China exports 2020 vs. 2019

As politics waxes and wanes, keep a close eye on China’s buying trends.

November 5, 2020

In the lead-up to the election, there has been lots of discussion about exports to China thus far in 2020. Moreover, the world is closely monitoring China’s economy following the initial COVID-19 outbreak.

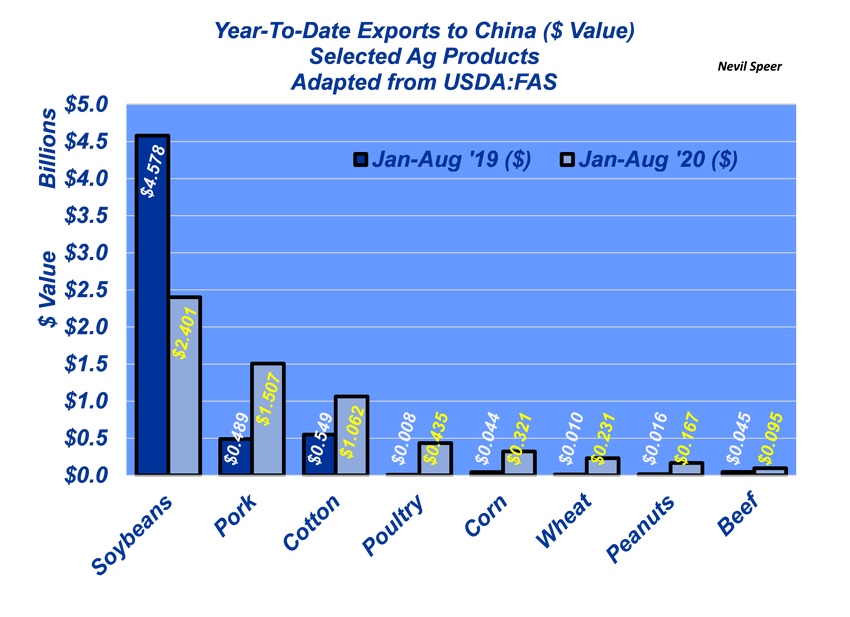

Accordingly, this week’s illustration highlights year-over-year comparison of exports of selected ag products to China through August. The data series is sorted according to total export value to date.

A couple of items are especially important for context:

Soybean exports are down sharply in ’20 compared to ’19, nearly $2.1 billion through August. However, it should be noted that some of that difference should be caught up in months to come given dry weather conditions in Brazil. China will likely have to be more reliant on U.S. supply going into 2021.

Not surprisingly, pork exports are up sharply to help backfill China’s protein deficit. Dollar value of pork exports through August have more than tripled to total nearly $1.51 billion.

Similarly, poultry exports have skyrocketed to $435 million in ’20, versus just $8 million a year ago.

Corn exports have also surged in 2020 – thus far, corn exports have totaled in excess of $320 million – and that sharp uptick has helped underpin the demand side for corn going into the ‘20/’21 marketing year.

Lastly, beef exports have more than doubled through August to total $95 million; more than double last year’s pace.

Clearly, there’s lots of uncertainty going forward; nevertheless, these are important trends to continue monitoring in the weeks and months to come – both politically and pragmatically. Stay tuned!

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do no necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)