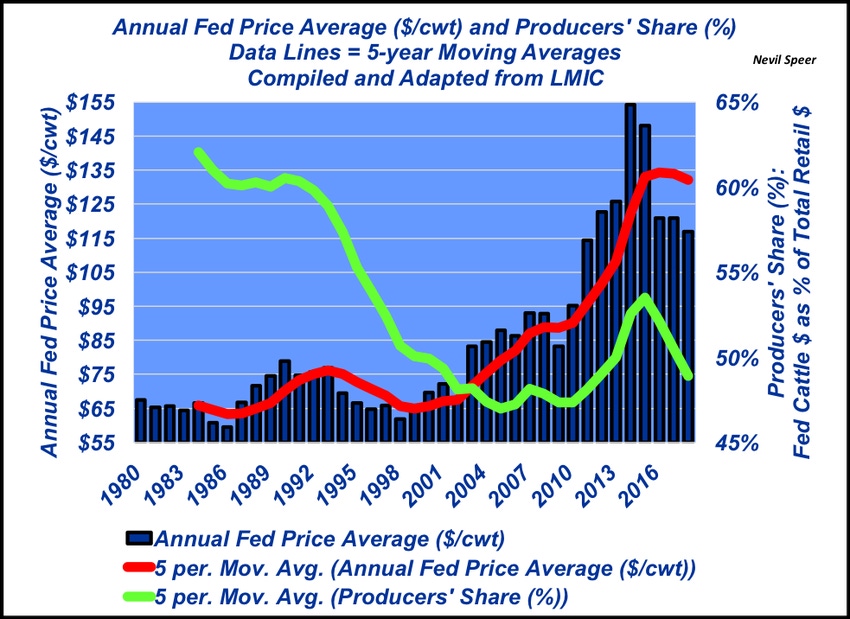

Fed cattle price and producers’ share of the retail dollar

How much money in retail beef sales gets funneled back to producers? Here’s a look.

May 1, 2019

Beginning in late February, Industry At A Glance focused on various issues surrounding international trade in the beef industry. The columns generated a large amount of feedback.

One of the concerns voiced repeatedly within that feedback revolves around “producers’ share” (or sometimes referred to as farmers’ share) of the retail dollar. Producer share refers specifically to the feeding sector and their general proportion of the retail dollar; it’s defined as the value of a fed steer/heifer as a percentage of total retail revenue generated per animal.

Much of the recent consternation occurs as cattle feeding margins were especially challenging in 2018. That occurred with producer share declining to 45% while packer margins were very favorable during the year.

Accordingly, this week’s graph provides an extended view of both fed price and producer share trends (the graph lines represent 5-year moving averages).

Annual producer share bottomed out in 2009 (44%), then began to climb in earnest in 2011 as supplies began to tighten, peaked in 2014 (57%), and have since receded from there. The decline in recent years is what catches many people’s attention. However, some caution is warranted when citing producer share as an indicator of long-run prices and/or profitability.

First, the five-year average remains at nearly 49% - in line with the long-run trends going back 20 years. Second, Glynn Tonsor, ag economist at Kansas State University, aptly points out several issues regarding producer share.

Most notably, it’s a function of retail price data quality. That is, the calculation and reporting of producer share is dependent on USDA ERS simple average retail prices – NOT real volume-adjusted retail prices that aren’t reported.

Given the large number of features and promotions, especially in recent history, producer share becomes inherently biased downward over time as the actual retail price paid by consumers is lower than that publicly available for “producer share” calculations. For more on this, please see Beef Industry Outlook 2018.

Moreover, subsequent discussions with Tonsor highlight the role of demand investments in the economic relevance of producer-share statistics. Namely, Tonsor states, “Any post farm-gate investment that increases demand for meat will lead to a decline in the live animal’s share of retail dollars (presuming the investment successfully increases demand) yet can improve the economic well-being of all in the industry by providing consumers more desired products. To this end, I discourage a sole focus on this statistic as it is easily misleading.”

Based on the feedback, this is an important issue to many readers. What’s your perception of producer share and fed cattle prices? Where do you see producer share headed in the coming two to three years?

Speer serves as an industry consultant and is based in Bowling Green, Ky. Contact him at [email protected]

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)