Rural mainstreet looks for decline in holiday sales

Creighton University’s Rural Mainstreet Index moves below growth neutral.

November 25, 2020

It’s been a tough year for folks in ranching and farming. And recent survey results show that rural main streets are feeling the pinch.

According to the Creighton University Rural Mainstreet Index (RMI), a monthly survey of bank CEOs in rural areas of a 10-state region dependent on agriculture and/or energy, the index fell to its lowest level since August of this year.,

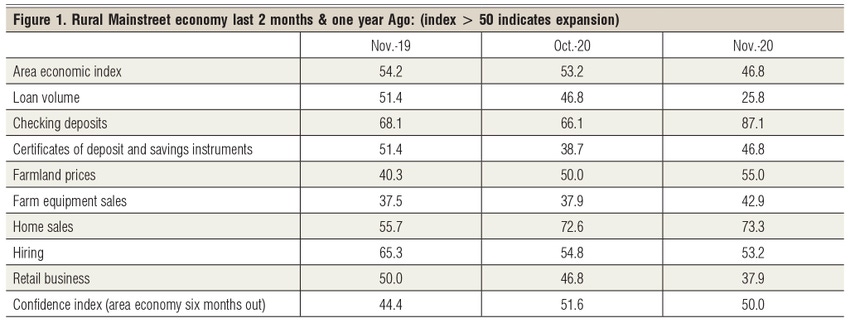

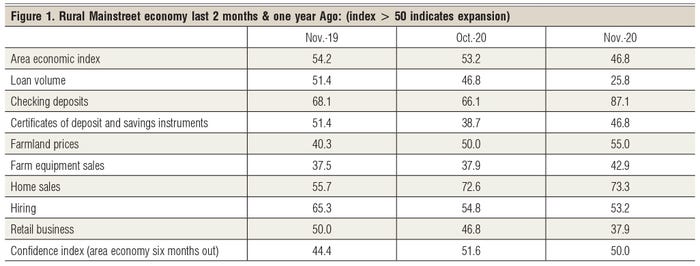

The overall index for November sank below growth neutral to 46.8 from October’s 53.2. The index ranges between 0 and 100 with a reading of 50.0 representing growth neutral.

“Recent improvements in agriculture commodity prices, federal farm support payments, and Federal Reserve’s record low interest rates have underpinned the Rural Mainstreet Economy. Still, only 6.5% of bankers reported economic improvements from October, while 12.9% detailed economic pullbacks for the month,” said Ernie Goss, PhD, Jack A. MacAllister Chair in Regional Economics at Creighton University’s Heider College of Business.

Farming and ranching: For a second straight month, the farmland-price index advanced above growth neutral. The November reading jumped to 55.0 from October’s 50.6. This is first time since 2013 that Creighton’s survey has recorded back-to-back above growth neutral readings in farmland prices.

The November farm equipment-sales index increased to 42.9, its highest level since December 2013, and up from 37.9 in October. However, this marks the 86th straight month the reading has remained below growth neutral 50.0.

Banking: Bankers reported record low loan volumes for November. The November loan volume index fell to its lowest since the initiation of the survey in 2006. The lending index slumped to 25.8 from October’s 46.8. The checking-deposit index soared to 87.1, a record high, from 66.1 in October, while the index for certificates of deposit, and other savings instruments rose to 46.8 from 38.7 in October.

This month bankers were asked to project the share of grain farmers likely to experience negative cash flow for 2021. Bankers expect 9.2% of grain farmers’ cash expenses to exceed cash revenue. This is an improvement from 2019 when bankers projected 12.4% of farmers to experience negative cash flows for 2020.

Hiring: The new hiring index slipped to 53.2 from October’s 54.8. Even so, data from the U.S. Bureau of Labor Statistics indicate that nonfarm employment levels for the Rural Mainstreet economy are down by 132,000 (non-seasonally adjusted), or 3.2% compared to pre-COVID-19 levels.

“It will take many months of above growth neutral readings to get back to pre-COVID-19 employment levels for the region,” said Goss.

Confidence: The confidence index, which reflects bank CEO expectations for the economy six months out, dipped to 50.0 from October’s 51.6. “COVID-19 related farm support payments and improving gain prices have supported confidence offsetting pessimism from the impact of the pandemic,” said Goss.

Home and retail sales: The home-sales index climbed to a strong 73.3 from 72.6 in October. The retail-sales index for November slumped to a frail 37.9 from October’s 46.8. “Higher unemployment and business closures linked to COVID-19 continue to harm the region’s retailers,” said Goss.

