Feedyards struggle amidst international economic hiccups

What happens over there matters over here

September 17, 2015

August was another tough month for cattle markets. The market has been caught in a slump since April; August added even more pain to the mix. Perhaps most important, amidst negative overtones in the equity markets, deferred futures contracts on both the fed and feeder side also came under pressure.

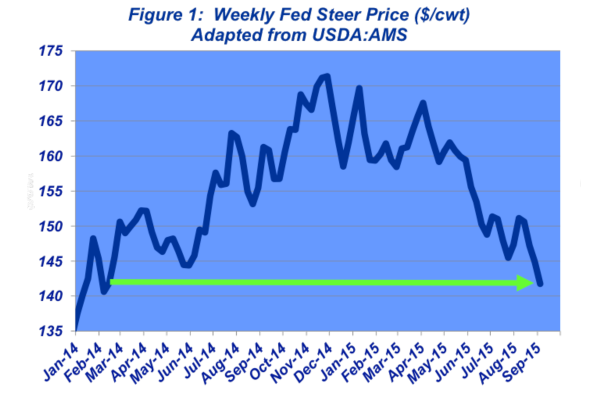

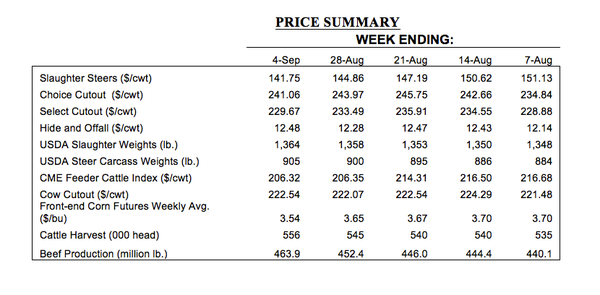

Fed cattle trade did manage to start the month on a positive note. On some follow-through from July, the market strung together back-to-back weekly gains and the month began with weigh-ups at mostly $151. But better prices ended there. And during the next four weeks, the fed cattle market found itself under pressure, slipping another $9-10 to finish the month at $141-142.

From a longer-term perspective, since early April when fed trade scored $167-168, the market has made positive gains only five out of 22 weeks. Cumulatively, cattle feeders have endured a $25 skid, encroaching on $350 per head, over five months. And you’d have to go all the way back to February, 2014 to find trade in the low $140s. (Figure 1)

That price skid created some significant challenges with respect to closeouts. Not surprisingly, that reality is being manifested on both sides of the inventory ledger. First, feedyard placements are dragging. The six month placement total through July equaled only 9.7 million head, nearly 365,000 head (4%) fewer compared with July 2014. Moreover, feedlot managers have also proven to be reluctant sellers. Marketings between February and July total 9.97 million head; 517,000 head less than 2014.

Understandably, cattle feeders are fighting the market. However, from a collective standpoint, that impacts front-end supply and pressures the market even more; an unavoidable consequence. Accordingly, cattle feeders are finding themselves running behind in terms of capacity utilization while also being increasingly front-end loaded.

Meanwhile, global economic concerns continue to hold back the bulls and were exacerbated in August with unfavorable economic reports coming out of China. Prospects for slowing economic growth—especially in China—weighed heavily on the stock market and commodity prices in general, beef included, during the month.

The strength of the U.S. dollar has also been a persistent theme throughout the year. And the news in August solidified even further the current foreign exchange scenario. A strong dollar is beneficial from a consumer perspective—imported goods effectively become less expensive. As such, the U.S. has witnessed a sustained uptick in beef imports for nearly 18 months running.

The flipside is the dollar’s strength makes exported goods and services from the U.S. relatively more expensive to foreign buyers. That plays out for the beef industry, too. Beef exports have run behind year-ago levels for 10 straight months. And while the U.S. does not export beef directly to China, devaluation of the yuan has ripple effects across Asia, further weakening currency values of many other major importing countries and making U.S. beef even less favorable versus other international sources than it was before.

