The cattle market found its bottom; where to from here?

The cattle market has seemingly found a bottom, but there’s some question about how much upside potential exists.

December 31, 2014

Markets never let you rest – especially commodity markets. The potential for substantial and unexpected moves requires constant vigilance and persistent monitoring. And the “all-alert” is probably most prudent just when everything seems predictable or orderly.

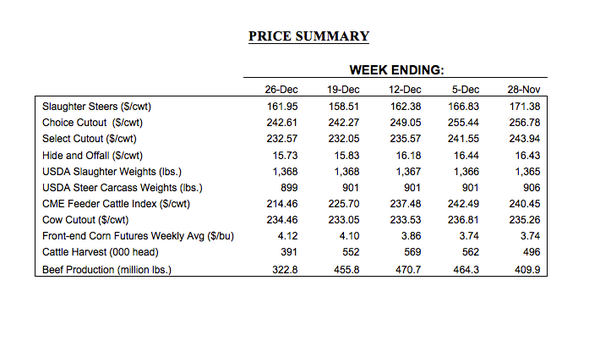

That reality is best witnessed by market action in the cattle markets during the past month. Recall that the November fed trade finished the month at $171/cwt., established several new record-highs during the month, and managed to average nearly $170/cwt. Just as quickly, however, the market’s sustained run of better prices came to an end as December opened for business. Over the span of just three weeks, the market retreated nearly $13 to settle back at $158 just prior to Christmas.

Equally important, the deferred live cattle futures also gave up ground. The February and April contracts have both gone from trading $169-$170 at the end of November to trading $159-$160 during the Christmas holiday week. The slide possesses some especially important implications. Primarily, cattle feeders who haven’t hedged fall-run purchases, on hopes of a spring rally, now have a deeper hole to dig out of.

That’s compounded by the fact that cattle weights are running well ahead of last year, plus the 120+ day feedyard inventory is sizeable (USDA’s December Cattle on Feed report placed the number at 3.302 million head – the second-largest level in the series history behind 2012). And as noted last month, “So while feedyards currently possess good leverage as packers chase cattle, the front-end supply will need to be monitored carefully going into 2015.” So, while the market has seemingly found a bottom, there’s some question about how much upside potential exists with those factors in play.

That discussion emphasizes some observations made in last month’s column regarding the unprecedented run in the feeder cattle market. Most notably, “…. cattle feeders have aggressively chased cattle. That’s occurred for several reasons:

• To ensure operating at increased capacity levels and

• To procure placements as a means to bet on a surging fed cattle market.

“As long as the fed market continues to reward that behavior, the risk appetite is likely to remain elevated (keeping prices above the regression line). That’s a good strategy when prices are improving, but could/will prove problematic if/when the fed cattle market goes through a corrective phase.”

Those very concerns spilled over into the feeder cattle market. CME’s feeder cattle futures ran out of buyers in mid-December and closed limit down five days in a row. Meanwhile, expanded limits provided some confidence regarding liquidity and managed to stem the slide. However, further selling occurred in the days following – the January and February contracts settled at $215 and $213, respectively, to close out Christmas-week trade. In both cases, that’s a $20/cwt. (or $150/head) adjustment in just three weeks of trade.

Which way from here?

Seemingly, the market is now on its heels looking for direction. As noted earlier, the market appears to be consolidating in a positive direction with post-Christmas trade. But longer-term direction will come following the holidays with some return to normal schedules.

Moreover, the wholesale market should begin to gain some traction moving into February and March (that’s especially true given the sharp decline in fuel prices – for more on that see this week’s Industry At A Glance). However, in the meantime, given the sharp downturn in recent weeks, traders will be especially careful, looking for confirmation of follow-through to the upside.

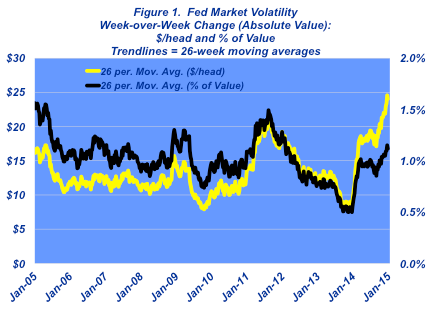

The market’s setback in December is disconcerting from any number of perspectives. And it’s probably been more difficult because 2014 has almost conditioned us to expect markets to continually rise. Moreover, the setback was dramatic and seemed particularly volatile. To that point, though, from a longer-run perspective, the move through the end of 2014 remains well within normal expectations of weekly changes.

Figure 1 details that concept; while $5 market shifts on any given week seem large, it’s the longer-run trend that really matters. All three weeks in which the market regressed ($4.50, $4.50 and $4.00, respectively), the percentage change ranged between 1.6%-1.75%, which is well within normal change expectations from week-to-week from a historical perspective.

Last year at this time, I noted that, “…as we embark on 2014, there’s some very new dynamics at work.” That same observation remains true as we enter into 2015 – especially considering the historical levels of capital tied up in the cattle industry. So, similar to previous months, the observation that, “Trying to outguess or outsmart this market is about like trying to outrun a speeding train. It’s nearly impossible to do and the consequences can be devastating.”

The market has revealed during the past month that it can be unforgiving. Moreover, fundamentals are such that gains in 2015 will likely be harder to come by than they were in 2014. That reinforces the need for prudent risk management around all aspects of business – no matter the particular segment. With that in mind, in closing, objective information and disciplined review are both essential to helping ensure successful decision-making going forward.

You might also like:

Breathtaking photos of winter on the ranch

6 tips for buyers & sellers at a cattle sale

Prevention and treatment of cow prolapse

Bale grazing lets cows feed themselves

8 tips for being a better ranch manager in 2015

Beef cattle genomics come full circle

About the Author(s)

You May Also Like