Warm spring weather could mean corn can gain ground from soybeans.

March 23, 2017

The grain market will be anxiously anticipating USDA’s Prospective Plantings report due out March 31. This is the market’s first adjustment to new acreage numbers since USDA’s first stab in late February at the agency’s Outlook Forum. USDA’s corn acreage estimate going into March was pegged at 90 million acres, while soybean plantings were guessed to be 88 million acres.

However, weather has been extremely favorable through much of the United States. Warm weather enables earlier plantings and generates the desire to get started to get a crop in the ground. If that’s the case, corn acres could begin to make gains against soybeans. Meanwhile, there’s the enduring tug-of-war around acres—the never-ending chore of monitoring inputs, markets, and profit potential of corn versus soybeans.

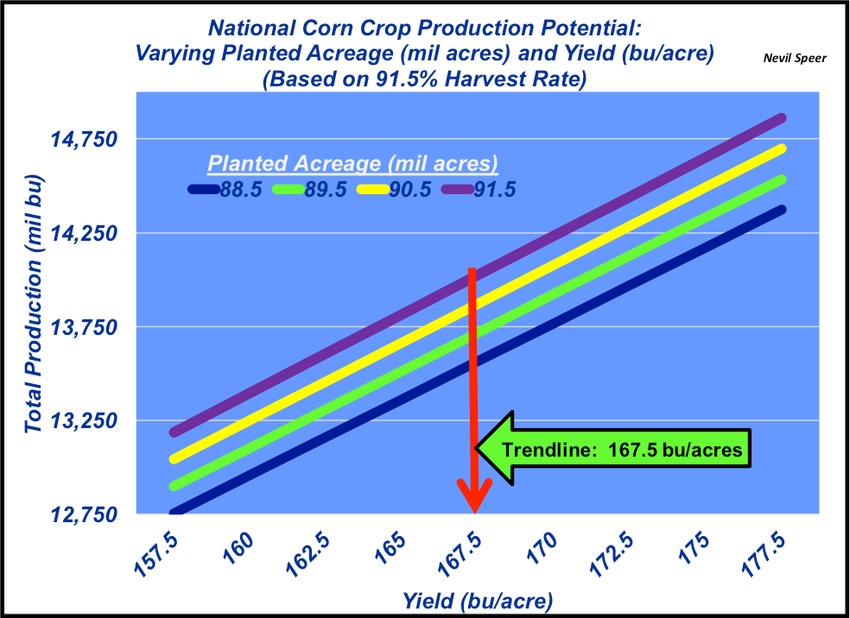

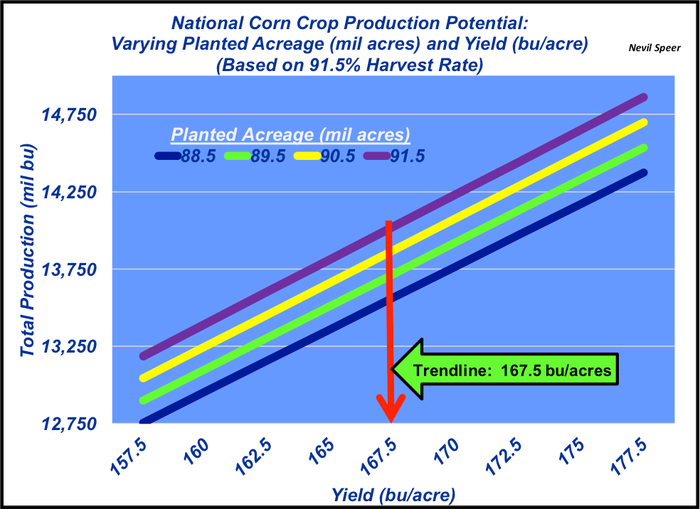

This week’s illustration provides a guide for where we may end up in terms of total production, based on some basic assumptions. The graph depicts production potential at various planted acreage (88.5, 89.5, 90.5 and 91.5 mil acres, respectively) and varying yield estimates, with 167.5 bushels per acre being the trendline guess for 2017. All of the production estimates assume 91.5% harvested acreage.

As noted in previous Industry At A Glance columns, the initial forecast for 90 million planted acres, equaling 82.35 million harvested acres, and 167.5 bushels per acre results in total production around 13.8 billion bushels. That’s right in line with the four-year average total use. Thus, carryover would remain relatively steady going into 2018.

What are your expectations around the initial 90 million acres? Do you think we’ll end up with more or less planted corn acres in USDA’s upcoming prospective plantings report? Will 2017 be another surprise year for yield – or will we produce right at trendline estimates? Are you making any purchasing and/or marketing decisions at this stage of the game? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like