Cattle prices in a new economic world

Here's a look at how the beef industry has changed in the six weeks since COVID-19 shocked markets.

May 11, 2020

During our travel from Yuma, Ariz., to Idaho, my wife and I had a scary experience. This month’s column is being written during a scary time. As snowbirds spending another winter in Arizona, we felt that we should get back to Idaho early this year. So … we packed up the car in late March and proceeded to travel back home.

The trip was an eerie experience! For example, during the drive through Las Vegas, we saw very few cars. The Utah hotel lobby where we stayed the one night out was completely empty. Our evening meal was done via a drive-through restaurant. Breakfast the next morning at the hotel was served in a paper sack — which was greatly appreciated, as we ate it in the car.

The highway during the second day had far fewer cars than normal, but gas stations were open. About the only traffic was snowbirds heading north. We made the 1,000-mile drive in two days.

We returned to an empty house in Idaho, so had to figure out how to restock a house without contacting people! Grocery stores were all out of hamburger. Tried to order a quarter of beef from our favorite locker plant, and we were told that they were back-ordered for months!

We went to our second locker plant, and they could sell us 30 pounds of hamburger. Yes, our Idaho home county does have some coronavirus cases. The number is increasing by the day as this is being written, which greatly adds to our uneasiness.

Our house is “sort of” restocked as I write this, and we are hunkered down for our 14-day isolation period from family and everyone with our fingers crossed — having no contact with anyone and praying we stay healthy.

Yes, you and I are now living in a new and different economy. I can only hope it is temporary.

Back to the beef industry: At this point, I certainly am not going to try to predict the beef industry over the next year or so. I am, however, going to try to document, as best as I can, what cattle prices have done since I wrote my last column.

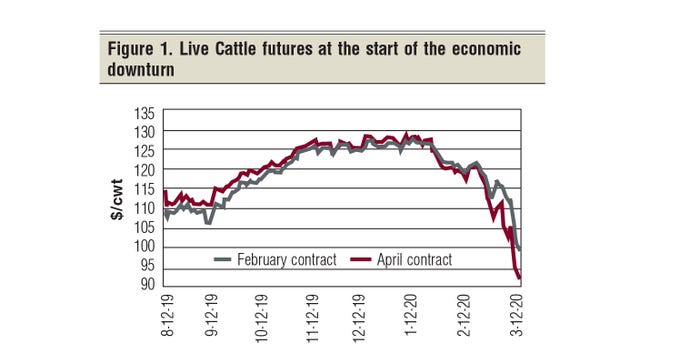

Needless to say, the U.S. economy has greatly changed with the dramatic fall in stock market prices and beef futures market. (Figure 1). This figure shows the drop in the March and April Live Cattle futures contract through March 17. Since then, it has been a volatile up-and-down ride.

The current shift from restaurant eating to home eating on a national scale is having a substantial impact on beef industry supply channels. While consumers were not dining out, they were buying — and buying — all available meat at the grocery stores.

The biggest challenge is getting the supply of beef to the grocery stores where consumers are, indeed, buying as fast as it is put on the store shelf. Our local grocery stores cannot keep meat in inventory.

Meanwhile, thousands upon thousands of restaurant and other food service employees are out of work. In late March, Congress passed the largest income transfer bill in history.

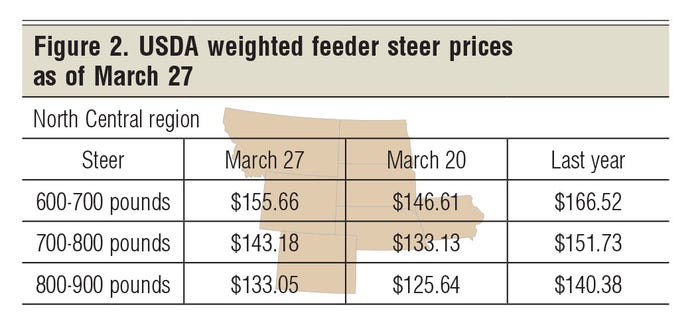

USDA March 27 livestock market report. Let me quote from the USDA Weekly Feeder and Stocker Cattle Summary dated March 27, 2020. “Compared to last week, steers and heifers sold $8 to $15 higher.” “Auction prices this week [week of March 27] rebounded heartily and recovered most if not all the losses incurred last week.” “Dressed sales in Nebraska were reported $15 higher than last week.” USDA reported (March 27), “Live cattle purchases in Kansas and Nebraska on Wednesday [March 25] traded $119-$120/cwt.”

