Fed cattle cash market vs. hedged net price

What works better? Hedging or cash market? 2019 proved to be a real-life case study.

October 17, 2019

Earlier this year, Industry At A Glance ran a series of columns on risk management that covered a variety of topics. The first column in the series (June 5) highlighted an example of how a straight hedge, from a selling perspective, would work for fed cattle.

The column, using an example of marketing fed cattle in May, explained the expectation would be as follows, assuming a $114.50 hedge by shorting the June live cattle contract and $9.75 basis:

…at the time of placing the hedge, the feedyard’s expected selling price would be $124.25 ($114.50 + $9.75). The feedyard is now indifferent to what occurs in the futures market – they are protected against downside market risk. The only remaining price risk revolves around basis.

Now fast-forward to the first week of May and the cattle are ready to be marketed. The cash market averaged $123.75 while the futures had drifted back to $114 (basis was right in line with the five-year average). The feedyard markets the cattle at $123.75 while simultaneously negating the short position in the futures market by purchasing June contracts at $114 – thereby facilitating a 50¢ profit. The net selling price is $124.25 ($123.75 + $.50).

All of that can seem somewhat irrelevant when talking hypothetically.

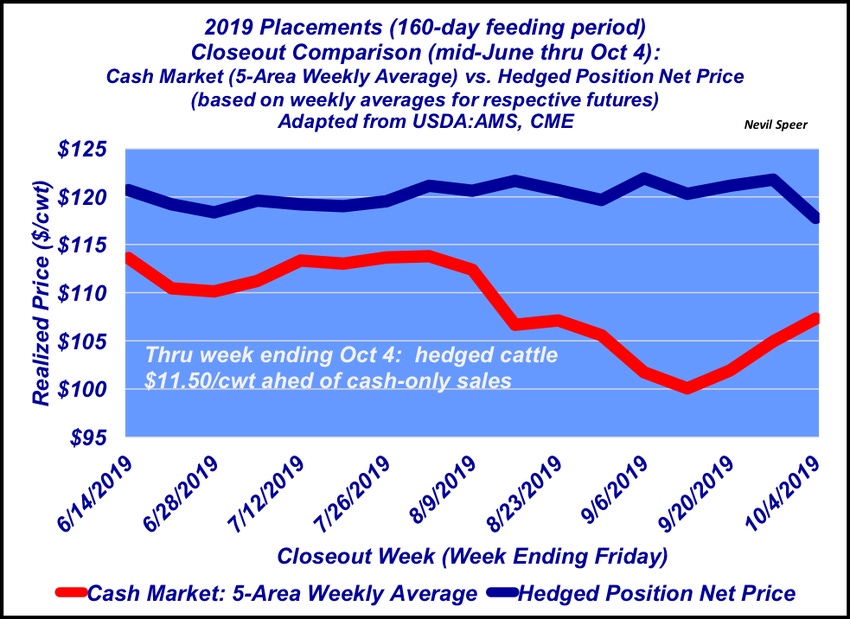

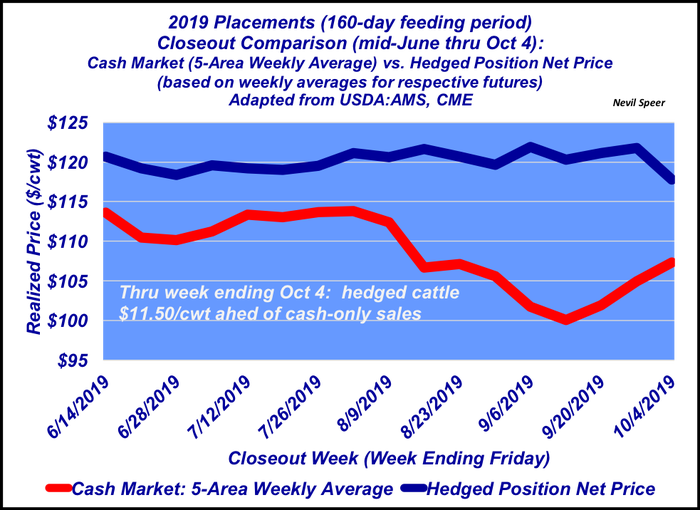

However, 2019 provides a very real-life case study regarding the benefit of futures markets and risk management. To that end, this week’s graph highlights the advantage of using hedges in a consistent manner; it contrasts the benefit for those feedyards which stay hedged regardless of market conditions versus those which simply operate in the cash markets.

Placements purchased in 2019 began to be marketed in June, based on a ~160-day feeding period. The illustration features the selling price of closeouts on a hedged basis versus a cash basis since that time (through the week ending Oct. 4). It highlights the value of risk management when unexpected, black-swan events occur (e.g. plant fires) – the hedged cattle aren’t affected by sharp downturns in the market.

Thus far, the value of hedging 2019 purchases is equivalent to $11.50 per cwt. The average slaughter weight during the respective marketing window is 1,330 pounds, based on USDA data, thereby providing the disciplined hedgers a $150+ per head advantage versus selling in the cash market only.

Clearly, that has huge implications for the entire feeding sector. And that value difference will ultimately translate back upstream to backgrounders and cow-calf operators. In other words, risk management is an invaluable tool that possesses implications for the entire industry.

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)