COVID-19 and feeder cattle: Price trends during the pandemic

Feeder cattle prices have rebounded and are now almost equivalent to a year ago.

As all who watch and take part in the cattle market know, prices went crazy as COVID-19 sent the U.S. into a lockdown and economic shock. What’s the situation now that markets and the economy have had time to adjust?

Feeder cattle prices are rebounding higher, at a faster rate than fed cattle prices lately. However, while feeder prices have improved quite a bit from the bottom set during March and April, they are not as high as prices at the end of last year. At least not yet.

Since March and April, when packing plants shut down or slowed production significantly, feedlots have been backed-up fed cattle. But that hasn’t stopped feedlot buyers from being active in the market.

Buyers were able to send purchased feeder cattle to backgrounding lots, which allows them to have cattle available when feeder cattle numbers usually decline later in the summer. In fact, the bigger runs in the Southern Plains have been taking place lately as double stocked feeder cattle have been moving off of the Flint Hills area.

Heavyweight feeders

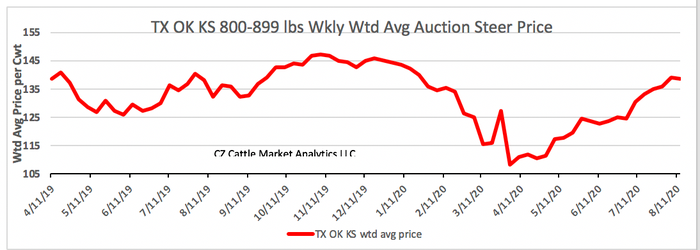

The weekly weighted average price for 800-899-pound steers is about $30 higher than the low and the monthly average is getting closer to last year (see the chart below). The recent weekly combined total for all reported auctions in Texas, Oklahoma and Kansas for Medium and Large No. 1 and 1-2 steers weighing 800 to 899 pounds showed 4,397 head, compared to 7,914 head the previous week.

The weekly Aug. 14 combined weighted average price for these three states clocked in at $138.58 for those 4,397 head that had a weighted average weight of 842 pounds. That compares with $139.20 the previous week for steers weighing 849 pounds. The weekly lowest price was $108.42 for the week ending April 3.

Prices along with volume both bottomed out when many packing plants were either closed or with much lower volume because the feedlots could not move many cattle then. However, after federally inspected slaughter cattle volume got close to last year’s numbers, feedlots were able to move a more normal volume of fed cattle. That opened more pens and started pushing feeder cattle prices higher a lot faster than the fed cattle price increase.

The head count volume has been higher than last year since April. The auction total head count is always higher when cattle are moving off wheat pastures in March through May. Sale barns usually see another increase in late July and early August with cattle moving out of the Kansas Flint Hills as well as Oklahoma native pastures.

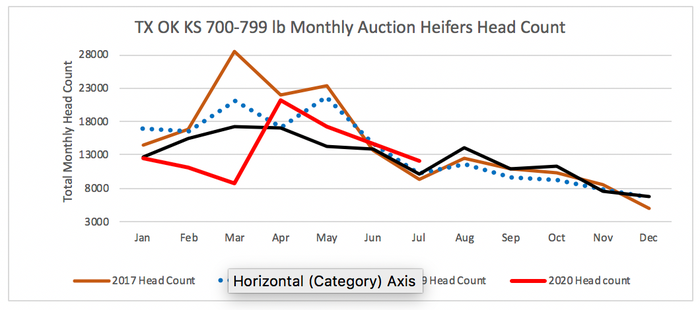

The weekly weighted average 700-799-pound auction heifer price has climbed about $28 since the low that was set in early April. However, heifer prices have been leveling out some during the last couple of weeks and now are very close to last year.

The recent combined weekly total for all reported auctions in Texas, Oklahoma and Kansas for Medium and Large No. 1 and 1-2 heifers weighing 700 to 799 pounds showed 2,591 head compared to 4,229 head the previous week. The weekly Aug. 14 combined weighted average price for these three states showed $133.05 for those 2,591 head that had a weighted average weight of 749 pounds. That compares with $133.38 the previous week for heifers that weighed 753 pounds. The lowest price was $105.15 for week ending April 3.

