Industry At A Glance: How Do You Manage External Risk?

Today’s cattle business requires ever-more vigilance in management against potential shocks from the outside.

November 11, 2013

Commodity markets are inherently volatile and unpredictable. That’s especially true in the beef complex given the large number of external influences that move the market. Moreover, markets have become even more reactive in recent years with the growing prevalence of technology, as computer trading, online news and social media all possess the ability to move markets almost instantaneously.

That requires ever-more vigilance regarding the management of one’s business against the potential shocks from the outside. It’s no longer sufficient to just oversee the production side and hope that other risks to the business either don’t occur or move so slowly they don’t matter. In addition, the increasing capital associated with the business make managing risk more significant all the time.

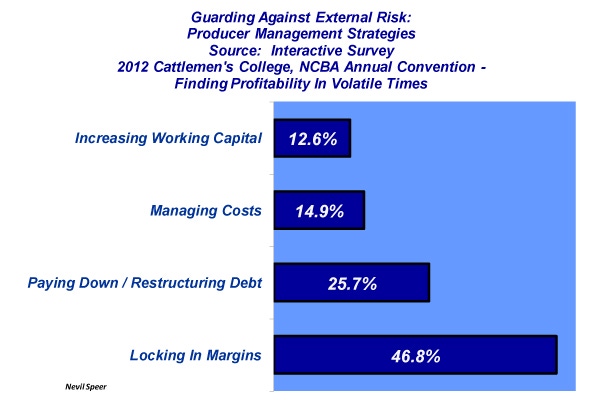

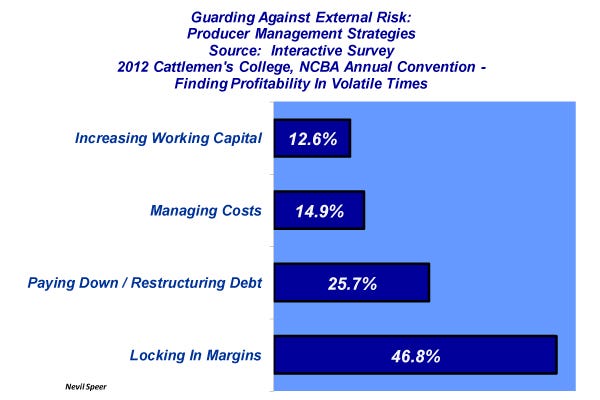

Risk management is often thought of simply in terms of markets. However, there are other means to mitigate risk including increasing the amount of working capital in one’s operation, managing costs, paying down or restructuring debt, and locking in operating margins.

Several years ago during a Cattlemen’s College presentation, I asked the attendees to designate the primary means in which they’re buffering their business against external risk. Those results are presented here.

Do these results surprise you, or do they correspond to how you perceive many producers trying to manage their businesses? What other important or key categories would you add in response to the question? Leave your thoughts below.

You might also like:

Carcass Weights Decline And Grade Increases

How To Diagnose, Treat Hoof Cracks In Cattle

Feedlot Tour: Triangle H Grain & Cattle Co.

Bale Grazing Lets Cows Feed Themselves

Winter Is Coming --> 200 Breathtaking Photos Of Winter On The Ranch

Average Value Of U.S. Pastureland Is $1200 Per Acre

About the Author(s)

You May Also Like