Industry At A Glance: Can The Fed Market Keep Climbing?

In nine of the past 10 years, the fed cattle market has moved higher into spring from its January high.

January 28, 2014

This January fed cattle market has caught everyone’s attention, and it’s been an incredible run considering that it was trading below $80 just a little over four years ago. Of course, one of the big questions is whether there is room for the market to run even further into the spring. And that’s a hard question to answer given that we’re in uncharted territory.

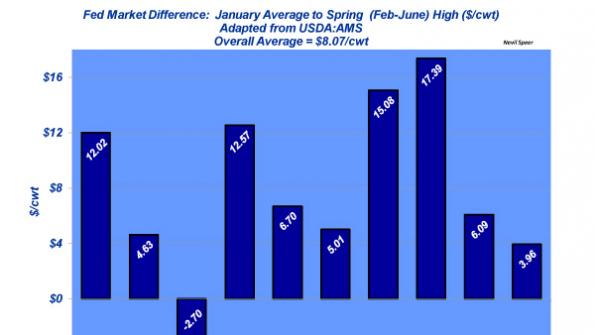

History, however, is a fairly good indicator of what may come. The market typically moves higher from its January average into the spring highs (February through June) by about $8/cwt. Positive action has occurred nine out of the last 10 years, with the only exception being 2006 when January served as the high point of that spring.

In the face of ever-tightening cattle supply and declining beef production, coupled with consumers seemingly shaking off the higher retail prices, it appears there indeed remains some potential to work higher yet. Of course, the flip-side of that perspective revolves around consumers and their propensity to keep spending (especially in light of higher utility bills coming in February, which might sour the mood for a month or two).

Where do you see this market headed? Leave your thoughts in the comments section below.

You might also like:

Should We Fret About Record Cattle Prices?

7 U.S. Ranching Operations Lauded For Top-Level Stewardship

Record Prices Will Continue, But Who Will Most Benefit?

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)