Four more years — of higher cattle prices

Beef Outlook: As the cow herd continues to shrink, steer prices are predicted to average higher.

July 5, 2022

Consistently high beef cow slaughter levels for the first half of 2022 ensure that the January 2023 U.S. beef cow inventory will decline for the fourth consecutive year.

As those in the industry ponder what this may mean for cattle prices in the next few years, it is instructive to examine past price behavior at similar points in the cattle inventory cycle.

Since the mid-1970s, there have been four other instances in which beef cow inventory numbers declined for four or more consecutive years after reaching an inventory peak. Those are 1976-79, 1983-86, 1997-2004 and 2007-14.

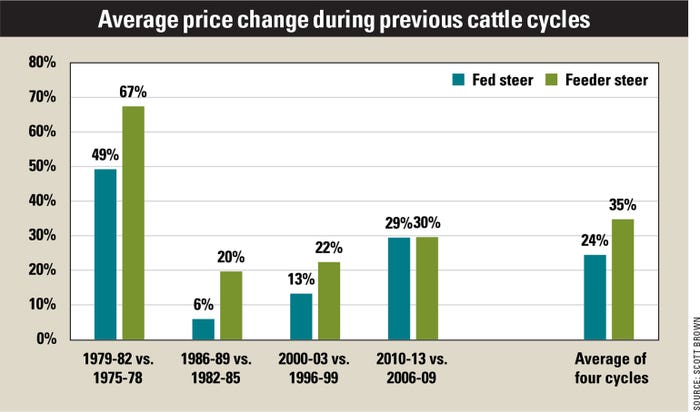

Without speculating how many years declines will continue in this current inventory liquidation cycle, comparing four-year-average prices following four consecutive years of liquidation with the four years just preceding that time frame provides some guidance on potential average prices for 2023-26.

Prices on rise

In every case during the previous four cattle cycles, both national indicator fed steer prices and 600- to 650-pound Oklahoma City feeder steer prices posted higher average levels in the four years following the position in the inventory cycle that we will find ourselves to begin 2023 relative to the previous four years. The average price increase in these cycles was 24.4% for fed steers, and 34.7% for feeder steers.

Using current USDA estimates to project prices for the remainder of 2022, average fed steer prices for 2019-22 calculate to $121.95, with feeder steers at $157.79. If we apply the average price change of the previous four cattle inventory cycles, it suggests an average fed steer price of $151.70 over the 2023-26 period, with feeder steer prices averaging $212.55.

Taking the smallest and largest percentage changes over the previous four cycles yields a range of $129.14 to $181.95 for fed steers and $188.72 to $264.14 on feeders.

Plan for uncertainty

While crunching the numbers is straightforward for this type of exercise, there are many risks and uncertainties that diminish confidence in the fact that past cattle cycle price behavior will be a suitable guide for the years in front of us.

Will beef demand and, therefore, cattle demand remain resilient in the face of the potential stress on consumer finances from inflationary pressure and the rising interest rates used to combat it? Will feed prices in the next few years cause the fed steer to feeder steer price relationship to look different than what occurred in previous periods? Will there be new major disruptions to either the beef demand or supply side that overshadow historical economic relationships within the market?

Despite all the potential for uncertainty, it is important to understand what can be learned from past cattle cycle price behavior and position your operation to take advantage of what is most likely to be the average market conditions in front of us.

As cattle producers navigate the pressure of sharply higher input costs, realize that higher cattle prices — perhaps even sharply higher prices at times — are the most likely outcome for the next few years. Make sure that decisions made in today’s environment keep your operation positioned well to take advantage of the times to come.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)