Key cattle numbers to consider in your 3-year marketing plans

As you plan your 2017 beef cow business year, you need to be aware of the cattle industry trends that will be driving cattle prices from 2017 through 2019.

March 27, 2017

By now, each of you have analyzed your 2016 business performance and paid your income taxes, and now many of you are working on your 2017 business plan. It is my assessment that 2017 is not a “business year as usual.” For many of you with beef cows, last year turned out to be a year of short cash flow — that was certainly true for my study rancher.

As you plan your 2017 beef cow business year, you need to be aware of the cattle industry trends that will be driving cattle prices from 2017 through 2019.

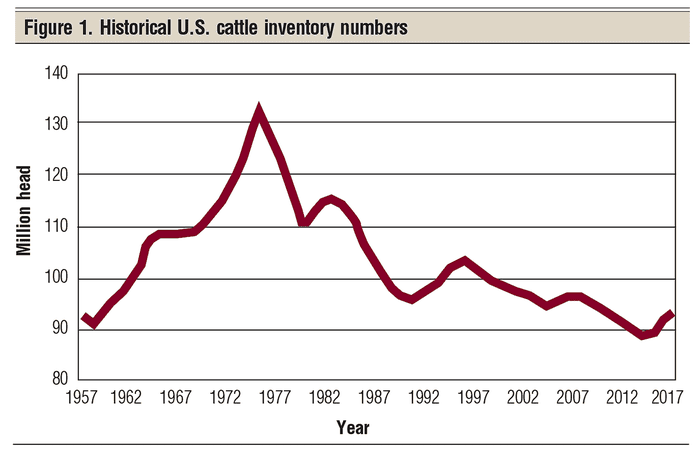

U.S. All Cattle numbers: The U.S. All Cattle number, as of January 2017, was 96.3 million head — up 2% from January 2016. Figure 1 puts today’s inventory numbers in perspective with past years. U.S. cattle numbers peaked in the mid-1970s and have generally trended downward ever since.

The biggest cattle cycle was in the 1970s, with another major cattle cycle in the 1980s. Since then, the cattle cycle has been less prominent, with a general downward trend in beef cow numbers.

Some key factors interrupted cattle cycles in the early 2000s. For example, we had a drought in 2002, Canadian BSE in 2003, drought again in 2006, and ethanol expansion in 2009 — each factor impacting the cattle cycle during the first 10 years of this century.

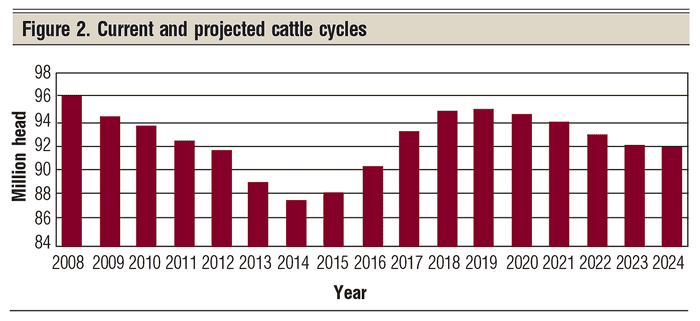

It does appear that the cattle cycle is again live and well — and again impacting today’s cattleman. Each year the Food and Policy Research Institute (FAPRI) at the University of Missouri publishes its annual study of agriculture, looking 10 years into the future. Figure 2 presents FAPRI’s 2016 projections of the next cattle cycle. The analysis suggests that the current cattle cycle, which started in 2014, is projected to peak out in 2019 at 95.2 million head.

What could change this cattle cycle projection? The primary factor would be a major drought in cow country, and nobody can really predict droughts.

Beef cow numbers: The number of beef cows is growing. The USDA annual Cattle inventory report released in late January suggests that the U.S. has 30.9 million beef cows. This is up 3% from 2016 and up 7% from the low in 2014.

Good regional forage and pasture conditions in recent years led to some dramatic changes in cow numbers, most notably in Oklahoma (+9%), Texas (+4%), Missouri (+8%) and New Mexico (+12%). Clearly, the Texas, Oklahoma, and Missouri beef cow number increases will impact the industry nationally.

2016 calf crop: The calf crop totaled 35.1 million head in 2016 — up 3% or 1 million head from 2015. More beef is projected to be produced in 2017 and beyond.

Running beef cows profitably in the low part of the current beef price cycle will require a well-planned and executed business plan.

Federally inspected slaughter: Year-over-year federally inspected steer slaughter increased by 1.2 million head in 2016, and heifer slaughter increased by 300,000 head. The increased beef cow numbers should ensure more slaughter animals in 2017, 2018 and maybe even 2019.

