COVID-19: Ethanol and DDGS take a dive

Ethanol plants are being idled because of decreased gasoline demand. All the while, ethanol inventory in storage grows bigger.

April 23, 2020

There’s been no shortage of coverage regarding the influence of COVID-19 on the livestock markets. And during the past several weeks, the same could be said of crude oil. However, while those stories intersect, one story has seemingly been overlooked by mainstream media: ethanol.

It’s an especially important situation that mandates more attention. Ethanol producers have been hit hard by a perfect combination of events. First, there’s COVID-19; the shutdown has hammered gasoline demand—that subsequently reduces the need for ethanol. For more on that, see the Renewable Fuels Association’s (RFA) latest report: The Economic Impact of COVID-19 on the Ethanol Industry.

Second, there’s the ongoing Saudi Arabia – Russia oil price war. Meanwhile, domestic oil production remains robust at 12-13 million barrels per day. For perspective, the U.S. consumed an average of about 19.96 million barrels per day in 2017. A 42-gallon barrel of oil produces about 19 gallons of gasoline, in addition to a variety of other products, according to the U.S. Energy Information Administration.

All those factors combine to pressure the price and subsequent profitability of ethanol. As such, the fallout on the industry has been devastating.

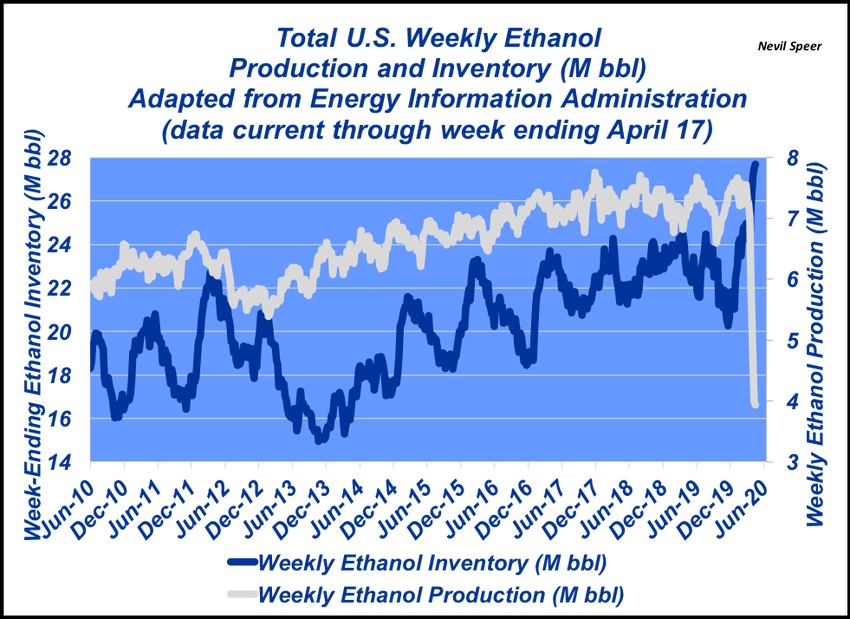

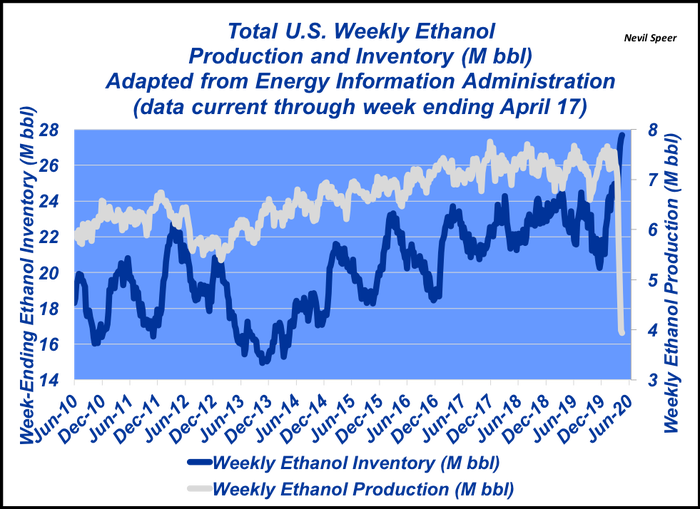

This week’s graph highlights just how sharp the impact has been. Ethanol storage spiked during the past month—all the while production has fallen by nearly 50% during the same time frame. To that end, RFA is reporting that 71 ethanol plants are now idled, with an equal number sharply reducing production.

This summer’s gasoline demand will be sharply curtailed due to COVID. Therefore, it’s going to take even longer than normal to use up current ethanol inventory, let alone begin thinking about ramping up production. And most important, the influence of these events on the ethanol industry possesses implications throughout agriculture.

That said, a long duration of ethanol plants being off-line will have major ramifications for livestock producers. First, there’s the issue of feed ingredient availability. And second, there’s also considerations around the need to manage ingredient prices: protein markets, shifting basis in corn market, and overall feed costs.

Stay tuned; this could be an important game changer going forward.

Nevil Speer is based in Bowling Green, Ky. and serves as director of industry relations for Where Food Comes From (WFCF). The views and opinions expressed herein do not necessarily reflect those of WFCF or its shareholders. He can be reached at [email protected]. The opinions of the author are not necessarily those of beefmagazine.com or Farm Progress.

About the Author(s)

You May Also Like