Dairy prices fall; will producers respond and cull more cows?

At what point will the dairy industry begin to respond to lower prices and/or negative profitability and cull cows beyond the normal culling rate?

October 27, 2016

Several weeks ago, this column focused on major trends in the dairy industry, most notably, the enduring rise in milk production, which is likely to exceed 210 billion pounds in 2016. The growth has resulted almost solely from marked advancements in cow productivity; milk cow inventory has remained relatively flat, hovering around 9.2 million to 9.3 million head.

In light of growing protein supplies, that reality begins to potentially influence consumers. That is, there’s greater availability of protein options than ever before – that’s especially true when considering the increased availability of new fluid milk products, whey protein supplements and yogurt. Therefore, dairy protein increasingly serves as a potential substitute (at least partially) for beef, pork and poultry.

That consideration inherently invokes questions around the dairy industry’s response to current market conditions. Milk prices are proving challenging. But does that necessarily translate to milk cow liquidation?

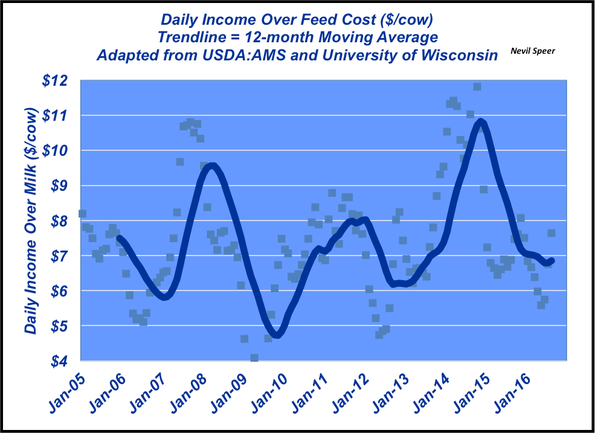

Probably not, considering this week’s illustration. The graph highlights daily income over feed cost trends during the past 10 years. The trend ranges from a low of about $4.50 per day all the way up to $11 per day. However, amidst those peaks and valleys, and high cull cow values during the past several years, milk cow inventory remained relatively constant.

The trend is relentless: more milk from a stable number of cows. This discussion is important from a competitive protein perspective, as detailed above, and a beef market perspective, too, in the event milk cow liquidation should begin to occur. With that in mind, at what point will the dairy industry begin to respond to lower prices and/or negative profitability? Or will the dairy industry prove successful growing demand around fluid milk, cheese and/or other dairy products? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

You might also like:

15 favorites from fall photos on the ranch

4 questions to ask before marketing 2016 calves

9 new pickups for the ranch in 2016

Seven keys to ranch profitability

How to cull the right cow without keeping records

Burke Teichert's top 5 tips on bull selection

Young ranchers, listen up: 8 tips from an old-timer on how to succeed in ranching

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)