The weekly head count volume increased after the lowest price started to improve. Prices were slightly below last year during July when they jumped almost $10 per cwt higher since June.

The monthly heifer head count volume was very low in February and March this year when it normally is higher with feeder cattle moving off wheat pastures. But it has jumped higher during April and May when cattle were finally moving off wheat pastures (see the chart below).

Lightweight stockers

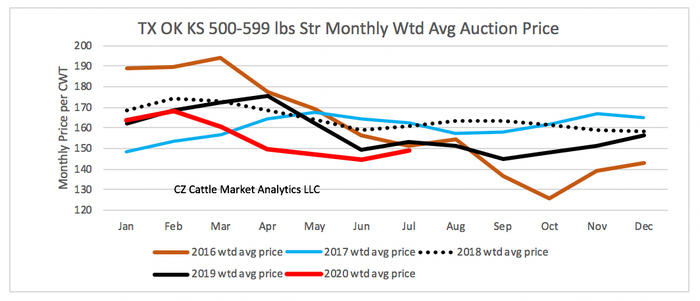

Lighter weight stocker cattle prices have not responded as high as the yearling prices. Prices for 500-599-pound steers increased about $10 dollars per cwt during late June and July, almost leveled out, then jumped another $4-$5 higher so far in August (see the chart below). The tremendous losses for the backgrounding industry, as well as expanding drought conditions, have no doubt kept these prices from improving more, along with the negative trends from COVID-19.

The recent combined weekly total for all reported auctions in Texas, Oklahoma, and Kansas for Medium and Large No. 1 and 1-2 steers weighing 500 to 599 pounds showed 2,084 head compared to 2,061 head the previous week. The weekly Aug. 14 combined weighted average price for these three states showed $156.68 for those 2,084 head that had a weighted average weight of 556 pounds.

That compares with $157.84 the previous week for steers that weighed 552 pounds. The lowest price was $142.52 for week ending June 26, so while prices have climbed higher, the jump hasn’t been as big as seen in the yearling cattle headed to feedlots.

The monthly average price continues below all previous years, but at least is currently getting closer to those averagaes. The monthly volume jumped higher most of the time since April, no doubt because more of these feeders were held longer because of low prices. Also, in the Southern Plains there is more variety in calving time than the Northern Plains, so more numbers are available now but definitely the biggest numbers are still move during the fall.

Fed cattle prices increased about $4 per cwt in July and continue to grind higher into August. That small increase in July, along with an up trending futures market which impacts hedging ability, has supported feeder cattle prices.

Hedging by feedlots has really helped during this tremendous price wreck that has caused many feedlots to lose lots of money. Hedging ability always has a big impact on the feeder cattle bids from feedlots but recently they pushed much higher during June and July.

My feeder cattle study uses all the USDA reported feeder cattle auctions from the Southern Plains and the Northern Plains. It includes all USDA reported auctions in Kansas, Oklahoma, and Texas for the Southern Plains as well as North Dakota, South Dakota and Nebraska for the Northern Plains.

The data include only the reported Medium and Large No. 1 as well as 1-2 feeder steers and heifers, but now includes all flagged items like fleshy or thin because the CME has started that procedure. It utilizes only weighted average calculations and not simple average. I had to rebuild all of my data bases to reflect the CME changes and use the same format in all weights for steers and heifers which allows for very accurate comparisons between the regions along with good yearly comparisons.

Czerwien is a market reporter in Amarillo, Texas. From the heart of Cattle Feeding Country, Ed follows the fed cattle, feeder cattle, slaughter cow and wholesale markets to keep beef producers up-to-date on the market moves that affect them. He previously worked with USDA as a Market News Reporter. Ed is now semi-retired and continues to work with cattle trade analysis. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like