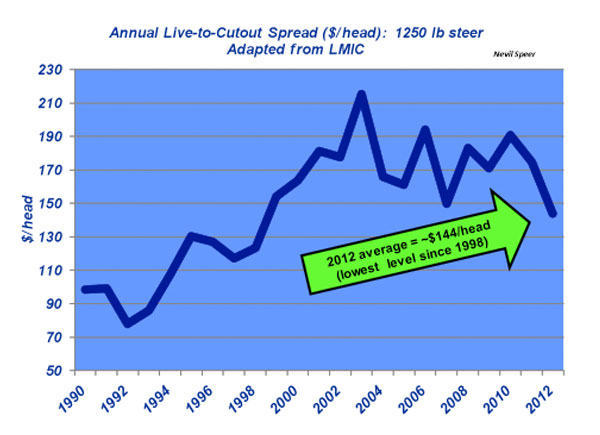

Industry At A Glance: The Live-To-Cutout Spread

A -$144/head is the lowest live-to-cutout spread since 1998.

May 23, 2013

The live-to-cutout beef spread provides some insight into packer gross margins over time. This spread is calculated as revenue from wholesale beef and by-product sales, less the cost of a live steer/heifer. Remember that gross margin does NOT equal profit; it doesn’t account for costs associated with maintaining and operating a beef plant such as labor, overhead, cost of capital, etc.

Most important to this discussion, the live-to-cutout beef spread is often used as an indicator of relative leverage within the industry. That is, some argue that spread differences over time reflect relative leverage in the marketplace. That argument was especially pronounced when the spread peaked in 2003; packers were unduly taking advantage of weekly negotiations.

However, since that time, the spread has chopped lower as the fed supply has become increasingly tight. The 2012 average was a negative $144/head, the lowest since 1998.

Nonetheless, some of that same discussion has flourished in recent months, given the market’s recent disappointing performance. Simultaneously, the level of alternative marketing arrangements continues to rise in the industry. As such, the discussion about alternative marketing arrangements (captive supplies) have seemingly resurfaced. The argument is that the cash market has become increasingly thin, thereby providing beef packers with undue opportunity to manipulate weekly pricing of the fed cattle market.

Where do you ultimately see those discussions headed? Accordingly, how do perceive the overall condition of the cash market at the current time, and its relationship to the economic health of both the packer and feeder? Leave your thoughts below.

You might also like:

See The Minute-By-Minute Commodity Prices

Readers Show The Love For Their Ranch Sweethearts

Meat Market Market Update | Daily Choice Cutout Hits Another Record

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)