Cattle input prices surge

How high will inputs go and for how long?

March 10, 2022

The Russian invasion of Ukraine has led to far-reaching impacts on commodity markets across the globe. In particular, oil and grain prices have surged which contributes to increases in the cost of production throughout the cattle and beef supply chain. Feeder cattle futures prices have dropped roughly $10 per CWT since mid-February depending on contract (though prices were higher in today’s trading).

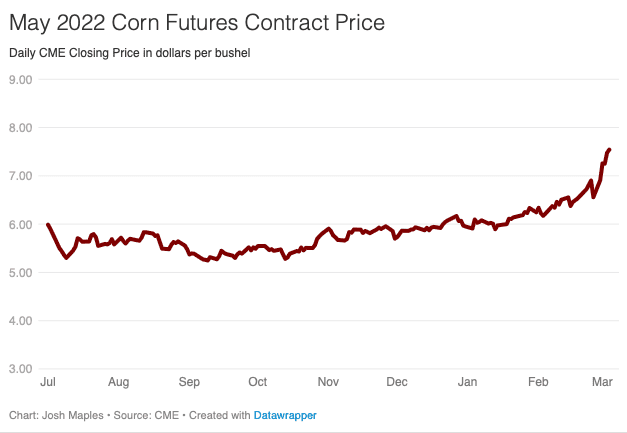

Near term corn prices have jumped by around a dollar per bushel in the past few weeks. Shown in the chart above, the May 2022 CME corn futures contract closed last week near $7.50 per bushel. Higher corn prices generally put pressure on feeder cattle prices since feeder cattle and corn are two primary inputs into producing fed cattle. Contracts expiring further in the future have also increased though not at the same magnitude. For example, the December 2022 CME corn futures contract closed last week at $6.30 which is up about $0.40 above mid-February.

Much concern and uncertainty surrounds corn stored and produced in Ukraine. In the February ERS “Feed Outlook” publication, a very interesting special article is included on Ukraine’s geography, corn production and exports. You can find the full report HERE and the special article starts on page 20. The article notes that corn acreage in Ukraine has tripled over the last 15 years and yields have roughly doubled. Much of the corn produced is typically destined for export. The article discusses that Ukraine accounts for about 3.5 percent of global corn production but was forecast to account for about 17 percent of global corn exports.

Cattle prices are caught in the broader uncertainty and market volatility. Many input prices were already high compared to recent years. The severity and length of time that higher input costs will persist are key questions without good answers. Feed costs (among other inputs) will be higher in the near term. Planting season is just around the corner in the U.S. and the amount of corn planted and crop progress will also be important for supply and price forecasts.

Source: Mississippi State University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)