The month bank CEOs were asked to project holiday sales growth for 2020. Compared to 2019, bankers expected retail sales to be down by 3.1%. Approximately, 54.8 % anticipate a reduction from 2019, and 16.1% project an upturn from last year’s holiday sales.

Each month, community bank presidents and CEOs in nonurban agriculturally and energy-dependent portions of a 10-state area are surveyed regarding current economic conditions in their communities, and their projected economic outlooks six months down the road. Bankers from Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wyoming are included.

This survey represents an early snapshot of the economy of rural agriculturally and energy-dependent portions of the nation. The Rural Mainstreet Index (RMI) is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy. Goss and Bill McQuillan, former chairman of the Independent Community Banks of America, created the monthly economic survey in 2006.

Below are the state reports:

Colorado: Colorado’s Rural Mainstreet Index (RMI) for November decreased to 40.0 from October’s 44.7. The farmland and ranchland-price index rose to 52.1 from 46.8 in October. Colorado’s hiring index for November sank to 50.3 from October’s 51.1. Compared to the same time last year, Colorado’s Rural Mainstreet economy has lost 9.3% of its nonfarm employment, representing 30,700 jobs.

Illinois: The November RMI for Illinois slumped to 50.2 from 53.4 in October. The farmland-price index climbed to 57.2 from October’s 51.2. The state’s new-hiring index improved to 55.5 from 55.4 in October. Compared to the same time last year, Illinois’ Rural Mainstreet economy has lost 7.1% of its nonfarm employment, representing 338,600 jobs.

Iowa: The November RMI for Iowa sank to 47.4 from October’s 52.3. Iowa’s farmland-price index rose to 53.4 from 50.6 in October. Iowa’s new-hiring index for November inched lower to 54.0 from 54.9 in October. Compared to the same month last year, Iowa’s Rural Mainstreet economy has lost 6.4% of its nonfarm employment, representing 43,000 jobs.

Kansas: The Kansas RMI for November decreased to 52.2 from October’s 57.5. The state’s farmland-price index advanced to 58.2 from 53.2 in October. The new-hiring index for Kansas fell to 56.4 from 57.5 in October. Compared to the same month last year, Kansas’s Rural Mainstreet economy has lost 4.6% of its nonfarm employment, representing 19,600 jobs.

Minnesota: The November RMI for Minnesota increased to 52.1 from October’s 49.3. Minnesota’s farmland-price index advanced to 54.4 from 49.2 in October. The new-hiring index for November dipped to 52.7 from October’s 53.4. Compared to the same month last year, Minnesota’s Rural Mainstreet economy has lost 7.9% of its nonfarm employment, representing 41,300 jobs.

Missouri: The November RMI for Missouri jumped to 57.3 from 55.1 in September. The farmland-price index expanded to 60.8 from 52.0 in October. The state’s hiring gauge climbed to 59.0 from 56.3 in October. Compared to the same month last year, Missouri’s Rural Mainstreet nonfarm economy has lost 2.6% of its employment, representing 8,000 jobs.

Nebraska: The Nebraska RMI for November slumped to 45.1 from 58.6 in October. The state’s farmland-price index improved to 58.7 from last month’s 53.8. Nebraska’s new-hiring index fell to a still strong 56.9 from 58.0 in October. Compared to the same month last year, Nebraska�’s Rural Mainstreet economy has lost 3.9% of its nonfarm employment, representing 11,300 jobs.

North Dakota: The North Dakota RMI for November dropped to 36.8 from October’s 42.7. The state’s farmland-price index improved to 50.5 from 45.8 in October. The state’s new-hiring index sank to 48.7 from October’s 50.1. Compared to the same month last year, North Dakota’s Rural Mainstreet economy has lost 11.5% of its nonfarm employment, representing 19,400 jobs.

South Dakota: The November RMI for South Dakota descended to 55.9 from October’s 59.6. The state’s farmland-price index expanded to 60.1 from October’s 54.3. South Dakota’s November hiring index dipped to a still strong 58.3 from 58.5 in October. Compared to the same month last year, South Dakota’s Rural Mainstreet economy has lost 3.7% of its nonfarm employment, representing 7,800 jobs.

Wyoming: The November RMI for Wyoming plummeted to 41.2 from October’s 52.6. The November farmland and ranchland-price index climbed to 56.1 from 50.8 in October. Wyoming’s new-hiring index fell to 54.3 from October’s 55.0. Compared to the same month last year, Wyoming’s Rural Mainstreet economy has lost 5.8% of its nonfarm employment, representing 12,000 jobs.

Source: Creighton University, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)