Farm income projected to decline for fourth consecutive year

ERS releases February farm income forecast.

February 7, 2017

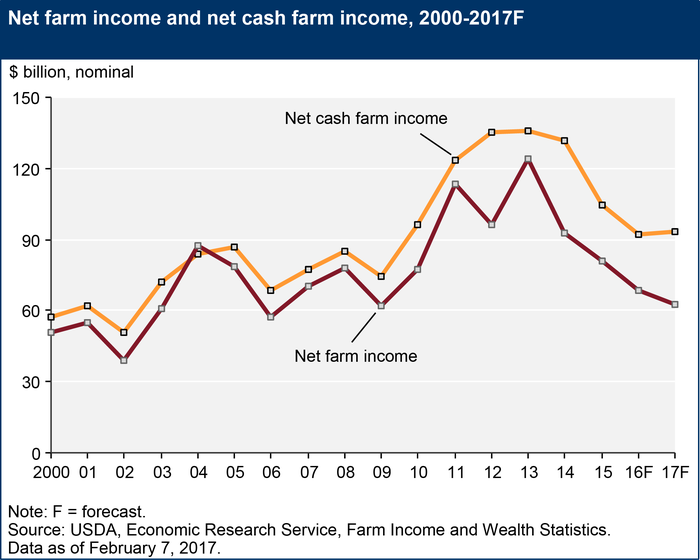

USDA's Economic Research Service says net farm income is forecast to decline by 8.7% to $62.3 billion in 2017, the fourth consecutive year of declines after reaching a record high in 2013. If realized, net farm income in 2017 will be the lowest since 2002, in inflation-adjusted terms.

Net cash farm income, on the other hand, is forecast to rise by $1.6 billion to $93.5 billion from the 2016 value, an increase of 1.8%.

The difference between the two profitability measures is expected to increase in 2017 largely due to an additional $8.2 billion in cash receipts from the sale of crop inventories.

The net cash farm income measure counts those sales as part of current-year income while the net farm income measure counted the value of those inventories as part of prior year income.

Cash receipts

Overall, cash receipts are forecast to remain largely unchanged, with large offsetting changes in dairy receipts—up by $4.7 billion, or 13.7%, based on forecast higher prices—and cattle/calf receipts, which are forecast down by $4.5 billion (6.7%) based on anticipated lower prices. The forecast for crops is mostly unchanged, with wheat receipts changing most in absolute and percentage terms, falling $1.4 billion (16.6%) relative to 2016. Direct government payments are down by $0.5 billion (4.0%) to $12.5 billion.

Forecast

The 2017 forecast for average net cash income for farm businesses is up by 2.2%, with the largest increases for farms specializing in cotton (up 34%) and dairy (up 47%). These strong gains are offset by a forecast drop in net cash farm income for cattle/calf operations (down 12.9%).

Expenses

After declining for two consecutive years, the forecast for 2017 total production expenses is flat, with farm-origin expenses (including feed, livestock, and seed) down 2.6% as a group.

Manufactured input expenses were more mixed, with fertilizer group expenditures forecast down by 9.1% and fuel/oil expenses up by 13.1%. Labor costs are also forecast to rise 5.4% in 2017.

Asset values

Farm asset values are forecast to decline by 1.1% in 2017, and farm debt is forecast to increase by 5.2%. Farm sector equity, the net measure of assets and debt, is forecast down by $51.2 billion (2.1%) in 2017. The decline in assets reflects a 0.3% drop in the value of farm real estate, as well as declines in the remaining categories. The rise in farm debt is driven by higher real estate debt (up 7.3%). Financial liquidity measures, including working capital, are forecast to weaken in 2017, as are solvency measures such as the debt-to-asset ratio. The debt-to-asset measure is now above its average over the previous ten years.

Source: USDA ERS

You May Also Like