Industry At A Glance: Feeder cattle pricing trend cooling slightly in 2015

Thus far in 2015, feedyards’ risk appetite has remained fairly robust – albeit at lower levels than 2014.

April 2, 2015

Last week’s Industry At A Glance focused on feeder cattle prices and a focus on pricing risk. The discussion mentioned that, “While feeder cattle prices are off their highs from 2014, the relative strength of the feeder cattle continues to march on.” Cattle feeders continue to aggressively pursue replacements and remain competitive to procure their inventory needs. That’s evidenced by last week’s illustration that portrayed an ongoing pattern of prices above the predicted value – based on historical norms.

This week’s illustration renders that reality in a little different perspective. Two major components define the feeder cattle market on any given week:

the corn market and

the deferred fed cattle contract against which the feeder cattle are being purchased. The latter being the overwhelming determinant on any given week.

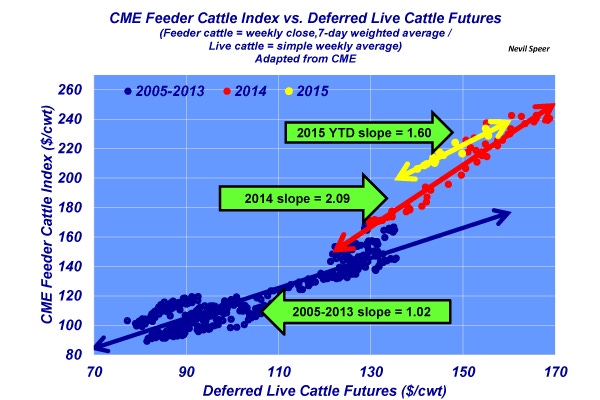

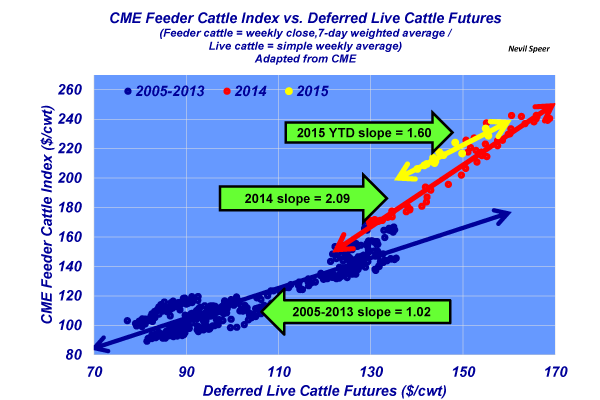

The accompanying graph depicts the weekly CME Feeder Cattle Index against the deferred Live Cattle futures contract. The data is outlined for the years 2005-2013, 2014, and year-to-date 2015. The long-run (2005-2013) historical pattern established a mostly one-to-one relationship. In other words, if the back end of the fed cattle market was up $1 per cwt (or about $12.50 per head), feeder cattle would rise approximately $1 per cwt (or about $7.50 per head) – and vice versa. That relationship jumped to 2.10-to-1 in 2014. In other words, if the deferred fed cattle contract rose $1 per cwt ($13 per head), feeder cattle prices jumped $2.10 per cwt ($15 per head

Stated another way, the risk appetite for feeder cattle was historically strong in 2014 – cattle feeders bet on the come through the entire year. That all works well if fed prices ultimately outpace the deferred fed cattle contract at the time of purchase. However, that begins to be problematic if the fed market proves to disappoint – the risk strategy cuts the wrong way.

Thus far in 2015, feedyards’ risk appetite has remained fairly robust – albeit at lower levels than 2014. That said, how might this relationship change in 2015 over time? Will cattle feeders become more careful about pricing replacements – or will they continue to aggressively chase cattle? Looking out a year from now, will we see 2015 closer to the longer-run historical pattern?

Leave your thoughts in the comments section below.

You might also like:

7 common fencing mistakes to avoid

60 stunning photos that showcase ranch work ethics

What you need to know about cattle ingesting net wrap

10 favorite tractors ranked in farmer survey

8 tips for being a better ranch manager in 2015

Prevention and treatment of cow prolapse

About the Author(s)

You May Also Like