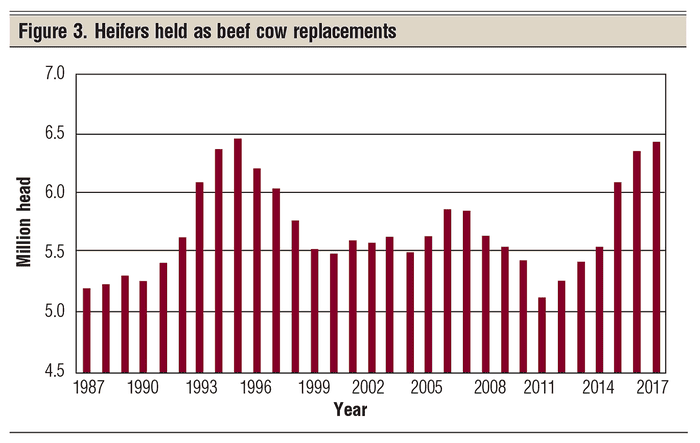

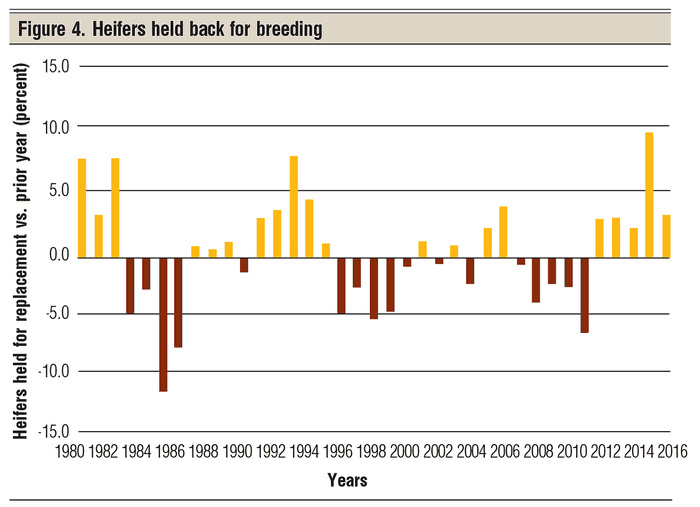

Replacement heifers: The big surprise in the 2017 annual inventory report was the number of heifers held for replacement — up 1.2% from 2016’s numbers (Figures 3 and 4). Most analysts, including me, were expecting that depressed prices would have discouraged heifer retention. The general expectation was a −5%.

Not so. Several states saw significant increases: North Dakota (+23,000), South Dakota (+20,000), Montana (+20,000), Texas (+20,000), Kansas (+20,000) and Missouri (+15,000). I now live in Idaho and it had −20,000 heifers. Good grass and feed conditions appear to be behind these increased heifer retention numbers.

This all suggests the calf crop of 2017 and 2018 will be up from 2016. Surely this increased calf crop is going to pressure cattle prices again in 2017 through at least 2018.

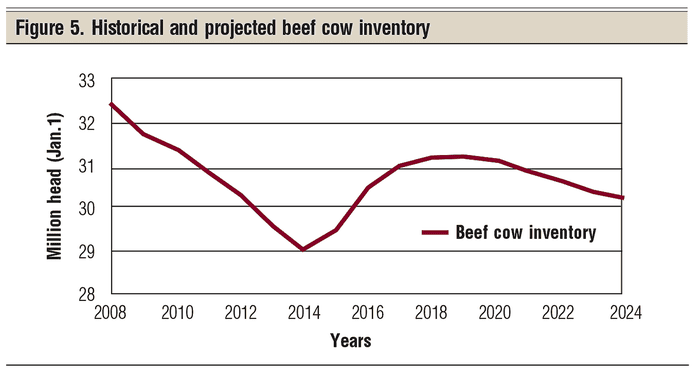

One critical key to beef prices over the next few years is the number of beef cows in the U.S. herd. Figure 5 presents nine years of actual beef cow numbers and seven years of projected beef cow numbers. It appears that we will continue to increase beef cow numbers at least through 2017 and 2018, and hopefully peak out in 2019.

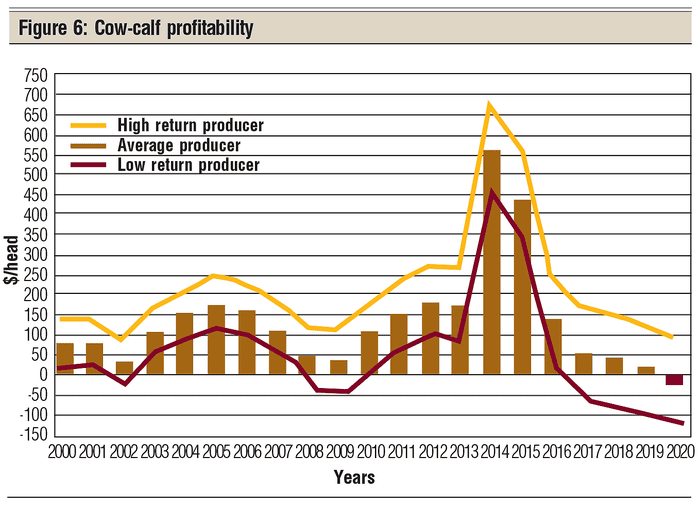

General profitability of beef cows: I will summarize this article with a final chart on beef cow historical profits and projected profits into 2020 (Figure 6). Over the years, I have used various editions of this profit chart from CattleFax, as it does an excellent job of illustrating profitability with beef cows.

The green bars summarize average cow-calf profits (cash costs only) from 2000, with projections through 2020. Clearly, beef profits are driven by the beef price cycle going from 2010 projected through 2020.

CattleFax’s primary message in this chart is the suggestion of some tough times for beef cow producers in 2017 through 2020. My projections all follow the same overall potential profit pattern.

A secondary message we can take from the chart, but just as critical, is that the top 20% of producers (yellow line) have made a profit each and every year, and are projected to make a profit in 2017 through 2020.

The dark red line in the CattleFax chart shows an equally important point — the low 20% profit producers tend to lose money in the low point of each beef price cycle and are projected to lose money in 2016 through 2020.

Figure 6 points out the importance of being a high net return beef cow operator. Over the years, my Integrated Resource Management (IRM) beef cow database suggests that high-profit producers are the “low-cost-per-pound-of-calf-produced” operators, not the “low-cost-per-cow” operators — an elusive but critical difference.

My data also suggest that low production costs per pound of calf produced come primarily from high production per cow. I found that pounds weaned per female exposed is a key profit indicator.

Running beef cows profitably in the low part of the current beef price cycle will require a well-planned and executed business plan.

Hughes is a North Dakota State University professor emeritus. He lives in Kuna, Idaho. Reach him at 701-238-9607 or [email protected].

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)