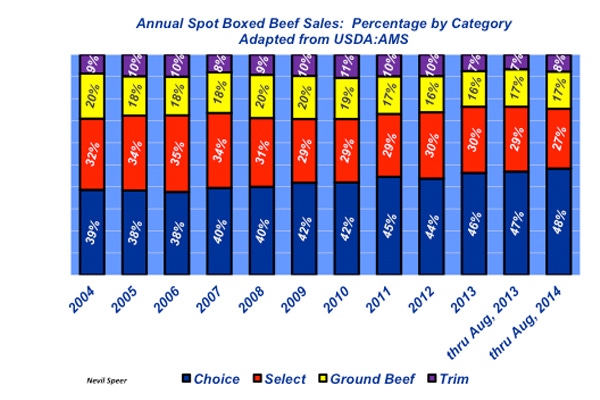

Industry At A Glance: Annual Spot Boxed-Beef Sales by Category

Demand for Choice beef product has been on the rise – representing an increase of nearly 9% of the total sales mix during the past 10 years.

September 11, 2014

Last week’s chart and discussion focused on ground beef and trimmings, noting how that particular mix typically comprises about 20% of cutout value on any given week based on USDA’s weekly calculation (available through the National Weekly Cattle and Beef Summary). What’s more important, however, is the general shift of relative contribution over time – both within the spot market and across the comprehensive cutout. This week’s focus is on the spot market; next week, we’ll focus on the comprehensive cutout.

The accompanying illustration depicts the composition of boxed-beef sales by category based on the weekly load count. Annual total load count during the year is depicted by the overall contribution of the four categories of USDA Choice, USDA Select, ground beef and trim. (The comprehensive cutout breaks out categories somewhat differently.)

The accompanying graph clearly shows that Choice product has been on the rise – representing an increase of nearly 9% of the total sales mix during the past 10 years. Meanwhile, Select, ground beef and trim sales have decreased 5%, 3% and 1%, respectively, during that same period. Stated another way, the beef market is evolving toward selling a greater percentage of whole-muscle cuts at the upper end of the Quality Grade spectrum.

That’s a favorable, and self-reinforcing, trend. More consumers are demanding higher-end beef products, and the market is producing more Choice product to meet that demand. Meanwhile, the beef complex has been highly focused on price resistance.

However, had consumers become increasingly price-sensitive as beef prices rose, a greater proportion of the industry’s beef product would simply have ended up as ground beef and/or trimmings and been sold at a discount on weekly basis simply to clear product. That hasn’t occurred. The favorable shift has fundamentally undergirded the market’s sharp rise in recent years.

How do you foresee these market shifts being facilitated in the future? Will the beef complex continue to enjoy this type of shift going forward? Or will the marketplace stabilize at its current levels?

Leave your thoughts below.

Other BEEF stories to enjoy:

Want More Money For Your Calves? Superior Study Says Weaning & Preconditioning Pays

September Cattle Market Outlook | Bull Run Cools, But Market Upside Possible

10 Ways To Have A Stress-Free Weaning Day

Effective Heifer Development Means Thinking Early & Long Term

BEEF Exclusive: Herd Expansion? BEEF Readers Say Its Go Time

15 ATVs and UTVs That Are New For 2014

About the Author(s)

You May Also Like