Let’s bring this discussion back to ranch country. Figure 2 presents a weekly summary (week ending March 27) of feeder cattle prices for the North Central region compared to the week before and last year.

Given the large physical health uncertainty in our population and great uncertainty in the national economy, in no way am I suggesting that prices are going to stay at this level — I am only summarizing where USDA said we were at the end of March.

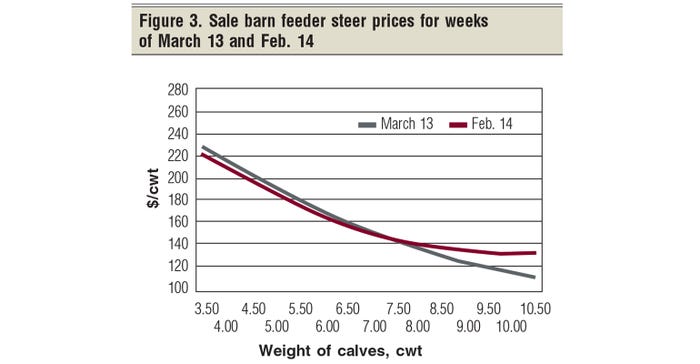

March price charts generated for my study herd manager. March rancher discussions focused on local sale barn feeder cattle prices rather than the futures market prices. Granted, physical sale numbers were down, but my study herd manager still wanted to review local sale barn prices.

Figure 3 presents the normal midmonth sale barn price comparison that my study herd manager and I typically look at monthly. The main message is that the major negative price impact was on the heavyweight steers — those weighing 800 pounds and up. This suggest that the economy’s major impact focused on those feeders headed toward feedlot replacement. The demand for grass cattle seemed to be kind of holding.

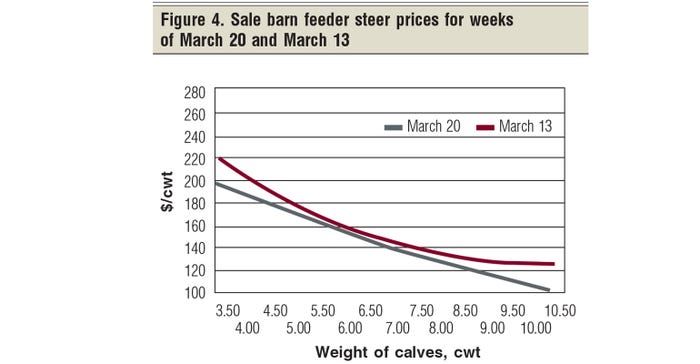

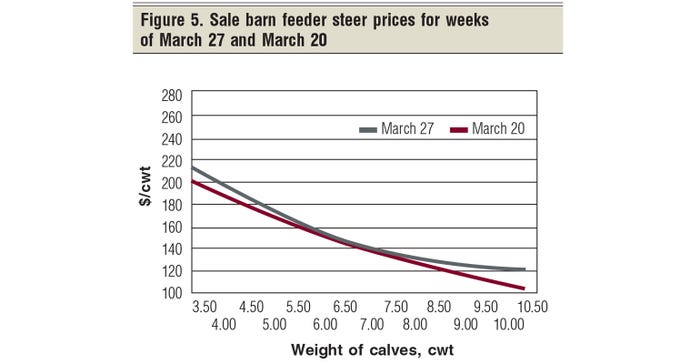

Figure 4 presents my study herd manager’s local sale barn prices for the week of March 20. Feeder cattle prices were slightly lower for all weights of feeder steers. Readers, be sure to note the week of each price line.

Finally, Figure 5 presents my study herd manager’s local sale barn prices for the week of March 27. Note that feeder steer prices came up slightly. I want readers to note (1) slightly higher prices than the week before; (2) particularly note that heavyweight feeder price strengthened; and (3) the price line took on a more normal curved shape toward the heavy end, which is a good sign for grass cattle.

This month’s message — good news for cow-calf producers. So far, fall weaning weight (550- to 600-pound) feeder steer prices have not been hit yet in the marketing system compared to fall 2019. Let’s hope this continues to be the case!

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like