Employment numbers in early 2017

People who have a steady job eat more beef. Here’s a look at the employment numbers so far in 2017.

April 27, 2017

Last month in my monthly column, I noted that, “Beef demand will be an especially important factor to monitor as we progress into summer. Bigger supplies and seasonally softer demand can serve as a double whammy for prices. However, if the economy is truly picking up, and consumer sentiment remains solid, better beef demand could help offset some of that seasonal slump.”

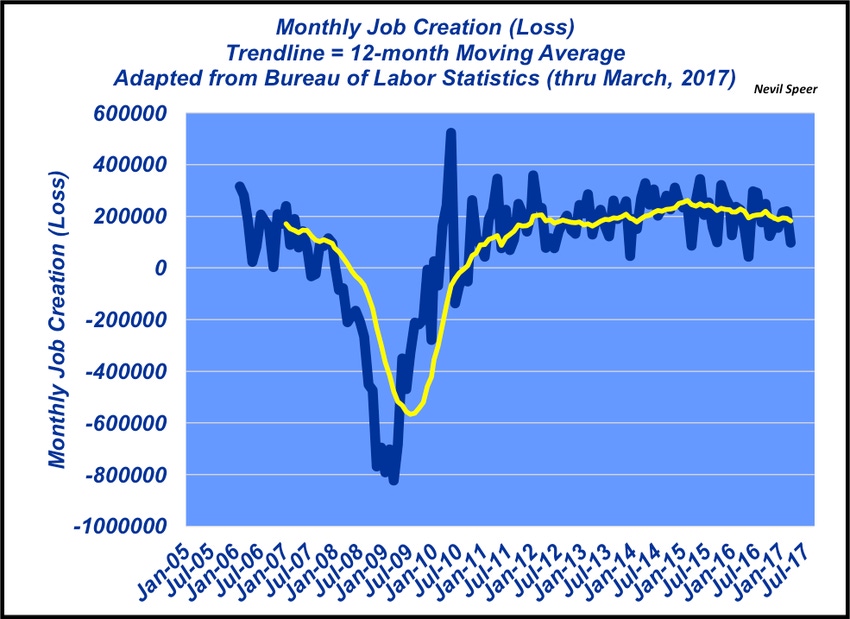

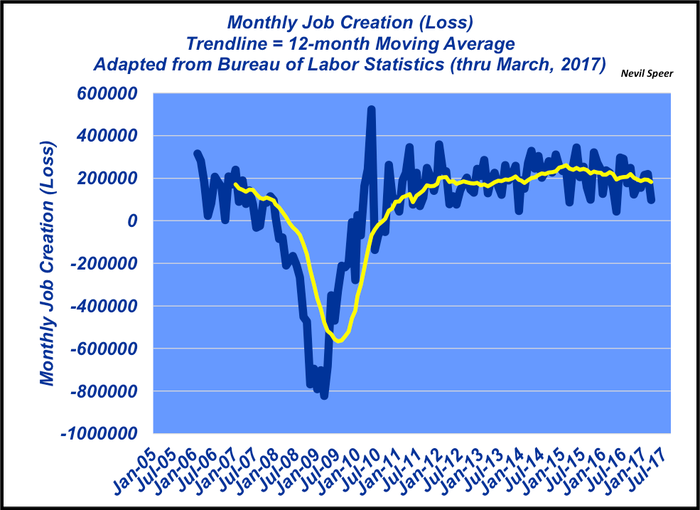

A big part of demand stems from general consumer attitudes about the economy – and in particular, individual perception of the broader employment situation. To that end, April’s Bureau of Labor Statistics report indicates 98,000 new non-farm jobs were created in March. While that may seem like a lot, the number was somewhat disappointing. Accordingly, much of the broader coverage was fairly muted. For example, several headlines read like this:

Dr. Robert Dieli (NoSpinForecast), noted the report was, “…a miss to the downside because of the absence of strength. Most sectors had a ho-hum month…So the headline was ‘ho-hum.’” He further analyzed, “The March payroll number was not what the markets had in mind, but what they got did no harm.”

Meanwhile, speculation and chatter around further interest rate hikes is never-ceasing. Much of the Federal Open Market Committee’s decision will revolve around their assessment of the employment situation in the United States. Therefore, each jobs report plays an important role in dictating the overall tone going into each Federal Reserve meeting.

With all that in mind, what’s your general assessment of the current state of the economy? Will consumers feel comfortable spending this coming summer? Or alternatively, do you perceive the March jobs report as the beginning of some softness with in the economy? How will all this translate for beef demand over the next three to six months? Leave your thoughts in the comments section below.

Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)