Buyers get choosier, preconditioned calves ring up the bids

Calf prices were widely inconsistent this week at steady to $5 per cwt higher, to $5 lower with instances of $10 either way, according to the Agricultural Marketing Service. Feeder cattle traded steady to firm.

October 30, 2015

Steady to uneven might be the most appropriate description of cash cattle prices this week.

“Calves are starting to dominate receipts and prices were very uneven, trading in wide price trends in all areas with demand fairly inconsistent,” explained analysts with the Agricultural Marketing Service (AMS) on Friday. “Calves traded from steady to $5 per cwt higher to $5 lower with instances ranging from $10 lower to $10 higher depending, in many cases, on location and quality.

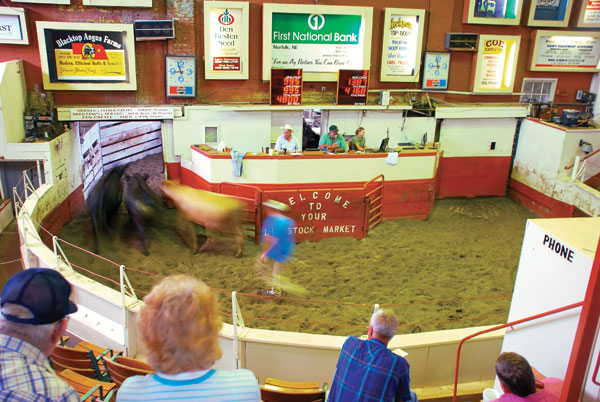

“Most of the very attractive high-quality offerings sold generally steady with last week’s prices, however average-quality, non-vaccinated calves sold at huge discounts to preconditioned offerings,” explained the AMS reporter on hand for Tuesday’s auction at Miles City Livestock Commission in Montana. “As colder and volatile changing weather is starting to occur weekly, buyers were very reserved as they bid on non-vaccinated calves. Discounts reached $15 per cwt for like-quality calves at times.”

Feeder prices sold steady to firm this week with instances of $3 on either side of even.

“While price levels remain good and consistent for green-conditioned yearlings and strings of fancy and long-time weaned calves, the other side of the coin is against small consignments of mixed quality, mixed color and un-weaned, fleshy, bawling calves that sell far behind the former,” AMS analysts explain.

Cash fed cattle trade also managed mostly steady prices at $138.00 to $138.50 per cwt on a live basis. Dressed sales in Nebraska were $2 higher at $210.

Although fed cattle prices are rebounding from recent lows, AMS analysts point out feeder cattle prices still challenge cattle feeders to place them with profit in mind.

“The market is still trying to find some steadiness after the enormous price fall then subsequent rebound,” AMS analysts say. “There is uneasiness due to large quantities of meat protein on hand (see “Red meat production forecast record large”) as this market tries to find out what it can or can’t support.”

Wholesale beef values edged higher week to week. Choice boxed beef cutout value was $2.87 per cwt. higher at $220.04. Select was $1.17 higher at $212.07.

Volatility in the futures markets offered more uncertainty than support. After limit-up moves on Wednesday, both Feeder Cattle and Live Cattle gave back much of the gain by the end of trade on Friday.

Other than 65¢ lower at the very back, Live Cattle futures closed an average of $1.60 lower week to week ($1.30 to $1.77 lower).

Between recently expired spot Oct and newly minted away Oct, Feeder Cattle futures closed an average of $2.47 lower week to week ($1.95 to $2.72 lower).

Cattle markets dismiss WHO report

Early-week pressure in futures could be tied to position squaring from the recent run-up in prices and slight bearishness from the previous week’s monthly Cattle on Feed report.

For the time being, that eased concerns about how the market would respond to Monday’s much-criticized report from the World Health Organization’s International Agency for Research on Cancer (IARC). The report suggests that eating processed red meats are akin to smoking cigarettes when it comes to cancer risk. The same report also labeled red meat consumption with the second-highest carcinogenic risk classification.

Keep in mind, the IARC also classifies the air you breath as a carcinogen.

“Given the weak associations in human studies and lack of evidence in animal studies, it is hard to reconcile the committee’s vote,” says nutritional toxicologist James Coughlin, Ph.D., CFS. “Of more than 900 items IARC has reviewed, including coffee, sunlight and night shift work, they have found only one ‘probably’ does not cause cancer according to their classification system.”

Coughlin, a toxicologist with more than 40 years of experience in meat and cancer, is critical of the IARC review process due to the lack of transparency, selective inclusion or exclusion of studies and broad interpretation of study results that are inconsistent with the conclusions of the study authors.

“In my experience as an observer to an IARC working group, the process typically involves scientists who have previously published research on the substance being reviewed and may have a vested interest in defending their own research” Coughlin says. “In the case of red and processed meat, the overall scientific evidence simply does not support their conclusion.”

Suffice it to say that IARC’s findings run counter to wide-ranging scientific opinion. To their credit, consumers appear to be taking the report in stride (see this week’s BEEF Editor’s Blog for more).

Questions remain concerning heavyweight cattle

“Even though the latest Cattle on Feed report came in as expected, it gave some preliminary signs that feedlot marketing rates may be creeping up toward more normal levels,” say analysts with the Livestock Marketing Information Center (LMIC). “Normal marketing rates, plus another two months of dampened placements compared to a year ago, could set the stage for a larger-than-seasonal move up in fed cattle prices into the late winter and early spring of 2016.”

On the other hand, Andrew P. Griffith, agricultural economist at the University of Tennessee, points out in his weekly market comments that the most recent data (Oct. 17) pegs average steer carcass weights at 930 pounds, 32 pounds heavier than the same time a year earlier and a new record.

“It is likely carcass weights have continued to advance and will continue to advance the next several weeks as is the seasonal tendency,” Griffith explains. “This has some analysts questioning if the heavy carcasses were cleaned up in September since weights continue to advance, and thus questioning if prices are in for another decline. It is unlikely that all of the heavy cattle were marketed in such a short window, but the seasonal weight increase is probably the main driver right now.”

You might also like:

Gallery: A waterer that never freezes? It's true!

Is the cattle market whiplash over?

What's ahead for 2015 on the cow-calf side?

Enjoy a laugh on us! Holmes and Fletcher classic ranch cartoons

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)