Will individual animal ID continue to increase?

Ten years ago, only 3.5% of the cattle possessed an electronic tag. That’s now closer to 17%. Meanwhile, the percentage of animals that possess no ID is half the rate of 10 years ago.

September 25, 2017

Last week’s Industry At A Glance introduced some data from the 2016 National Beef Quality Audit (NBQA). The audits were established to, “…[deliver] a set of guideposts and measurements for helping cattle producers and others determine quality conformance of the U.S. beef supply,” as described by NCBA’s Beef Quality Assurance Advisory Board. NBQA’s premise is based on principles outlined by Edwards Deming – most notably, continual improvement requires objective, fact-based decision making. Data is requisite to making proper adjustments for improvement to occur.

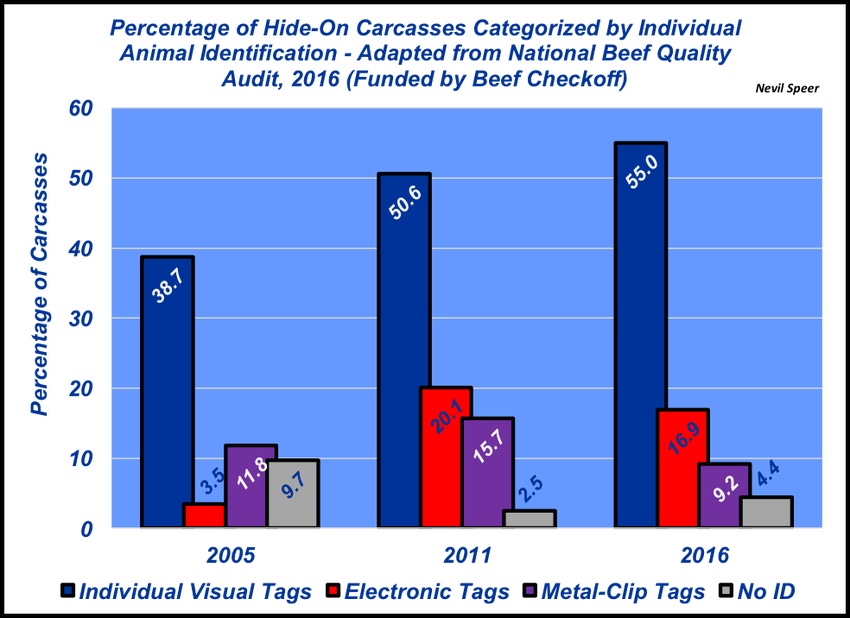

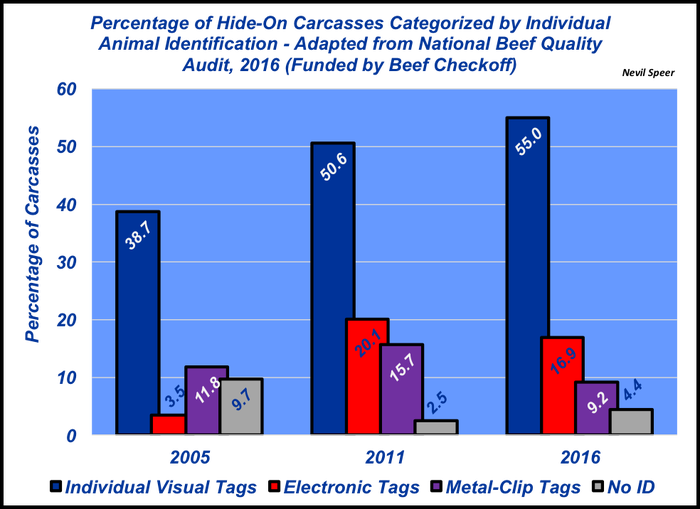

Over the years, NBQA has enabled the industry to objectively assess what��’s occurring in terms of the cattle mix and stakeholder perceptions. As part of the endeavor, this week’s graph provides some insight into individual animal identification trends over the past 10 years or so. It’s clear the use of individual identification has increased since 2005.

For example, 10 years ago, only 3.5% of the cattle possessed an electronic tag. That’s now closer to 17%. Meanwhile, the percentage of animals that possess no ID is half the rate of 10 years ago, although the 2016 analysis shows that 4.4% of cattle still aren’t individually identified.

Those trends aren’t surprising given the increased emphasis within the industry on value-added programs and the necessity for more careful record keeping. The real question becomes the trend in the future.

How will these percentages change in the next five to 10 years? Where do you see the trends in the industry and the requirements for individual animal ID headed in the future? How will further adoption of consumer programs alter the need for animal identification and traceability? Leave your thoughts in the comments section below.

Nevil Speer is based in Bowling Green, Ky., and serves as vice president of U.S. operations for AgriClear, Inc. – a wholly-owned subsidiary of TMX Group Limited. The views and opinions of the author expressed herein do not necessarily state or reflect those of the TMX Group Limited and Natural Gas Exchange Inc.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)