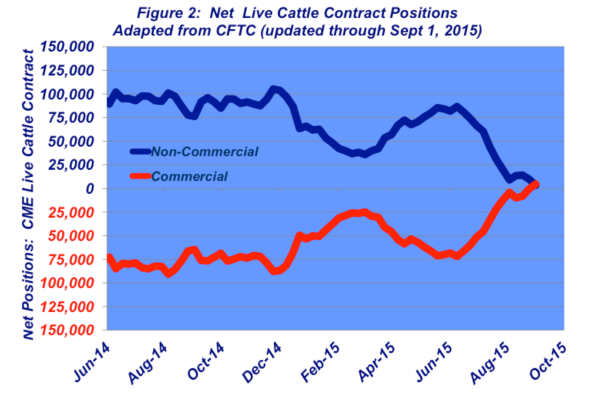

As noted above, perhaps the most important and concerning turn of events during August occurred on the futures side. Worries about demand, coupled with uncertainty around a potential interest rate hike, and a general risk-off mentality has weighed on all commodities. Specific to the beef complex, live cattle futures have witnessed a steady exit of non-commercial longs in the market. (Figure 2) The spring 2016 live cattle contracts are now trading around $140; meanwhile, summer 2016 contracts have dipped all the way back to the low $130s.

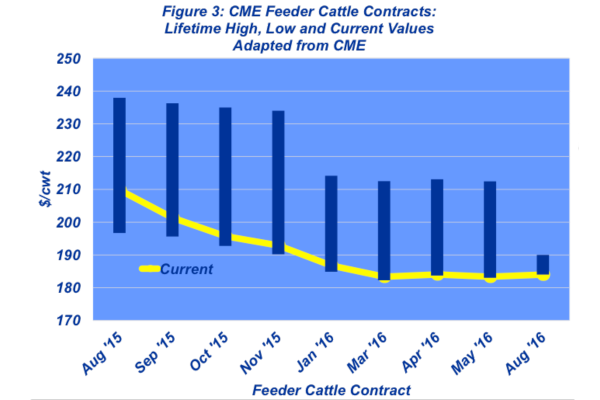

Therein enters consideration for decision making within the cow-calf sector. Heavy losses and subsequent reluctance to purchase feeder cattle has pressured feeders. The CME feeder cattle index has declined nearly $25 from the near-term high scored back in June. Furthermore, the pressure has spilled over into the feeder cattle futures; most contracts are now trading at the low-end of their respective lifetime values. (Figure 3)

While those prices aren’t definitive about what will occur in late-2015 and early-2016, the trend is important. Most significant, it underscores the need for cow-calf producers to reevaluate their respective cost structure going forward. For example, annual summaries from the Kansas Farm Management Association reveal that running cows was profitable for the past 10 years when considering feed (variable and operating) costs only. However, inclusion of non-feed costs in the analysis portrays a very different scenario.

Only two of the past 10 years would have resulted in a positive return; meanwhile, the average loss between 2006 and 2013, when considering all costs, was $160/head. At the same time, softer prices also draw attention to the importance of the overall investment around replacement females.

As noted during the past several months, the market is now operating in a relatively new and untested environment. Work on the demand side can never falter—consumers are fickle and the competition is fierce. Simultaneously, supply will begin to grow over time—a very different dynamic versus the past 10 to 15 years. And on top of all that, August reinforced how intricately linked the world’s economy really is—if it happens somewhere, it matters everywhere.

All that, coupled with ever-increasing capital at risk, highlights the importance of strategic decision making across all segments of the beef industry. That requires time and hard work, but it’s essential to remain effective over the long run. It also underscores one of the primary tenets from Jim Collins’ great book, Built to Last. In a world of constant change, successful companies manage to “preserve the core” while at the same time work to “stimulate progress” along the way.

You might also like:

70 photos honor the hardworking cowboys on the ranch

Chipotle facing lawsuit for GMO-free claims

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)