Managing price risk for cow-calf producers

Producers currently can utilize price risk management tools before spring calve are sold.

April 20, 2023

By Josh Maples

David Anderson, Texas A&M AgriLife Extension, has written about markets reaching record-high cattle prices as cattle supplies tighten and some of the questions out there about the market later in the year. Cow-calf producers certainly welcome higher prices anytime, but what about the producers who don’t have anything to sell right now?

Nearly 75% of the calves born in the U.S. are born during the first half of the year, which means many producers are calving or have already finished calving for the year. These calves are still nursing and most likely won’t be sold until later in the summer or fall.

While it may be months before the spring calves are sold, producers do have opportunities to utilize price risk management tools now.

Not only are cattle prices surging to high levels now, but there is also optimism that cattle prices could continue to gain steam as we move through 2023.

Seasonal contracts

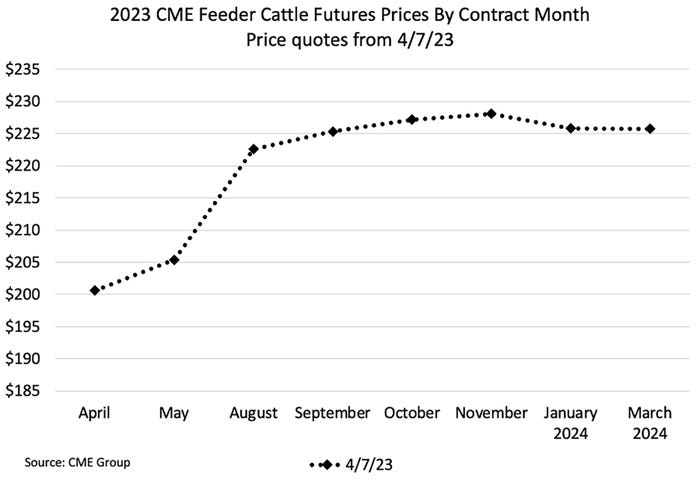

The chart above plots the contract price for each Feeder Cattle Futures contract month traded on the CME Group. The spring contracts are trading near $200-$205 per cwt, but the summer and fall contracts are trading above $220.

Some of this increase is seasonal, but much of it is also driven by the expectation of continually tighter cattle supplies. Importantly, these expectations of high cattle prices mean there are price risk management opportunities not seen since 2014-2015.

Price risk management tools

There are a few price risk management tools that cow-calf producers selling later this year could consider. Selling a futures contract or purchasing a put option are potential strategies. One thing to consider about these choices is the contract size is 50,000 pounds which might be a little large for many cow-calf producers.

Forward contracting is worth considering – this simply means a producer would lock in a sales price with a buyer in advance. USDA’s subsidized Livestock Risk Protection (LRP) tool is also worth considering and can be used on as few as one head which makes it worth a look for producers of all sizes.

Your local crop insurance agent may be well equipped to help you in any LRP decisions. Each of these tools has their own design and tradeoffs to understand before jumping in, and there are certainly other risk management strategies out there.

However, all tools are currently offering risk management opportunities at price levels not seen in the past eight years. Even if a producer doesn’t have any calves to sell now, they can still take advantage of the optimism in the market by managing their price risk.

Source: Southern Ag Today

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)