Will China’s BSE announcement bolster U.S. cattle prices?

BSE isn’t a major driver in the global beef market anymore. That’s why the overall impact of Brazil’s BSE announcement will be muted.

It seems that news about bovine spongiform encephalopathy or BSE has fallen off the radar. Until now.

Last Friday, the Brazilian government reported a case of atypical BSE in a 17-year-old cow. That announcement was immediately followed by the Brazilian government suspending beef exports to China.

The first question for U.S. beef producers is will this affect our prices? Probably not, according to economists with the Daily Livestock Report (DLR), “but much will depend on how China responds to this.”

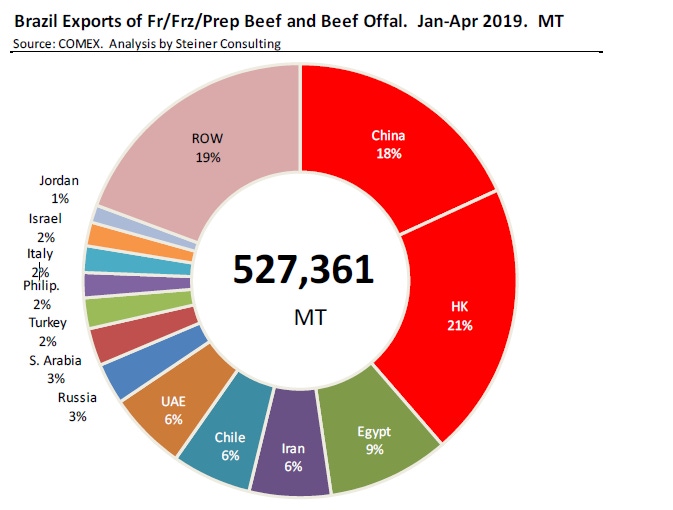

That’s because of China’s growing appetite for beef and Brazil’s position as one of its major beef suppliers. This DLR graph shows just how much of big deal it is. Combining exports to China and Hong Kong, 39% of Brazil’s first quarter beef exports likely ended up in China.

That’s not to say the U.S. isn’t exporting beef to China. Last year, the U.S. exported 1,352,917 metric tons (mt) of beef and variety meats, according to the U.S. Meat Export Federation. Of that, 122,832 mt went to Hong Kong; 12,501 mt went to Vietnam; and 7,297 mt went directly to China. Combined, that’s 10.5% of U.S. beef exports that likely found a home in China last year.

For the first quarter of 2019, total U.S. beef and variety meat exports are 307,306 mt. Hong Kong took 21,304 mt; Vietnam took 1,849 mt; and China took 1,680 mt. Combined, that’s 8% of first quarter U.S. beef exports.

READ: Could it get worse than The Cow That Stole Christmas?

China is the world’s biggest beef importer and their appetite continues to grow. According to DLR, Chinese beef imports jumped 75% in April. What’s more, China has recently absorbed all the growth in exports from all major world exporting countries, except, of course, the U.S. Chinese buyers are scouring the world to get additional beef as demand in the country far exceeds the ability to meet it domestically.

That’s why the DLR economists correctly say that any economic ripples from Brazil’s BSE announcement depend on China’s reaction.

“With the suspension in place, Chinese buyers will have to turn to other South American countries to secure beef, but those supplies are already maxed out,” DLR says. “If Brazil is shut out of the Chinese market for a prolonged period of time, then we could see Chinese buyers become even more aggressive in the Australian market. This could force Japanese and South Korean buyers to source more U.S. beef. But, as mentioned earlier, much will depend on how long China decides to keep Brazil in the penalty box.”

Given all that, Chinese officials have a lot of incentive to solve this situation quickly. As a quick refresher, after The Cow That Stole Christmas, it took China nearly 14 years to grant direct access for U.S. beef. To be fair, global reaction is much more muted now, but don’t expect China to start buying your beef anytime soon.

And that means this will be nothing more than a blip on the global beef market and one that will soon be forgotten.

About the Author(s)

You May Also Like