Cowherds are getting bigger, but weaning weights haven’t changed.

August 10, 2017

State farm management association programs allow farming and ranching participants to obtain comprehensive analysis of their respective enterprises which comprise the farm operation. That information subsequently leads to establishing meaningful benchmarks for comparative purposes – both from a production and financial standpoint.

Accordingly, Industry At A Glance has regularly utilized data from Kansas Farm Management Association (KFMA) to provide some insight into decision-making in the cow-calf sector. The KFMA data is especially useful from several perspectives. One, Kansas’ program is one of the largest in the country. Two, the data represent mostly mid-size (including both diversified and full-time) operations. Last, there’s a solid track record across all the data, enabling meaningful comparisons over time.

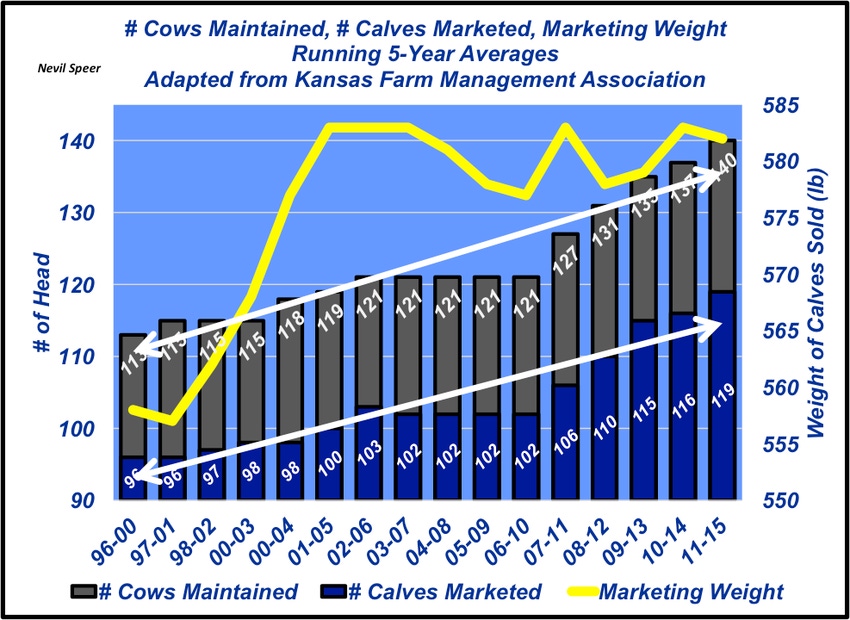

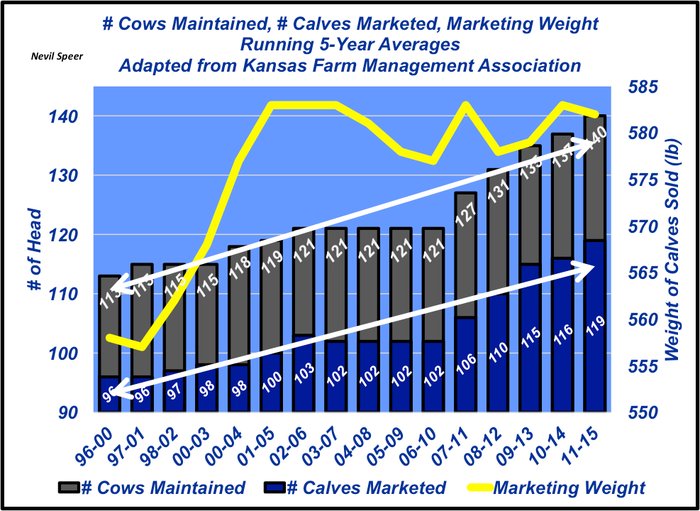

The data outlined in the graph represent five-year moving averages beginning with 1996-2000 and subsequently updated annually through 2011-2015, resulting from the most recent 2016 analyses. Analysis of the five-year moving averages avoids year-over-year peaks and valleys because of weather, markets, etc. and helps provide some focus on longer-run trends within the cow-calf sector.

The key components in the graph include number of cows maintained, number of calves marketed and marketing weight. The trends are solidly consistent over time:

Cowherds are getting bigger. Operational size continues to steadily increase, thereby indicating ongoing consolidation within the cow-calf sector.

The marketing rate hasn’t budged. The relative proportion of calves marketed (or calf crop percentage – aggregately determined by pregnancy, calving, and weaning percentages, respectively) hasn’t varied through the years. Seemingly, there’s been no major shift over time – one way or the other – in terms of either cow fertility or calf survivability.

Weaning (marketing) weights have plateaued. Lastly, marketing weight of calves hasn’t changed either during the past fifteen years, despite the fact that the beef industry has been able to consistently push slaughter and carcass weights higher.

How do you perceive these trends? Are they in line with your operation? Are they consistent with your perception of what’s occurring in the cow/calf sector? Do you foresee any of these trends changing in the coming years? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like