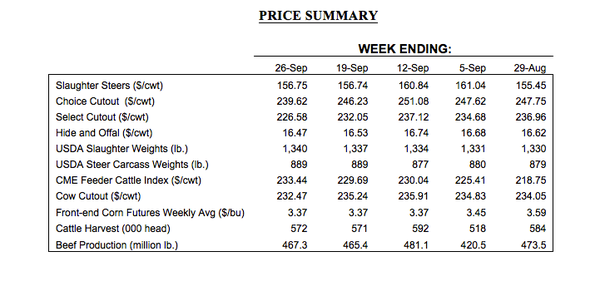

The cattle market action in September was largely a repeat of what occurred in late-July and into early August. The net outcome from end to end was mostly flat trade, and the final two weeks of fed trade in September scored $156-$157, just $1 ahead of where August trade finished the month (mostly $155-$156). Similarly, September’s average of $158 is right in line with the average trade during both July and August.

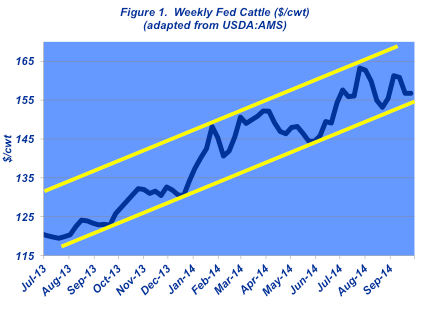

That summary closely matches last month’s column. Seemingly, the cattle market is in a steady churn and continues to trade within a well-defined channel (Figure 1). However, September, just like August, also contained its share of volatility.

As such, the broader picture doesn’t depict the tough work required to manage the week-to-week dynamics. More important are the stabs at $160+ trade. While the upside is always welcome, any sharp move in either direction just adds complexity to risk management and marketing decisions.

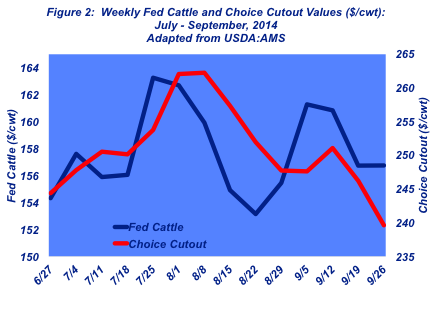

Last month’s column contained some discussion regarding the long-term outlook heading into fall. No sooner was the column posted, and the market surged $6 to trade back above the $160 mark. The jump was unexpected, occurring on the heels of a flat wholesale market and forced weekly packer margins that were well into negative territory (Figure 2).

Cattle feeders then managed to garner $160+ for a second week following Labor Day, after which the market settled back in the upper-$150s. That’s a positive sign, though, for feedyards, as steady trade came while wholesale beef sales were slipping. Choice cutout receded $14 over the course of 11 consecutive days, and weekly averages are now back in line with prices established in mid-July.

With all that said, the market seems poised to consolidate. It’s now largely a matter of biding time and allowing wholesale trade to establish solid support. Fed prices will likely shop within the current trading range established during the past several months. Within that outlook, however, two things are important.

• First, $160+ trade has now been tested several times. The question is whether fed prices can break through overhead resistance and make a run at $165 or $170 going forward. As noted last month, the cutout typically stages a solid rally from August through December. And that actually could be even stronger this year given new price levels and continued pricing power, thus making a run at new highs possible.

• Second, there’s concern about the downside and the key levels to monitor. The Choice cutout has established good support around $240, which allows a foundation for fed trade of $150-$155. Breaking through that support would indicate weakness that would be problematic going forward.

Clearly, the first scenario is the favored one, especially given some of the breakevens that feedyards are working against. The Kansas Feedlot Net Return series reveals seven consecutive months of positive closeouts with net returns exceeding $125/head. That’s the best-ever run of profitability in the series’ history, which was initiated in 1993. Better yet, the projections for August and September also trump the $100/head mark.

However, Glynn Tonsor, Kansas State University agriculture economist, aptly explains the current situation: “While the recent return levels are historic on a $/head basis, the return on investment is far from record setting. The main implication of this is that feedlot operators, lenders and analysts would be well-served to note this, pay attention to corresponding implications of elevated capital requirements, and ultimately reflect on these factors in making purchasing/selling and related risk management decisions.”

Can You Tell Profit When You See It?

Enter our 2014 BEEF Efficiency & Profit Contest & you could win $1,000 cash (indvidual) or $5,000 in Merial product (feedlot group). Enter here!

That discussion is further compounded by the fact that net returns are projected to turn negative beginning in October. Cattle feeders continue to be aggressive in pricing replacements, which adds up to some challenging projections going forward. Losses are projected to exceed $200/head by January with breakevens trending around a $165-$170 market. Nonetheless, betting on continuation of the fed price rally has paid good dividends of late and nothing is too surprising in this market – especially to the upside.

So, as noted the past several months, “Trying to outguess or outsmart this market is about like trying to outrun a speeding train. It’s nearly impossible to do and the consequences can be devastating.” Given the continued pattern within the market, sharp moves are the primary challenges to be managed – both up and down.

Producers and traders are encouraged to closely monitor all developments around trade, demand and external markets. The market seems to be at a critical juncture. Therefore, as always, it’s important to have objective information and disciplined review; both are essential to helping ensure successful decision-making going forward.

You might also enjoy:

70+ Photos Honor The Hardworking Cowboys On The Ranch

Weaning Beef Calves? Stop The Bawling!

Photo Tour: World's Largest Vertically Integrated Cattle Operation

Calf And Feeder Prices Widen Gap With Fed Cattle-Beef

55 Beef Cartoons From Leigh Rubin

Obama Administration Takes Aim At Antibiotic Resistance

4 Tips For Extending Fall And Winter Grazing

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)